Media International Exchange 2024.11.12

There are loopholes of the United States’ hard-line policy toward China; trade reduction effects are disappointing

In fact, the U.S.’s economic security policy consists of postponed tariff expansion and deregulatory measures

JBpress on September 18, 2024

1. Changes in U.S.-China trade are not as large as expected

The U.S. Trade Representative (USTR), which had proposed to impose additional tariffs on products such as electric vehicles (EV), semiconductors, solar panels, and in-vehicle batteries starting from August 1, decided to do so starting from September 27.

This will further tighten America’s China policy, which aims at U.S.-China decoupling.

Since the launch of the Biden administration, the tightening of economic security restrictions has affected trade between the U.S. and China.

In response to this, China has expressed its strong dissatisfaction and taken countermeasures.

U.S.-China trade was expected to decrease substantially owing to the repetition of heated exchanges of measures and countermeasures between the two countries.

A look at changes in the value of trade in the past alone indicates, however, that the hard-line policy has not brought as large effects as expected, and this assessment is widely shared among China specialists and other experts in Washington, D.C.

A look at year-on-year changes in China’s imports from and exports to the U.S. (see the figure below) shows that after the launch of the Biden administration in 2021, they have not grown since 2022, with both imports and exports continuing to fall or remaining almost at the same level.

At first glance, it appears that the decoupling policy has clearly produced obvious results.

Year-on-year changes in China’s imports from and exports to the U.S. (unit: %)

BLUE = Exports / RED = Imports

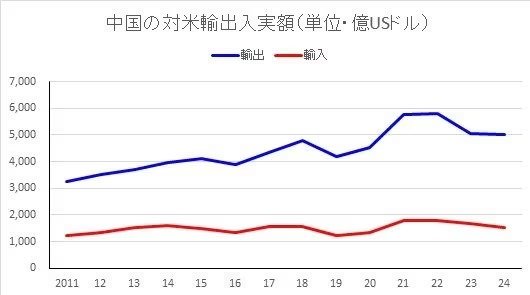

But an analysis of the value of imports and exports rather than their year-on-year changes (see the figure below) shows that U.S.-China trade looks slightly different.

Certainly, since 2022, both imports and exports have stopped growing. China’s exports to the U.S. decreased in 2023. They did not fall much compared to the period before 2020, however.

China’s imports from the U.S. have also continued to fall since 2022 though the fall was not as remarkable as that for exports.

But this was affected by the slowdown of domestic demand together with the decrease in China’s economic growth rate in 2022 and thereafter and is not necessarily attributable to the effects of the U.S.’s economic security policy alone.

From the viewpoint described above, it can be concluded that the economic security policy, which aims at U.S.-China decoupling, is evaluated as having not brought as large effects as expected.

The value of China’s imports from and exports to the U.S. (in US$100 million)

BLUE = Exports / RED = Imports

2. The realities of the U.S.’s relaxed implementation of its economic security policy

The major reason the U.S. government’s strict economic security policy does not have major effects on U.S.-China trade though it is actually carried out is strong needs for economic activities mainly among private enterprises in the U.S. and China.

The U.S. government describes its outline of economic security policy as “small yard, high fence.”

From the viewpoint of security, the best way to implement a thorough economic security policy is to stop trade between the two countries.

But that would not allow many American businesses to survive, forcing the U.S. economy to be faced with a harsh economic stagnation.

Meanwhile, if reasonably priced, high-quality Chinese products cease to be imported, prices in the American market will rise significantly, making it likely that the frustration of American people who are already troubled by inflation will explode.

For this reason, by limiting economic security restrictions to small areas (small yard) when imposing them, the U.S. government is paying attention so that they do not have major effects on economic activities.

In recent months, however, the U.S. government has gradually applied its economic security policy to a wider range of areas.

American private enterprises are protesting strongly against raised tariffs and restrictions on trade with their Chinese counterparts because they limit business opportunities.

Their protests cannot be disregarded because activities of private enterprises lead directly to economic stability. Disregarding them will have adverse effects on the forthcoming elections.

Therefore, if private enterprises protest strongly, the U.S. government cannot help but make certain compromises.

For this reason, the raising of tariffs and the restriction of trade with China, which are proposed as part of the economic security policy, are often relaxed.

At present, the raised tariffs introduced by the Trump administration in 2018 are continuing without being revised since the tightening of tariffs after their review scheduled for 2023 has been put off.

The scope of tariffs imposed is expected to be expanded after their review, but so far, this has not been implemented.

In addition, according to recent media reports in the U.S., a former high-ranking official of the Department of Commerce (DoC) presented the facts described below.

Huawei is included in the Entity List, and not only American businesses but Japanese and Dutch ones are also restricted in their trade with the Chinese company.

In the U.S., however, the restrictions were applied strictly for the first one year and a half after they were introduced. But later, the government changed its stance, allowing the American businesses to fall outside the restrictions on a case-by-case basis.

As a result, if American businesses apply to DoC’s Bureau of Industry and Security for trade with Huawei, 99% of such applications are accepted.

This relaxation prompted the value of specially approved transactions with Huawei during the past five years to reach US$350 billion.

The reason the government relaxed its restrictions as described above is that it found that continuing strict controls would have tremendous adverse effects on the American economy.

It seems, however, that the governments and businesses in Japan and the Netherlands have not been notified of these realities, and the above-mentioned high-ranking official points out that diplomatically, this is highly risky.

3. Balance between economic security and economic activities

The facts described above are considered as undesirable by government officials who emphasize economic security, but for businesses, they are something that should be welcomed.

Economic security policy restricts free economic activities based on security needs.

Such policy is led by governments and based on zero-sum relations between two states; in other words, the merits of one state are the demerits of the other.

By contrast, the objective of economic activities is business expansion.

Such expansion is pursued by private enterprises and based on win-win relations; in other words, the merits of one of the two companies is those of the other, and the loss of one of the two is the loss of the other.

The major premise for the conclusion of an agreement on economic transactions is that both the seller and the buyer are satisfied with it, and a relationship of mutual dependence arises therefrom.

China is a hostile rival of the U.S. government, but in many cases, Chinese businesses are customers or friends of American private enterprises.

As described above, economic security and economic activities are two different practices that are incompatible with each other. However, both are necessary for states and businesses alike.

For this reason, it is important to maintain a reasonable balance between the two.

If a favorable balance is maintained between two states, the safety of both states is ensured in the long run, economic activities continue to expand, and the people of both states are satisfied.

This can be explained by the theory of yin and yang, the Oriental thought.

The relationship between yin and yang is understood by the contrast between night and day, man and woman, and heaven and earth. Both yin and yang are needed for people to feel safe and happy, and it is important to ensure that yin and yang are harmonized with each other and that a harmonious balance is maintained between the two.

If the balance is lost and leans toward either of the two, stability is lost, causing distress to everyone. The favorable balance is expressed with the term “a middle course” or “the doctrine of the mean.”

If explained from this point of view, economic security represents yang and economic activities represents yin.

Without economic security, it is difficult to maintain the long-term safety of the state. But the foundation of the state’s power is economic power supported mainly by private enterprises. If its economic power declines, the state becomes unable to maintain human resources and equipment needed for national security.

The middle course means striking a reasonable balance between the two.

Both governments and private enterprises lose their balance as a whole if they look at their own “yard” alone when thinking about what they should do. This also applies to the relationship between the U.S. and Chinese governments.

If they understand each other from a broad perspective, they will find the middle course; in other words, where they should agree with each other.

It is important to promote mutual understanding through dialogues between the public and private sectors in the U.S. and China, adjust policy administration in concrete terms with the middle course in mind, and make continued efforts to maintain a right balance.