Media International Exchange 2024.01.26

The Chinese economy is expected to normalize in one to two years, while showing signs of gradual recovery

At present, its situations are better than Japan’s balance-sheet depression

The article was originally posted on JBpress on December 18, 2023

1. Macroeconomic indicators have shown a trend of gradual recovery since it bottomed out in July

On the whole, the Chinese economy broke out of the three-year COVID-19 disaster at the beginning of 2023. The end of the year is approaching, but it is still not sure when the Chinese economy can get back on track of pre-COVID normal operation.

From the beginning of the year to March, the Chinese economy showed a stronger recovery than expected, but in early April, it stalled. During the January-March period, its seasonally adjusted real gross domestic product (GDP) grew at an annualized rate of 9.2% compared to the previous quarter, showing a sharper recovery than expected, and later, during the April-June period, the growth rate plunged to 2.0%.

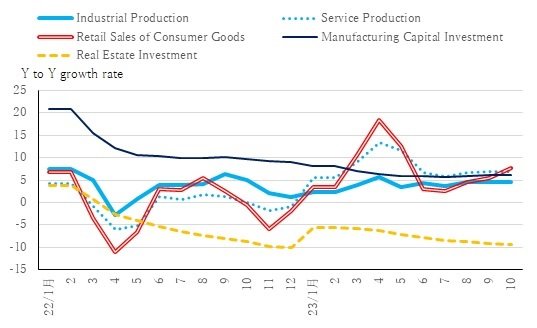

Subsequently, the economy bottomed out in July, and since August, industrial production, service production, consumption (retail sales of consumer goods), capital investments in manufacturing, etc. have continued to recover gradually, except for real estate-related investments (see the figure below).

Changes in Major Economic Indicators

(Compared to the Same Period of the Previous Year)

Note: Figures for capital investments in manufacturing and real estate development indicate those compared to cumulative ones for the period since the beginning of the year (CEIC materials).

2. The actual condition of the economy in recent months is far from normalization

These statistical data only shows that in macroeconomic terms, the overall Chinese economy seems to be approaching normalization.

But its actual condition is far from normalized.

One reason is that the recovery of private enterprises’ confidence is delayed.

Owing to the effects of last year’s zero COVID policy, many small and medium enterprises went bankrupt in sectors such as dining and lodging. The stores closed under the policy and related employment have not fully recovered.

Meanwhile, the aftereffects of the common prosperity policy, which targeted the managers of private enterprises that achieved high profitability, are serious, making private enterprises remain cautious toward investment.

In addition, in 2021, the period of rapid economic growth, which had continued for more than four decades, came to an end, and the inability of corporate managers and consumers to adjust their mindset to such a change has also affected the delay in the recovery of private enterprises’ confidence.

Another reason is the prolonged stagnation of the real estate market.

During the January-March period, the real estate market temporarily recovered more than expected, but in April and thereafter, it slowed down, and in October, even real estate prices in major cities such as Beijing and Shanghai fell compared to the preceding month.

Selling prices for used houses compared to the preceding month show that among the 70 major cities in China, only two – Hangzhou (Zhejiang Province) and Sanya (Hainan Island) – saw selling prices rise in October.

Mentioned above are the two major reasons for economic normalization being prevented in recent months.

Since these two negative reasons affect each other, the overall economy would not normalize even if one of them is eliminated. Both need to be improved simultaneously.

The key to future successful policy operation is, therefore, to combine measures to promote the recovery of private enterprises’ confidence and to stem the stagnation of the real estate market in a balanced manner.

The Central Economic Work Conference held on December 11 and 12, decided the basic policy to administer economic policy in 2024.

Originally, prior to this Conference, the Third Plenary Session of the Central Committee had been expected to take place in October or November and indicate a new medium- to long-term policy vision.

If so, a new innovative policy menu based on the new basic policy would have been presented.

In reality, however, the Third Plenary Session was postponed (when it will take place has not been decided), leaving a new medium- to long-term policy unindicated, and therefore, the core of the decisions made by the Central Economic Work Conference did not differ greatly from the report on political activities published during the National People’s Congress of March 2023.

Since this does not raise the expectations of people for the government’s policy administration, it cannot be expected that private enterprises will recover their confidence and that the stagnation of the real estate market will be stemmed, and there is no hope of getting the economy back on track towards a vigorous recovery.

3. At present, its situations are better than Japan’s balance-sheet depression

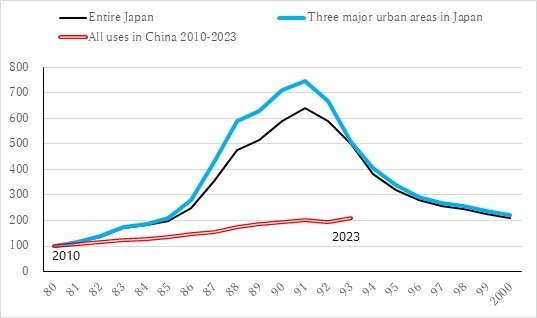

There is a view that compares this present condition of the Chinese economy to Japan’s balance sheet depression in the 1990s, but the difference between the two is clear if the changes in real estate prices and the stock markets are compared.

In particular, while in Japan real estate prices rose by seven times or more during the ten years or so after 1980, the range of rises in China during the ten years or so after 2010 remained at around two times (see the figure below).

Comparison of Changes in Real Estate Prices in Japan and China

Comparison between Japan during the 1980-1993 period and China during the 2010-2023 period

Source: Ministry of Land, Infrastructure, Transport and Tourism, and CEIC

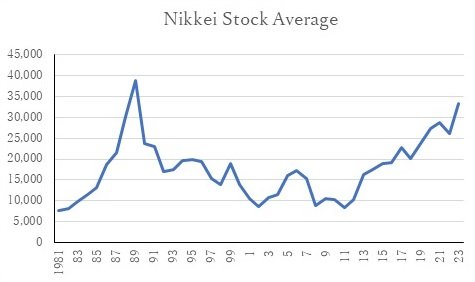

Stock prices indicate that while in Japan they rose and fell by around six times in the 1980s and thereafter, in China they fluctuated within a narrow range of 2500 to 3500 in 2016 and thereafter (see the figure below).

Comparison of Stock Price Fluctuations in Japan and China

Source: CEIC and Nikkei Stock Average archives

A comparison of real estate prices and stock prices, two core indicators of asset bubbles, in Japan and China as described above shows that compared to Japan in the 1990s, the present-day China’s situations are much better in terms of the formation of asset bubbles because the range of rises and falls in asset price is small.

Even if the situations are better at the moment, however, the fall of real estate prices in China may not be stopped, and the range of falls might become large as the prices drop in a wider range of areas if the government fails to take effective measures as it does now.

If so, an increasing number of financial institutions would be affected, and the risk of the problem developing into a financial crisis that involves major financial institutions could not necessarily be kept at zero.

Since early on, the Chinese government has carefully regulated real estate prices so that it would not make a mistake similar to Japan’s bubble economy in the real estate and this took effect.

In the future, in order to further make the most of the experience Japan had when the bubble economy collapsed, the Chinese government should swiftly dispose of bad debts and commit public funds to bailouts without spending too much time on these processes.

If it does so, it could keep the effects of collapse of the real estate bubble within a range in which they can be fully absorbed in both financial and fiscal terms.

4. Medium- to long-term outlook for the Chinese economy

Certainly, the actual condition of the Chinese economy in recent months is far from normalized, and it continues to face difficulties, but it should gradually get back on track towards normalization if the government administers its policy appropriately in the years to come.

Since the period of rapid economic growth has already ended, however, the real growth rate is highly likely to remain at the 4% level even if the economy recovers to normal conditions.

Furthermore, since structural downward factors such as a declining birthrate and aging population, slower urbanization, reduced large infrastructure construction investments, and the deteriorating performance of state-owned enterprises surface in the middle of the 2020s and thereafter, the growth rate will continue to decline during the second half of the decade. It is expected to fall to 3.0-3.5% by 2030.

Nonetheless, looking back on the Chinese government’s policy administration in the past, one finds that it has brought certain satisfactory results in its important policy issues, including the real estate market, reform of state-owned enterprises, open market, and social security policies.

Firstly, in terms of measures for the real estate market, the Chinese government made skillful use of Japan’s experience to reduce the areas affected by the collapse of the real estate market’s bubble mainly to third- to fourth-class cities, preventing major cities from being involved therein.

Secondly, the reform of state-owned enterprises seems to have stagnated since 2018.

However, the ratio of state-owned enterprises among the total assets of industrial enterprises and their total number, shows that it has not risen.

One characteristic of China is that in the phase in which economic conditions deteriorate, the government uses state-owned enterprises, which are easy to employ as a means to provide underpinning for the economy, for economic stimulative measures and that therefore, the ratio of such enterprises to investments in fixed assets, etc. increases.

The percentage of loss-making state-owned enterprises remains unchanged, at around 30-35%, and there is a risk that state-owned enterprises’ losses will be a heavier fiscal burden on the government in the future.

For this reason, by continuing to reorganize nonperforming state-owned enterprises, the government is expected to maintain its policy to reduce future financial burdens.

Thirdly, the open market policy remains unchanged given the government’s current stance of attracting foreign-affiliated businesses actively.

The issue to be addressed in the future is how seriously China should work to join the Trans-Pacific Partnership (TPP).

Fourthly, in terms of social security, I am sure that the Chinese government fully understands that the Japanese government raised the benefit levels and thereby suffered from the burden of higher benefit levels and was forced to issue huge government bonds additionally and that this became one of the major reasons Japan fell into a long economic slump as the degree of freedom in budgetary allocation narrowed.

For the poor and middle classes, the uncertain future of the social security system is a reason for uneasiness.

However, if the government strives to gradually improve the social security levels at a pace that fits the real power of the economy, it could avoid the adverse effect of heavier financial burdens pushing down its economic growth power in the long run.

Currently, China is dealing with the difficult situation as it administers its economic policy.

But if it avoids the development and collapse of such a bubble as Japan, Europe, and North America experienced, gradually lowers the percentage of state-owned enterprises, continues efforts to open its market to foreign businesses, and maintains social security at a level that suits the real power of its economy, it is highly likely that it will be able to maintain the stability of its economy in the long run.

Of course, an important condition is that armed conflict between the U.S. and China be avoided.

If many Japanese businesses take the decision to raise wages in March 2024, it could be expected that the Japanese economy will escape from the long deflation and get back on track for long-term normalization.

The Chinese economy is also expected to normalize in 2025 if the government continues the appropriate policy administration described above.

If both the Japanese and Chinese economies regain vigor, it can be expected that in the second half of the 2020s, they will contribute to the stability of the world economy as both countries lead the entire Asia region.