Media Global Economy 2022.09.16

China’s rapid economic growth is likely to end earlier than expected

Medium- to long-term structural factors that push down the growth and measures that should be taken by Japanese businesses to cope with them

The article was originally posted on JBpress on August 17, 2022

Likelihood of termination of the period of rapid economic growth

After the Tiananmen incident in June 1989, China temporarily tightened its economic control, putting a sudden stop to its shift to a market economy and introduction of free competition.

For this reason, the Chinese economy plunged into serious stagnation from 1989 to 1990.

Under these circumstances, as the future of the economy was uncertain, Deng Xiaoping made his south China tour and delivered important speeches from January to February 1992, presenting the major policy of promoting a shift to a market economy.

Later, under the leadership of Prime Minister Zhu Rongji, China overcame various structural problems by reforming its inefficient economic system based on the previous planned economy through the implementation of the economic policy of introducing market mechanisms aggressively.

During the three decades or so since then, the Chinese economy has powerfully continued to grow rapidly using the shift to a market economy as a springboard while being faced with many difficulties.

In the latter half of 2009, in terms of gross domestic product (GDP), China caught up with Japan, and in 2021, its GDP reached 3.5 times that of Japan.

In 2010, China’s real growth rate was 10.6%. That year became the last year China achieved two-digit economic growth. In the 2010s, the Chinese economy was in the final phase of rapid growth, which had continued for over 40 years since 1978.

And now, it is seeing the termination of its rapid growth.

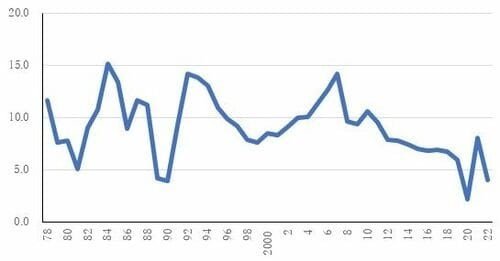

The changes in the real GDP growth rate over 40 years or so (see Figure 1) clearly indicate what phase the Chinese economy is currently in.

The 2010s represent a phase in which the growth rate fell steadily, ranging between 6% and 9%.

Since the reform and opening-up policy started in 1978, the annual growth rate has fallen below 5% only twice – in 1989, when the Tiananmen incident occurred (4.2%), and in 1990, the year after the incident (3.9%) – and 2020 (2.2%) was the first year the growth rate dropped below 5% since these two.

And this year, too, the growth rate is expected to fail to reach 5%, hovering around 4%.

Figure 1: Changes in the Real GDP Growth Rate (Year-on-Year %)

(Note) The real GDP growth rate of 4.0% in 2022 is provisional (Source: CEIC).

If, in a broad sense, a period of rapid economic growth is considered as one during which the average annual real growth rate exceeds 5%, the likelihood is that the Chinese economy already saw the end of its rapid growth in 2020.

Of course, the possibility that over the next several years China will maintain its economic growth at 5% or higher again cannot be denied, but such a possibility seems to be slim.

This, however, is a talk about figures, and the impression the author had when he exchanged opinions with economists, corporate managers, and other experts in China was that many well-informed persons recognized that China’s rapid economic growth had extended up to last year.

It seems that the majority of corporate managers were engaged in economic activities on the assumption that rapid economic growth would continue as in the past.

However, this assumption seems to have started to collapse early this year.

It is not definite yet that the rapid economic growth has ended, but there are several factors that make the author feel that the Chinese economy has entered a different phase. The following section analyzes these factors.

Short-term factors that lowered the growth rate in the most recent years

One of the major differences between the period of rapid growth and that of stable growth is a difference in the expected growth rate.

If people believe that they can constantly achieve an economic growth rate of 5-10%, they make production, investment, employment, and other plans accordingly.

However, if they widely share the forecast that the growth rate will not reach 5%, production plans will be downsized, the scale of investment reduced, the wage increase rate lowered, and the willingness of consumers to buy damped.

Thus begins a period of stable economic growth.

If factors that lowered the growth rate in 2020 and thereafter were short-term and special ones, the Chinese economy is highly likely to recover a 5% level growth rate as such factors are eliminated.

If one looks at the factors for the current economic downturn from such a point of view, two of what seem to be short-term and special factors can be identified.

One is that the zero COVID-19 policy has become less effective with the risk of its adverse effects on the economy growing.

In the first quarter of 2020, strict lockdowns were imposed mainly in Wuhan, declining the economy sharply, but immediately after that, the government made all-out efforts to implement the strict zero COVID-19 policy, recovering the economy quickly. At that time, people believed that the Chinese economy would regain its vitality if the lockdowns in Wuhan ended.

Early in 2022, the effectiveness of the zero COVID-19 policy declined owing to the spread of infection with the Omicron variant, which is highly transmittable but sees a high percentage of its patients have no symptoms.

But since the central government held fast to the zero COVID-19 policy, the city government of Shanghai was forced to impose a lockdown for a long period of time, and this affected the entire Chinese economy, plunging it into a serious slump.

The other is a rise in the unemployment rate among young people.

The total unemployment rate rose to 6.1% in April 2022 but fell to 5.5% in June. The unemployment rate for youths aged 16-24 reached 19.3% in June, however.

One reason for this is that the number of university graduates this year rose suddenly, to 10.76 million, an increase of 1.67 million compared to last year.

Another is that the performance of industries such as IT, education, and real estate, which are popular among university graduates and pay high salaries, is deteriorating chiefly owing to the government’s tighter controls last year, and restructuring is continuing in these industries.

Still another is that as the future of the economy is increasingly uncertain, businesses are becoming more and more cautious about employment. These and other factors are affecting the Chinese economy.

Since two of the above-mentioned factors for an economic downturn are both short-term and special ones, the pressure for such a downturn is likely to weaken if effective anti-COVID-19 measures are introduced and employment opportunities for university graduates are maintained.

However, the author often hears that although these factors are short-term, an increasing number of people are uneasy, thinking that these problems may occur repeatedly.

This can be interpreted as reflecting the fact that the Chinese people are becoming slightly less confident about the resilience of their economy, a belief that they shared as a matter of fact during the period of rapid economic growth.

Medium- to long-term factors that push down China’s economic growth rate

The factors that make the author feel that the Chinese economy has entered a different phase include those which cannot be considered as short-term, special ones, and moreover, they are interrelated to one another. Specifically, they are as described below.

A first factor is the acceleration of a decline in birthrate and the aging of the population.

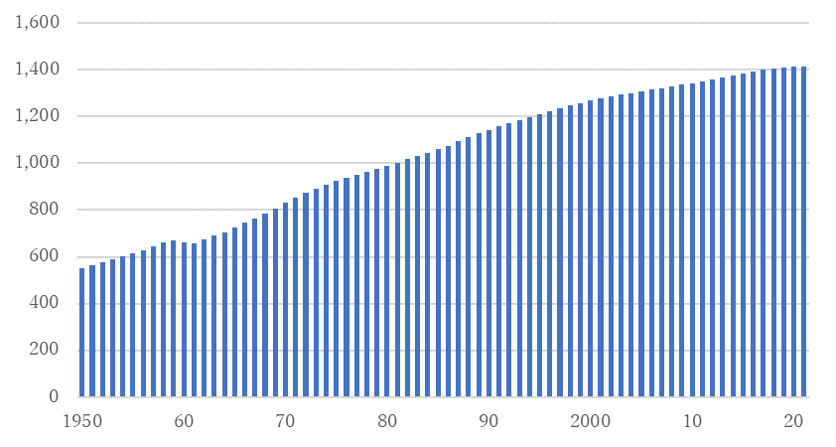

In January 2022, the National Bureau of Statistics announced that the population at the end of 2021 was 1,412.6 million, an increase of only 0.48 million compared to the same period of the previous year (See Figure 2).

Figure 2: The Total Population (Million Persons)

Following this announcement, it is pointed out that in 2022, the population is likely to reach its peak though it was previously expected to do so in 2028.

The working-age population (defined in China as those aged 15 or older and less than 60), which has major effects on economic activities, started to decrease gradually after it reached its peak in 2011 when it was 940.72 million, and it has been indicated that the population decrease will accelerate in the second half of the 2020s.

A second factor is the slowdown of urbanization.

The concentration of population in first-tier cities such as Beijing, Shanghai, Guangzhou, and Shenzhen and in second-tier cities that follow them will continue in the future, but most of the third- to fourth-tier cities can no longer expect their population to grow owing to the inflow of people.

A third factor is decreases in investments in the construction of large-scale infrastructure.

In particular, the central government is applying stricter standards to examine public works projects in an effort to reduce the risk of bad debts growing, and this is accelerating the tendency mentioned above.

A fourth factor is the prolonged stagnation of the real estate market.

The direct reason for this is the central government’s tighter measures to reduce speculation in real estate.

In addition, forecasts of population decreases and slower urbanization affect the stagnation as people are aware that in the future, they will become factors that push down demand for real estate.

The prolonged stagnation of the real estate market causes provincial governments to face fiscal difficulties and the central government to shoulder heavier fiscal burdens.

In financial aspects, it brings bad debts to small and medium-sized financial institutions in provincial areas and causes local governments to bear heavier financial and fiscal burdens in order to help failed financial institutions.

A fifth factor is the prolongation of conflicts between the United States and China.

From a macroeconomic point of view, this does not have such large effects directly on the Chinese economy, but its psychological effects on businesspeople cannot be disregarded.

A sixth factor is a downturn in the expected growth rate.

The factors specified above combine to weaken expectations for the future of the economy, which in turn makes corporate managers more cautious about investment and consumers less willing to buy.

A seventh factor is that if the growth rate falls owing to the factors listed above, the performance of state-owned enterprises whose managerial efficiency is low would deteriorate, and the central and provincial governments would be forced to bear heavier financial burdens as they have to cover greater losses posted by such enterprises.

It was previously expected that these medium- to long-term factors would start to become prominent around 2025.

It appears, however, that for reasons such as the announcement of new statistical data and the effects of policy implementation by the government, these factors have begun to surface about three years earlier than expected.

Factors that underpin the Chinese economy

If there were only the negative factors mentioned above, the Chinese economy would certainly see its growth rate decline rapidly in the years to come.

But since there are factors described below which underpin the economy, it is expected that the growth rate will only decline somewhat slowly.

One factor is the continued growth in investment in China by foreign-affiliated businesses.

As the income level of the Chinese population rises rapidly and demand for high-value-added products expands, the Chinese market becomes even more attractive.

In addition, as it is concerned about a slowdown in the growth of domestic demand, the Chinese government provides generous support to foreign-affiliated businesses in an effort to attract excellent businesses even more actively, and this supplies a nice tailwind for their investment expansion.

For this reason, the policy of the majority of major Japanese, North American, and European businesses, which are highly competitive in the global market, is to continue to take an aggressive policy in the Chinese market.

A second factor is that Chinese businesses are becoming more and more competitive in the international market.

Owing to rapid growth in the number of university graduates, human resources with high academic backgrounds are growing substantially in number.

Supported by these abundant personnel with high academic backgrounds, the competitiveness of Chinese businesses in fields such as EV, lithium batteries, solar panels, semiconductors, PC, and smartphones has improved steadily.

As in the past, the industrial sectors in which Chinese businesses have a competitive advantage are anticipated to continue expanding in the future.

A third factor is wider economic exchange with developing countries in the Asian region.

China has energetically promoted its Belt and Road Initiative, establishing closer cooperation with neighboring developing countries, particularly in Asia.

In the future, as the countries of the Association of Southeast Asian Nations (ASEAN) and India are predicted to maintain long-term economic development, it is expected that the cooperation between these countries and China will become even deeper, expanding relations of cooperation such as the horizontal division of labor even further in the medium and long run.

A fourth factor is the avoidance of large bad debts.

China has closely studied Japan’s experience in real estate bubbles and implemented various policies to avoid such risks.

The results of such policies have manifested themselves in the form of successful policy to control speculation in the real estate market of first- to second-tier cities.

Given this situation, China is highly likely to be able to avoid such a long-term stagnation of the entire economy as Japan experienced following the collapse of the bubble economy in the 1990s.

In light of the factors listed above, even in the phase in which China’s economic growth rate continues to fall in the 2020s, the possibility is slim that the attractiveness of the Chinese market to businesses in Japan and the rest of the world dwindles rapidly.

It is essential for Japanese businesses to analyze changes in market needs in each sector of the Chinese market calmly and in detail without being misled by reports by mass media, which emphasize declines in the economic growth rate, and strive to win in the competition in the Chinese market through appropriate marketing and swift decision-making by management.

The competitors in the Chinese market are Chinese businesses which are further increasing their technological capabilities and first-rate North American and European, South Korean, and Taiwanese businesses which maintain their high competitiveness in the global market.

The key to the survival of Japanese business in this harsh competition in the future is to develop highly specialized human resources with high academic backgrounds and provide leadership education to produce people who boldly take on new challenges in the competition in the global market.