Media Global Economy 2021.06.15

Setback for China: Unable to Stop Birth Rate from Falling; Japan’s Cooperation Essential China’s one-child generation sees no point in having a second child

The article was originally posted on JBpress on May 19, 2021

1.Rapidly declining birth rate

On May 11, 2021, the National Bureau of Statistics of China (NBS) announced the results of the Seventh National Population Census conducted in 2020.

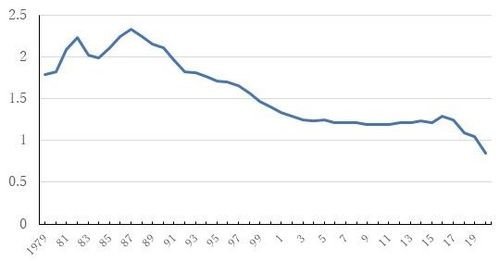

The number of births in 2020 was 12 million, and the proportion of births to the population was 0.85%, the lowest ever since the statistics began in 1952 (Chart 1).

In order to control population growth, the Chinese government introduced the one-child policy in 1979, which in principle prohibited couples from having a second child, except for farmers and ethnic minorities who met certain conditions.

Recently, there have been concerns about the declining birth rate, and the Standing Committee of the National People’s Congress (a counterpart of the diet in Japan) decided at the end of 2015 to allow all couples to have two children under a new policy, which came into effect at the beginning of 2016. An extension of childcare leave was also incorporated into the new policy.

However, this resulted in the birth rate rising only in 2016, the very year the new policy was launched. From 2017 onwards, contrary to the purpose of the new policy, the decline in the birth rate has been accelerating (Chart 1).

Chart 1: Trends in Proportion of Births to Population (Unit: %)

Sources: CEIC and NBS.

2.Reasons behind declining birth rate

As the main reasons behind the falling birth rate despite the abolition of the one-child policy, the NBS pointed out that the population of women of childbearing age continues to decrease; the age at which people become parents is rising; and child-rearing costs are escalating.

To these reasons pointed out by the NBS, I would like to add the following three points.

First, with regard to the decrease in the population of women of childbearing age, since the birth rate has been rapidly falling since 1988, as shown in Chart 1, it is understandable that the number of women of childbearing age started decreasing about 30 years after that.

The reason for the decline in the birth rate since 1988 is the end of the third baby boom in China.

Incidentally, the first baby boom (1950-58) was triggered by an increase in the number of marriages against the backdrop of the enactment of the Marriage Law after the founding of China; the second (1966-70), by the discontinuation of the population policy due to the Cultural Revolution; and the third (1980s), by an increase in the number of births as first baby boomers were having their own babies.

Second, escalating child-rearing costs are primarily due to the rise in the cost of various types of education.

Since the 1980s, a living arrangement has been established on the assumption that parents have just one child, in which the child is raised by a total of six adults, namely, the child’s parents and their respective parents (grandparents).

Up until the 1990s, the college-going rate was low, and there was a widely shared perception that as long as one graduated from college, one could get a good job (610,000 college graduates in 1990, 1.55 million in 1999 and 9.67 million in 2020).

As a result, it became the norm among average urban households to invest the six adults’ income in the only child to provide him/her with gifted education from infancy, and based on this assumption, people started to take the high education expenditures for granted.

Under such a household structure, most families are, even if suddenly permitted to have a second child, forced to give up on doing so because they cannot afford to pay the same amount of money for education for the second child as for the first.

Thirdly, I think major reasons other than those pointed out by the NBS include the fact that people raised without siblings under the one-child policy are now becoming parents themselves.

Many Chinese of the same generation as I have children of childbearing age. When I asked them why the number of children did not increase in China, they replied that in addition to the high education costs mentioned earlier, there was a reason unique to the country’s one-child generation.

Young people born under China’s one-child policy have no siblings, and neither do their friends.

For this reason, a Chinese friend of the same generation as I was astonished to hear the following answer when he asked his child immediately after the abolition of the one-child policy why he did not want to have a second child.

“We all were raised as an only child and don’t feel any inconvenience. So, even if I am told it’s better to have another child, I don’t know if it’s really a good idea.”

This was a few years ago, but I believe that the mindset of Chinese young people who grew up as an only child has not changed significantly even to this day.

In light of the above reasons, it will be very difficult to stop the decline in the birth rate in China, and it may be inevitable that the problem of a dwindling birthrate and aging population will become a heavy burden on the Chinese economy in the long run.

3.Population aging to accelerate from 2025 onwards

China’s working population peaked in 2011 and has been on the decline since then. Even if China embarks on an initiative to change its demographic composition, the working population will not begin to grow again until 15 years from now, in the late 2030s at the earliest.

Given the fact that the age at which people start to engage in productive activities is rising due to the popularization of higher education, it will probably be after 2040. Furthermore, as explained previously, it is unlikely that the new policy will boost the birth rate.

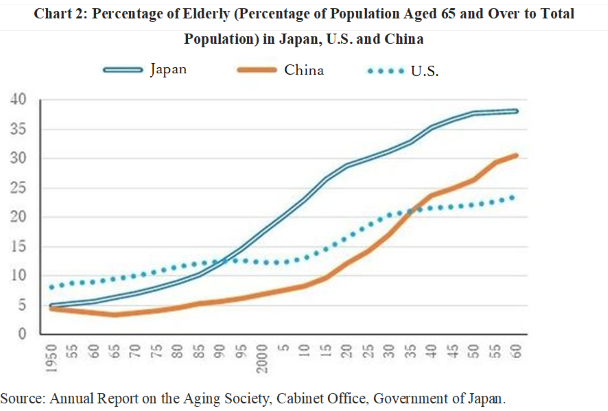

The working population will certainly continue to shrink for at least the next 20 years, whereas the aging of the population will accelerate from 2025 onwards (Chart 2).

By the mid-2030s, the percentage of the elderly (the percentage of the population aged 65 and over to the total population) in China will surpass that of the U.S. and approach that of Japan.

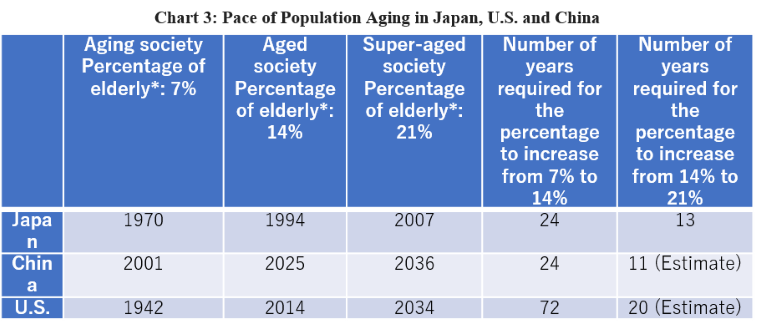

As clearly shown in Chart 3, the pace of population aging in China is expected to exceed that of Japan from 2025 onwards.

It took 13 years for Japan to shift from an aged society (the percentage of the elderly standing at 14%) to a super-aged society (21%), while it is forecast to be as short as 11 years for China.

Incidentally, the corresponding period of time for the US is estimated at 20 years, the longest among the three nations.

It is clear from Japan’s experience since the 1990s that the aging of the population is highly likely to cause long-term and serious damage to the whole economy and society through slowing economic growth and increasing the social security burden associated with the plunging working population.

*The percentage of the population aged 65 and over to the total population.

Sources: Annual Report on the Aging Society, Cabinet Office, Government of Japan and UN World Population Prospects.

4.Slowdown in economic growth from late 2020s inevitable

I have long argued there is a high possibility that China will see the end of its era of rapid economic growth in the late 2020s and its economic growth rate will fall from then onward, owing to the following four factors:

The first factor is the acceleration of population aging (the pace at which the working population is declining); the second is the slowdown of urbanization; the third is the decline in investment in large-scale infrastructure construction; and the fourth is the deterioration in the performance of state-owned enterprises (SOEs).

The first factor is likely to have the greatest impact of the four and is explored in detail above.

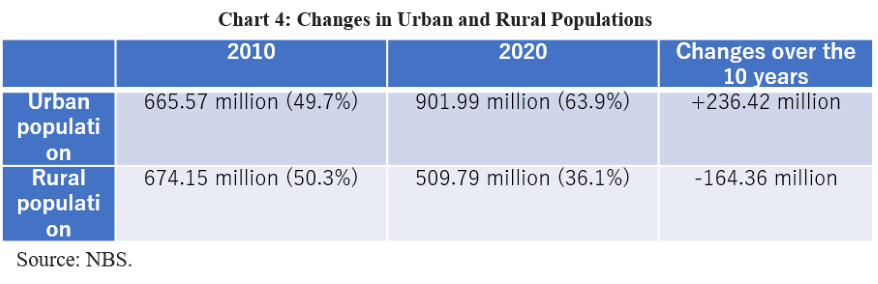

As for the second factor, as shown in Chart 4, the urban population ratio increased by 14.2 percentage points to 63.9% over the 10 years from 2010 to 2020.

This has supported the Chinese economy through increased housing construction and expansion of service consumption in urban areas.

If urbanization continues at the same pace, the urban population ratio will reach slightly under 80% by 2030.

In the meantime, in the 14th Five-Year Plan launched this year, the Chinese government has set a policy of facilitating the influx of farmers into cities by easing restrictions on the acquisition of urban household registration by farmers, as well as by developing systems for the right of farmers’ children to compulsory education and the right of farmers to social security after moving to cities.

Once this policy begins to exert its effect, the pace of urbanization will accelerate for the time being.

However, since the fall in China’s rural population will lead to a decrease in budget allocation and political voice for rural areas, resistance from local governments is expected.

In addition, in line with the enhancement of social security benefits for farmers and the rise in the standard of living in rural areas, some farmers are no longer willing to migrate to cities.

Moreover, due to the fact that migration from rural areas to urban areas has been taking place mainly among the younger generation, many of the farmers remaining in rural areas are the elderly, and their need to migrate to cities tends to decline.

Based on the above, although China’s urbanization will continue for some time to come, it is anticipated to lose momentum before 2030.

With regard to the third factor, large-scale infrastructure construction, construction of important large-scale infrastructures such as major high-speed railroads and highways has already been completed, and there are not as much large-scale infrastructure planned for the future as before.

Furthermore, with the transportation infrastructure connecting China’s major cities such as Beijing, Shanghai, Guangzhou, Shenzhen, Wuhan, Chongqing and Chengdu having almost been developed, the transportation infrastructure to be built going forward will either connect the other cities or connect the inner parts of the above-mentioned major cities and their surrounding areas.

Its pump-priming effect will be lower than that of the previous key trunk line network construction. Accordingly, large-scale infrastructure construction is less likely to drive economic growth than before.

The fourth factor, the deterioration in the performance of SOEs, is caused by the drop in the economic growth rate brought about by the above three factors. Also in Japan, the end of the high growth period led to worsening of the performance of SOEs such as Japan National Railways, Nippon Telegraph and Telephone Public Corporation, and Japan Post and forced them to go private in order to reduce the financial burden.

I believe that the same situation will happen in China. Moreover, considering that the share of SOEs in the Chinese economy remains at 20-30%, far higher than the comparative figure in Japan in the 1980s, the deteriorating performance of SOEs will have all the more serious side effects.

Owing to the above factors, China’s economic growth is predicted to slow sharply from the late 2020s onwards.

5.Policy implementation by the Chinese government

The long-term risk scenarios described above have been known for almost a decade. Taking them into account, the Chinese government has implemented various policy measures to deal with those risks.

Its basic policy is to build a private sector-led economy that relies not on fiscal and industrial protection policies but on the market mechanism, and to reduce monetary and fiscal risks.

Specifically, it aims to reform SOEs, strengthen corporate competitiveness by promoting innovation, reinforce the management base of small and medium-sized enterprises (especially in terms of financing), improve the transparency and efficiency of financial markets, address local government debt issues, work on non-performing loan problems, cut excess production capacity, enhance environmental protection policy, develop the social security system, and so on.

The above issues have long been pointed out by Beijing, and the necessary policy measures have been presented in detail.

Nevertheless, the implementation of these measures has been delayed owing to an array of challenges that have arisen one after another since the start of the Xi Jinping administration.

Those challenges include anti-corruption campaigns, reform of the People’s Liberation Army, downturn in the private economy (slower growth in exports and capital investment), the formation of mini-bubbles in stocks and real estate and consequent falling asset prices, economic friction with the Donald Trump administration, and response to the spread of COVID-19.

There is a growing risk that China will, despite a mountain of important issues at hand, see the end of the era of rapid growth, a decrease in the growth rate and economic destabilization in about five years.

Depending on the situation, that time may come sooner.

The next five years will be China’s last chance to tackle the above challenges before the economy becomes unstable. The 14th Five-Year Plan outlines a basic policy for the management of economic measures.

It is almost a repetition of the existing policy measures, with nothing new in it. However, it is my understanding that it contains Beijing’s strong will to realize the important policies that have not yet been implemented.

If the Chinese economy falls into chaos, the entire society will be destabilized. Given the seriousness of that risk, China cannot afford to be at odds with the U.S. It can compromise with the U.S. at any moment, but it cannot lose any time in carrying out domestic policies.

In that light, there is no way China can afford to confront Japan.

Foreign companies have a major role to play in facilitating China’s open-door policy and promote indigenous innovation, to which Beijing attaches great importance.

Japanese companies are particularly important, as they have made significant contributions to employment, tax revenues, and technological advancement in various parts of China over the years.

The Chinese economy is not as assured of long-term stable development as many people in Japan, the U.S. and Europe think.

The truth is that the stability of the Chinese economy is somehow maintained thanks to efforts by the Chinese government to overcome each and every difficulty with utmost caution.

It is also true that Japanese companies have little room for development if they remain in the domestic market, whereas there are great opportunities if they venture into the Chinese market.

I hope that the governments and businesses of Japan and China will work closely together, recognizing that the two countries could have a win-win economic relationship while taking into account the risks involved.