Media Global Economy 2021.04.28

Deepening US-China Economic Interdependence Contrary to Decoupling Policy US consumer and business behavior is independent of government intentions

The article was originally posted on JBpress on March 17, 2021

1.Biden administration maintains a hard line towards China

It has been almost two months since the transition from the Donald Trump administration to the Joe Biden administration took place.

As is the case with the Trump administration, the Biden administration’s basic policy on China is a hard line toward the country by positioning it as a strategic competitor.

Secretary of State Antony Blinken, National Security Advisor to US President Jake Sullivan, Indo-Pacific coordinator Kurt Campbell, Special Assistant to the Secretary of Defense Ely Ratner, and other key members in charge of US foreign and security policies toward China have taken a hard-line stance to the country.

Their perceptions of China are not expected to differ significantly from the Trump administration’s basic perceptions of China with regard to Xinjiang, Hong Kong, Taiwan and the tech cold war.

The Biden administration has made the containment of COVID-19 and economic recovery its top priority for the time being, and cooperation with the Republican Party is crucial for the congressional approval of legislation to that end.

Moreover, Congressional officials are bipartisan in their support for a hard line against China.

Accordingly, the Biden administration is likely to maintain a hard line against China in tandem with Congress for some time to come, thereby focusing on implementing its domestic policies smoothly.

However, many of the senior officials in the Biden administration who are responsible for policy toward China are well versed in China issues. In this respect, the current administration is critically different from the Trump administration, which managed policy toward China based on a false perception of the country.

In addition, since the president will no longer act on his own in disregard of the policy set forth by the administration, the predictability of policy is expected to increase.

If the Biden administration is able to achieve certain results in the implementation of key domestic issues and measures, it is forecast to show its own colors in its policy toward China little by little from the summer onward.

Specific issues for consideration are thought to include a review of tariffs, selective application (partial easing) of restrictions on tech exports to China, which have so far been applied uniformly, revival of regular ministerial-level dialogue between the US and China, and possible climate change cooperation.

However, many believe that we can hardly expect to see any major changes in foreign and security policy.

2.US consumers are on a buying binge of Chinese products

Despite the above outlook for the US-China relationship, the two countries appear to be getting closer on the economic front.

Since the second half of 2020, US consumers have significantly increased their purchases of Chinese products, and US companies have continued to demonstrate an aggressive investment stance in the Chinese market.

These facts seem to indicate that the economic behavior of US consumers and businesses is independent of the policy direction of Washington. Here are two symbolic events that show this.

The first is the rapid expansion of China’s exports to the US in the second half of 2020.

At that very time, the Trump administration was strongly promoting US-China decoupling.

China, meanwhile, had adopted strict preventive measures to control the spread of COVID-19, restricting the movement of a wide range of local residents after only a few new cases were found in one area.

This was effective in curbing the spread of the disease, but the damage to the restaurant, travel, and retail industries was so huge that it delayed the recovery in consumption.

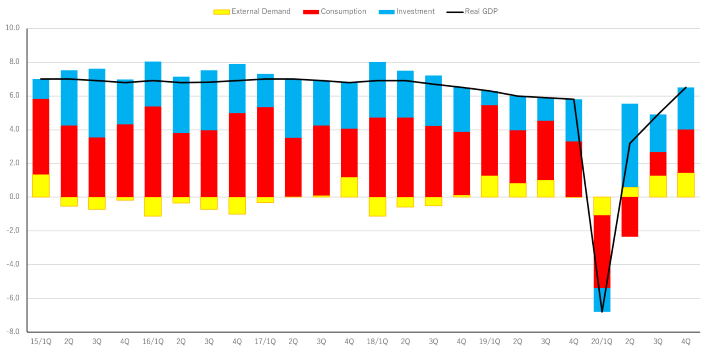

A look at the trends in the contribution of each component to real GDP (gross domestic product) growth over the past several years finds that the contribution of consumption has been around 4%, while that of investment has been around 2-3% (Chart 1).

Chart 1: Contribution of Each Component to China’s Real GDP Growth Rate

In the second half of 2020, the contribution of investment recovered to almost normal levels, at 2.2% in 3Q and 2.5% in 4Q, whereas the contribution of consumption was only 1.4% in 3Q and 2.6% in 4Q, lower than normal levels.

Nevertheless, real GDP growth rate was 6.5% in 4Q, recovering to pre-COVID-19 levels. It was the high growth in foreign demand that offset the slow recovery in consumption.

This high growth in foreign demand was underpinned by the surge in exports to the US.

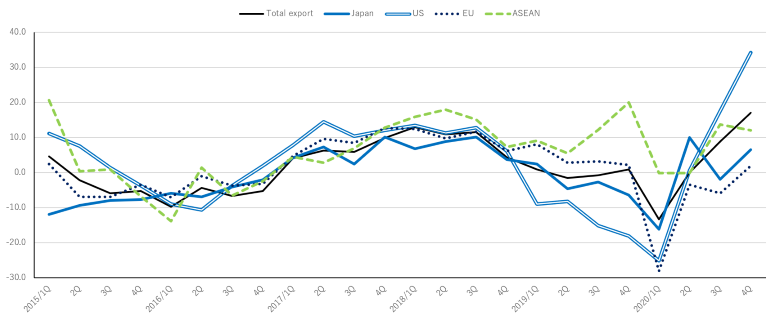

Data on China’s exports by country and region show that exports to the US soared in the second half of 2020 (Chart 2).

Chart 2: China’s Exports by Country and Region

In the second half of 2020, China’s exports to the US grew at an astonishingly high rate of 17.6% in 3Q and 34.3% in 4Q, year on year.

The comparison is made with the second half of 2019 in which COVID-19 had not yet spread. Nevertheless, the growth was so rapid.

The sharp increase in China’s exports to the US is attributable to the following three factors.

The first is the Christmas shopping season, and the second is the cash benefit as a countermeasure against COVID-19. Both of these are factors that have boosted consumer spending in the US.

Normally, part of the money would go to service consumption. However, owing to restrictions on outings amidst the COVID-19 pandemic, service consumption, such as eating, drinking, and traveling, decreased, and consumption of goods increased by that amount.

This has led to an increase in imports from China. According to a recent opinion poll, nearly 90% of US citizens bear ill feelings toward China.

It is found that even so, there has been no change in US consumer behavior in favor of Chinese products, as long as the quality is good and the price is reasonable.

And the third factor is the fact that production lines for various products were halted in many countries owing to COVID-19, and Chinese companies took over production of such products, some of which led to an increase in exports to the US.

3.US Companies Continue to Invest Aggressively in China

The second event is the continuation of the aggressive investment stance of US companies in China.

World-class, highly competitive global companies have a common view that there is no other market in the world as attractive as China over the next 10 to 15 years.

For this reason, all leading companies in the US, Europe, Japan and other major countries and regions are aggressively investing in China.

The rival companies that these companies compete with in the Chinese market are foreign companies from Japan, the US and Europe rather than local Chinese companies. Accordingly, products without cutting-edge technology cannot survive the cutthroat competition.

Concerned about the outflow of security-related technology to China, the US government has rigorously restricted the export of products using high-level technology to China.

However, considering the need to ensure the competitiveness of US companies in the Chinese market, Washington cannot ban the use of advanced technologies in consumer products.

Although they are not directly diverted to military use, there is no stopping the Chinese people at the production site from gradually acquiring the technologies as they continue to manufacture such consumer products in China over the medium to long term.

Foreign companies will be caught up with by their Chinese counterparts unless they continue to develop new technologies before their Chinese rivals master the technologies and start producing products of almost equal quality at lower cost in a few years.

If Chinese competitors catch up, product prices will drop, and it will become difficult for foreign companies to secure profits. The only way for foreign companies to prevent this from happening and to maintain a technological and competitive advantage over their Chinese counterparts is to continue developing state-of-the-art technologies.

As described above, even if Washington tries to curtail the expansion of investment in, and the outflow of technology to, China, the reality is that it is extremely difficult to do so.

It is clear from the above that US-China decoupling in terms of both consumption and investment is not only unfeasible, but it also seems to be next to impossible to prevent the trade and investment relationship between the two countries from growing closer over the medium to long term.

4.How Should the US, Europe and Japan Confront China Going Forward?

When I explain the above to China experts in the US, I am often asked a question.

The question is “Then, what kind of policy should the US adopt toward China?” To this I give the following answer:

The governments and companies of Japan, the US and Europe continue to strongly urge Beijing to improve the business environment in China so that they can compete with their Chinese counterparts on equal terms. And in fact, Beijing also shares this goal.

If the Chinese market continues to rely on state-owned enterprises and private companies that are supported by subsidies and preferential policies, and to lack transparency, market mechanisms, fair market access and other adequate conditions, Chinese companies will not be able to compete on par with rivals from developed countries.

In the reality of the end of the era of rapid growth and the transition to stable growth that China will probably face in a few years, the improvement of the international competitiveness of Chinese companies will be an important prerequisite for mitigating the risk of instability in the Chinese economy.

This policy issue was clearly recognized by Beijing when the decisions of the third plenary session of the 18th Central Committee of the Communist Party of China were announced in November 2013.

Perhaps even as early as 2001, when China joined the World Trade Organization (WTO), it had a rough idea of the need to promote market structure reform.

Although the Trump administration claimed that US engagement policy towards China had failed and that China had not changed at all in the past two decades, it is not true.

In the two decades since 2001, China has made steady progress in the transition to a market economy. However, the pace of progress was not as fast as expected.

On the contrary, the Chinese economy expanded in scale and strengthened its competitiveness faster than expected, which posed a threat to the US.

Since 2013, the Chinese government has faced tough challenges year after year, including the massive bad debt disposal created by economic stimulus packages after the collapse of Lehman Brothers, anti-corruption campaigns, reform of the People’s Liberation Army, a dramatic slowdown in private capital investment and exports, the formation and bursting of a mini-bubble, the serious US-China dispute under the Trump administration, and COVID-19.

In order to solve these key issues at hand, it was difficult for Beijing to push through structural reforms that would make enemies of the vested interest groups with political power.

Therefore, bold structural reforms to introduce market mechanisms comparable to those of developed countries were postponed.

As a result, there are only a few years left until the mid-2020s, when the Chinese economy is forecast to begin experiencing medium- to long-term instability. The current Chinese government cannot afford to postpone structural reforms.

Beijing appears to be using external pressure to accelerate domestic market reforms.

This approach is similar to that once taken by the Japanese government; it used trade frictions with the US and the Japan-US structural talks to promote domestic structural reform.

The Chinese government took a positive attitude toward building a new framework for improving the trade and investment environment last year, as demonstrated by the implementation of the Foreign Investment Law in January in response to a demand from the US for an improved investment environment, followed by the RCEP agreement in November, President Xi Jinping’s announcement of his intention to actively consider joining the CPTPP in November (which has been repeated since then), and the China-EU Comprehensive Agreement on Investment in December.

This is thought to reflect Beijing’s proactive stance in promoting domestic reforms.

For the governments of Japan, the US, and Europe, it is important to accelerate the Chinese government’s proactive reform efforts through external pressure.

Specific measures of external pressure include ensuring the effectiveness of the China-EU Comprehensive Agreement on Investment, which has only been agreed upon but has not yet been ratified by European countries; monitoring and demanding improvements in the actual operation of the Foreign Investment Law, with the US government playing the central role in it; and confirmation of various market competition conditions in China’s domestic market in a transparent and detailed manner by the Japanese government during CPTPP accession negotiations.

With the governments of Japan, the US and Europe urging Beijing through these various channels to proactively promote structural reforms, the Chinese economy will be able to develop the foundations for maintaining stability.

At the same time, the global economy will be able to secure a more robust free-trade regime and a fairer investment environment.

I hope that both sides of Japan, the US and Europe, and China will share these goals and smoothly promote structural reform and market opening in China through mutual understanding and cooperation.