Media International Exchange 2019.10.24

Reason for China's National Capitalism Not Being a Threat - A risk that could cause serious damage to the global economy would be long-term stagnation in China, if anything -

When I have a discussion with experts in international politics and economics during my business trips to the US and European countries, I notice that the view that China's national capitalism sweeping across the world will become a great threat to developed countries in the future is widely shared.

Of course, in Japan, there are not a few people who share this view.

However, many of the overseas workers of Japanese companies who stay for a long period in China understand the actual conditions of inefficient management of state-owned companies, and information about them is shared to a certain degree in Japan. So I feel that the view that the threat caused by Chinese state-owned companies is a concern is not as strong in Japan as it is in Europe and the United States.

Compared with Japan, in the United States and European countries, the majority of experts, but not all of them, are afraid that Chinese state-owned companies, which are supported through huge amounts of subsidies and protective policies such as regulation of entry into the market on foreign-affiliated companies and Chinese private enterprises, would sweep across global markets by taking advantage of the huge earning power backed by the state.

With regard to these concerns, I always make an effort to remove their misunderstanding by explaining the following points:

Firstly, it is evident that state-owned companies are managed in a more inefficient way compared with private enterprises in China. One of major reasons for this is that, for central enterprises (large-scale state-owned companies under the direct control of central government) whose sales and total profits account for half or more of those of state-owned companies, the top priority in managing them is to achieve the state's policy objectives and that management efficiency is of secondary importance for them.

Managers who are regarded highly by the Party and the central government will often take an important post in the central and local governments such as a minister of the central government or a director general of a local government.

As the existence of state-owned companies, which operate the policies on behalf of it, are important for it, the Chinese government grants subsidies to them as necessary.

However, the main purpose of it is not to increase the management efficiency of state-owned companies to increase their international competitiveness in order to monopolize the global market.

If so, the Chinese government should consider inviting an extremely able manager from a foreign company by paying a high salary to entrust the management reform, but I have not heard of such a case. The situation where the management efficiency of the average state-owned companies is largely lower than that of private enterprises continues.

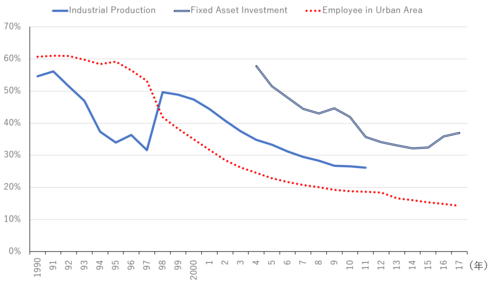

The reason why the Chinese economy could realize high-growth economy over a long period of time after the 1980's is that the proportion of inefficient state-owned companies has shrunk while conversely the proportion of efficient private enterprises continues to increase (see Figure 1 at the beginning of the preceding page).

[Figure 1] Proportion of state-owned companies in major economic indicators (Source: CEIC)

Secondly, even if the Chinese government carries out protective policies, it cannot nurture a company with sufficiently high competitiveness to survive in the global market. This is evident in view of the experience of the high-growth period in Japan.

Companies well protected by the government in the high-growth period, such as banks, oil companies, transporters, carriers, communications carriers, and small-scale retailers, have low competitiveness without exception as a business structure dependent on protective administration is ingrained in them. This is true of not only state-owned companies but private enterprises.

Under a situation where economic development is at the stage of a developing country, companies' techniques are at a low level, and companies can increase their competitiveness only by introducing the techniques of companies in developed countries, it is possible to promote the development of companies through subsidies and industry protection policy of the government.

However, when companies in developing countries begin to catch up with companies in developed countries at a technological level, they need to develop their skills in technological development and to retain technological capabilities to compete evenly with the highest level of companies in the world.

After companies in a developing country have reached that stage, as the government is not a professional in various industrial techniques, it will become unable to support advanced innovation in them.

Moreover, as companies in which a culture of dependence on the government's protective administration is ingrained can gain a certain profit without trying hard to succeed in the global market by themselves, they have little incentive to try so hard. As a consequence, they drop out of the global competition.

Thirdly, judging from sales and the amount of profits, Chinese companies appear to have terrific competitiveness. However, this is because Chinese companies only enjoy an exclusively favored position in China as the Chinese government restricts foreign companies' free entry into the Chinese market. There are only a few Chinese companies that can compete evenly with leading foreign companies in the global market, which is a place of equal and free competition.

China has a large population, and the Chinese market is large in scale and continues to expand with the high-growth economy. Thus, only in the domestic market are Chinese companies blessed with business opportunities, which cannot be gained in other countries.

If leading companies in net trade, financial services, the manufacturing industry, and the service industry were allowed to enter the Chinese market on perfectly equal terms to Chinese local companies, many of China's giant companies should lose their market share in a short period. However, Japan, America, and European countries also protect their industries to varying degrees; the Chinese government is not the only country that protects its industries.

Moreover, Huawei is a very rare and exceptional case among Chinese companies and possesses the highest level of technological capabilities in the world, and its principal battlefield is the global market. Thus, it does not need aid from the Chinese government. In this respect, Huawei largely differs from the majority of Chinese companies, which have developed only in China.

2. Long-term shrinking tendency of state-owned companies in the Chinese economy

For the above reason, I think that it is improbable for Chinese state-owned companies to dominate world markets. The long-term tendency of shrinking state-owned companies in China supports this view. As the Constitution of China provides that the public ownership system shall be the foundation of the national economy, it is extremely difficult to negatively deal with state-owned companies, which are its core existence.

However, the foundation of the trust many citizens put in the Chinese Communist Party is placed on sustained and stable success in economic policy operation. In order to maintain this trust, as mentioned above, it is essential to shrink state-owned companies continuously and to promote the development of efficient private enterprises.

Therefore, while it adheres on the surface to an attitude of attaching importance to state-owned companies, as things are, the Chinese government shows in its policy operation a long-term tendency to reduce the proportion of state-owned companies steadily and to promote the development of private enterprises.

The Chinese government holds up the target of making state-owned companies excellent, large, and strong as its political slogan, but in fact the number of state-owned companies, especially giant central companies under the direct control of the State-owned Assets Supervision and Administration Commission, has decreased from 117 in 2012 to 97 in 2017.

By merging state-owned companies into a new company, the new company seems to have become large in scale as well as excellent and strong, as unprofitable departments have been closed at the time of merger.

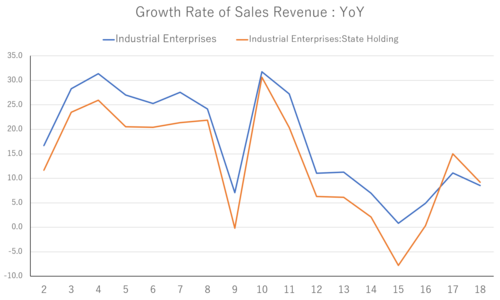

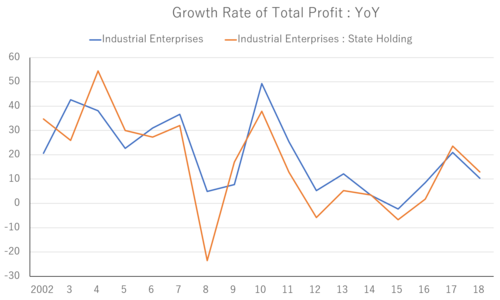

However, a case where the new company's management efficiency has been greatly improved compared with that before the merger as the result of the merger and where its market share has increased to be superior to private enterprises cannot be seen. Accordingly, in the industrial sector, the rise in sales of state-owned companies is almost consistently below that of all companies. In other words, it shows that the rise in sales of state-owned companies continues to be below that of private enterprises (see Figure 2). The changes in the growth rate of total profits show almost the same tendency as sales (see Figure 3).

[Figure 2] Growth rate of Sales (income from business) (unit: % year on year) (Source: CEIC)

[Figure 3] Growth rate of total profits (unit: % year on year)(Source: CEIC)

Note: As data about growth rates year on year in 2002 through 2006 and 2008 through 2009 regarding state-owned companies are not announced, I calculated those rates based on data about the amounts of profit. Other figures are announced data about the rates year on year.

3. Did state-owned companies start to be expanded in earnest after 2017?

From the graphs shown in Figures 2 and 3 above, we can see that the growth rates of both sales and total profits of state-owned companies were below those of private enterprises until 2016 but that those of state-owned companies were higher than those of private enterprises in 2017 and 2018.

Does this show that state-owned companies have improved in management efficiency to be superior to private enterprises as a result of success in state-owned company reform by the Chinese government? I put this point to a high-ranked government official who participates actively in economic policy operations in the Chinese central government. He came back quickly with a negative reply.

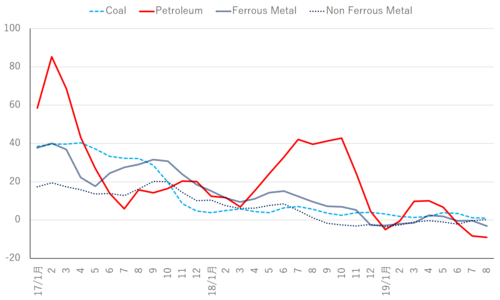

The official said that the recent improvements in state-owned companies' results were not brought about from their improved management efficiency and that a rise in selling prices due to a rise in the prices of oil, coal, steel and the like simply resulted in improved financial results.

Regarding the trend in their prices, surely the rises in producers' prices in 2017 and 2018 were marked ones (see Figure 4). Similarly, improvements in state-owned companies' results were seen when the market recovered in 2011 formerly.

The above government official replied that, regarding the outlook, as the oil market, steel market and the like have stabilized in the current year and the rise in prices has cooled off (see Figure 5), the results of state-owned companies will fall below those of private enterprises in the future as before.

[Figure 4] Industrial product producers' shipment prices (unit: % year on year) (Source: CEIC)

[Figure 5] Industrial product producers' shipment prices (unit: % year on year) (Source: CEIC)

As actual managerial indicators in this year regarding state-owned companies will be announced next year, validation using announced data cannot be made for a while.

However, as it is known that managerial indicators can be acquired regarding state-owned companies even at an intermediate stage inside the Chinese government, it can be considered that those indicators will probably change as indicated by the aforementioned government official.

4. A concern for the Chinese economy is a risk of long-term economic stagnation in the 2030s

Let us return to a talk with European and American experts who are anxious about the rise of China's national capitalism.

After I explained about state-owned companies and the Chinese government's industry protection policy as mentioned above, what I will point out is a completely different concern. Many European and American experts have the impression that the Chinese economy will continue to grow at a high rate over a long period of time in the future and will rise above the US considerably in gross domestic product (GDP) and control the global economy. On the contrary, I expect that China's high-growth period in which its real GDP growth rate is above 5% will end in the 2020s and that such growth rate is likely to fall to 3%-4% owing to three factors in the second half of 2020's.

The first factor is a slowdown in urbanization, the second is a reduction in the construction of large-scale infrastructure, including rapid rail transit, expressways, and airports in major cities, and the third is an increase in the fiscal burden resulting from an aging population and lower birthrate.

In about 2030, the Chinese economy will catch up with the US in GDP, and the GDP of each the US and China will amount to about 20% of that of the whole world.

However, it seems that, in the 2030's, China's economic growth rate will also be below the growth rate of the global economy like other developed countries and that China will start to show a downward trend in its share of GDP gradually, as will the US, in the global economy.

Around the middle of the 2020's, China's GDP per capita will be above 15,000 USD, and China will join developed countries in terms of its economy. As a consequence, China's economic resilience (recovery power from economic stagnation) will decline like other developed countries.

Therefore, if China's economic growth rate significantly falls once owing to any factor such as an external shock, recovery from it is likely to take years or more.

This is evident from economic stagnation that Japan, the US and European countries have experienced.

It is too optimistic to assume that only China will maintain high resilience, even though it has become a developed country, and will return to normal in about one year.

There is a possibility that the scale of the Chinese economy will reach four or five times the scale of the Japanese one. Needless to say, if an economy of four or five times the scale of the Japanese economy which is closely connected with Japan in terms of both trade and investment fell into long-term stagnation, the Japanese economy would face an extremely severe situation. Moreover, it is certain that the whole global economy will probably suffer severe damage and will be involved in long-term stagnation and that an unstable state would continue.

I think that the view that Chinese companies will dominate global markets and that China's national capitalism will control the world is not a realistic assumption. A more realistic concern is a more unstable global economy caused by the long-term stagnation of the Chinese economy, if anything.

For Japan, the way to avoiding this risk is for Japanese companies to increase investment in China, to increase sales and profit in China's huge market, to support employment, equipment, and tax revenue in China using their technological capabilities, and to promote win-win relations between Japan and China much more. If this was realized, the risk of long-term stagnation in the Chinese economy in the 2030's should be reduced to a certain degree, and it would largely contribute to stability of not only the Japanese economy but the global economy.

The age in which we consider the economy of both Japan and China as a different and independent existence has already passed. The time in which the win-win relations between the economies of both countries should be rightly recognized and a long-term strategy considered has come.