Media International Exchange 2016.09.08

Resurgence of the Galapagos Syndrome of Japanese Companies in the Chinese Market -Japanese Companies Left Behind in the Global Trend to Promote Investment in China-

American, European and Korean companies are starting to invest in China actively

Last November, I had breakfast with a former senior official of the US government on the occasion of his visit to Japan. He is familiar with Asian and Pacific policies, and his first words were "I had some meetings with Japanese major companies and government officials, and I was surprised that their views on the Chinese economy were inclined toward extreme pessimism. Would Japan be all right with this situation?"

Now, the concern he expressed is becoming visible as real data.

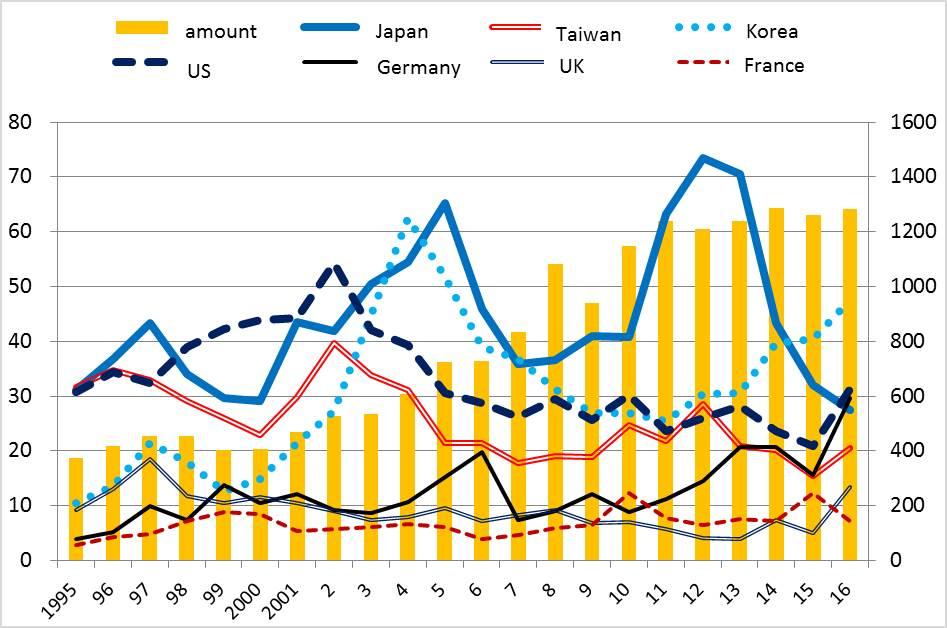

In the first half of this year, the growth rates of the major countries' direct investments in China are +50% for the US, +90% for Germany, +169% for the UK, +18% for South Korea, +34% for Taiwan, -41% for France and -14% for Japan on a year-to-year comparison. Except for Japan and France, major countries have considerably increased their investment in China.

However, the decline in France's investment this year is actually a reaction to the huge increase last year (72% increase on a year-to-year comparison). When compared with the year before last, the amount was slightly increased. Japan is the only country where the amount of investment has continuously decreased on a large scale since 2014 (refer to the Figure 1).

based on the year-to-year comparison. (Source: CEIC)

It is known that this statistical data represents the investment trend of about a year behind the actual trend. Therefore, it was a few years ago, not this year, that these main countries started to take a positive attitude toward investment in China.

In this regard, I checked with an expert who is well-versed in investment trends of Japanese and foreign companies, and found that the trend represented by the statistics is the same as what can be realized in China. The change in the attitudes of American and European companies coincides with the period when their countries started to slowly recover from the world economic crisis after Lehman's collapse.

On the other hand, Japan's investment in China started to drop sharply in 2014 in the statistics. However, the drop actually started in 2013, immediately after the outbreak of the territorial dispute over the Senkaku Islands.

Japan-China relations have gradually improved since the Japan-China Summit Meeting last April. However, as there are still some flash points such as the South China Sea territorial dispute and the increase in the frequency of Chinese government vessels entering the sea surrounding the Senkaku Islands, the pace of improvement is slow, and uncertainty over the future of Japan-China relations has not been dispelled. Therefore, feelings toward China among the general public in Japan are also slow to improve.

This situation has also affected the attitude of Japanese companies toward investment in China. Most of their direct investment still consists of expanded reinvestment by companies which have already entered the Chinese market. There has been almost no investment from new companies.

Moreover, the reinvestment has not gained enough strength because Japanese companies are generally maintaining a cautious stance. In this respect, the difference between Japanese companies and American and European companies, which shifted to a positive stance a few years ago, has become more obvious.

According to the above-mentioned expert familiar with the trends of investment in China, a large-scale fair of children's clothing and foods recently held in China attracted tens of thousands of people per day from all over the country. Many American, European and Korean companies set up huge exhibition booths at the fair to put their efforts into publicity and promotion activities for the Chinese market.

On the other hand, Japan was the only major country from which major companies did not participate. The participants from Japan were only a few unknown local companies, and there was no large exhibition booth. The expert said he felt strong anxiety when he saw the obvious lack of Japan's presence at the event.

"It was as if only Japan was boycotting the Olympic Games held in the Chinese market, where world-class athletes from all other major countries were engaged in fierce competition" was how the expert described his impression of the situation.

Resurgence of the Galapagos syndrome

Previously, Japan boasted world-leading technological capabilities to produce mobile phones, personal computers, digital TVs and other products. However, as the companies were not active in expanding their market overseas, these products were widespread only in the Japanese market, and isolated in terms of the global standards.

This is the so-called Galapagos syndrome.

In spite of their world-class technologies, the companies suffering from this syndrome were left behind in the global market due to the inward-looking attitude of the top management. This has been recognized as an obvious failure.

Now, major global companies in the world are investing a huge amount of capital and excellent human resources in competing in the Chinese market. However, Japanese business managers make no attempt to turn their attention to this market. To me, their inward-looking attitude looks like a resurgence of the Galapagos syndrome.

It has been a well-known fact that Japanese companies were left behind and lost great opportunities in the global market due to the inward-looking attitude of reluctance to develop and sell products and services that meet the needs of the overseas market. I cannot help wondering why many of these companies have not learned lessons from this fact.

Of course, some Japanese companies in automobile, retail, houseware and other industries are actively expanding their business in the Chinese market and making a large profit. However, they account for only 10-20% of all Japanese companies. Most Japanese companies are not taking the opportunities in the Chinese market seriously because they are excessively concerned about the China risk.

Background factor: Lack of understanding about the Chinese market

Why do many Japanese business managers fail to notice the change in the Chinese market and the shift of American and European companies' stance to promote investment in China?

It is because they have reduced their number of business trips to China since the escalation of anti-Japan demonstrations related to the territorial dispute over the Senkaku Islands in 2012. As a result, they now have fewer opportunities to see the Chinese market by themselves, and come to believe the information reported by the media without question even though it is extremely biased toward pessimism.

Many local reporters in China working for the Japanese media have a critical view on the pessimistic bias of their headquarters. In reality, however, they cannot say anything critical of the head editor's decision on the headlines and size of articles.

In spite of such conflict inside the media, many business managers never get to know the real situation and continue to manage their companies without correcting this pessimistic view on China.

For example, the Li Keqiang index is an economic indicator that mainly represents the trends of a heavy industry, and it cannot be used to analyze the trends of the recent Chinese economy led by service industries. Also, there is no longer any restriction on transferring profits made in China to Japan as dividends. If you ask reporters familiar with the Chinese economy about these facts, you will find that they are common knowledge.

However, as the Japanese media do not repeatedly cover these facts in an understandable manner, there are still not many business managers who understand these basic facts.

Actually, these facts are known to any managers who visit China on business several times a year. Therefore, the ignorance about them is not only due to the media coverage.

While many Japanese business managers are losing interest in the Chinese market or excessively cautious about it, the Chinese market has undergone massive structural changes. The following three changes have occurred in the Chinese market since 2010, so you can no longer understand the market situation using conventional wisdom.

The first change is the shift from investment-driven to consumption-driven. The growth of China's GDP (Gross Domestic Product) had been driven by exports and investment until around 2010.

However, since 2011, the contribution of consumption has been consistently larger than that of investment except for 2013. In particular, the contribution rate of consumption to the GDP growth rate reached 73.4% in the first half of this year.

The second change is the rapid expansion of demand for high-value-added products and services due to the rapid increase in the middle class since 2010. The total population of the cities whose GDP per capita is 10 thousand dollars or more was 100 million in 2010, and exceeded 300 million in 2013.

This population is estimated to be around 400-500 million at present, and 800-900 million by 2020. This is the number of potential customers for Japanese companies.

As the third change, economic growth previously driven by coastal regions is now being driven by inland regions. The income levels of the main coastal cities such as Beijing, Shanghai and Guangzhou have already reached the level of developed countries, and these cities are gradually entering a period of stable growth.

On the other hand, main inland cities such as Wuhan, Chongqing, Chengdu and Xian continue to enjoy a high economic growth. American, European and Korean companies are particularly focusing on the development of these inland markets.

Because many of Japanese business managers are not aware of these three structural changes, they are making a judgment on their business in China based on 10-year-old views on the Chinese economy.

Positive attitude of Japanese companies seen in Wuhan

Not all Japanese companies are suffering from the Galapagos syndrome. Some successful companies with a manager who has a good understanding of the Chinese market have ensured large profits by properly seizing new opportunities in the Chinese market.

I made a business trip to Wuhan in late July, and found that Japanese companies in the city were full of vitality. Wuhan is home to a huge state-owned company called Wuhan Iron and Steel (Group) Corp., which is undergoing corporate restructuring to reduce the workforce by 6,000 employees.

Nevertheless, Wuhan continues to enjoy an economic boom, with its GDP having grown by 7.6% in the first half of this year. Actually, I found large construction sites everywhere in the city, from high-rise apartment buildings, office buildings, to subways. Looking at the situation, I felt that the city was growing at a rate of 8-10%.

A Japanese business executive who lives in Wuhan said he did not feel any economic slowdown in his daily life because he saw with his own eyes Wuhan citizens highly motivated to consume.

In particular, the opening of AEON's second mall in Wuhan last December gave an even stronger boost to Japanese companies. This mall is the largest AEON MALL in Asia, and it has a 530-meter-long three-story building and parking with a capacity of 4,500 vehicles.

From what I heard, since the opening of this AEON MALL, the most fashionable way for Wuhan citizens to spend a weekend has been to go to the mall with family and enjoy meal, shopping and playing in the amusement park. Since around the same time, the number of Japanese restaurants has rapidly increased in the city, and "Japan" has become a trend among the population of Wuhan.

Moreover, thanks to the recent successful sales of Japanese cars, automobile-related companies in Wuhan are so busy in meeting orders that the employees have to work on holidays. Every month, one or two new Japanese companies are starting a business in the city. In addition, since ANA started a direct flight service between Narita and Wuhan (one flight per day) this April, trips from/to Japan have become considerably more convenient.

Now, there are growing calls for the establishment of a Japanese School and Japanese Consulate General among Wuhan citizens. Those in charge of this effort are asking all parties concerned for their support. In this way, the attitude of those involved with Japanese companies in Wuhan is very positive.

How can Japanese companies break away from the Galapagos syndrome?

In order for business managers to dispel excessive pessimism about the Chinese economy, it is best to visit China and see the actual conditions with their own eyes. When I was consulted by an economic organization on the destinations of their mission to China last year, I recommended Wuhan without a second thought.

After the mission visited Wuhan last December, they made a trip report within the economic organization. Since then, no member companies of the organization have expressed excessive pessimism like they did previously.

If a company plans to start business in the huge Chinese market, where rapid structural changes are in progress, it is essential for the president of the company to make important decisions, including the structural reform of the management system. If the company waits for a consensus to be built with the bottom-up approach, the situation of the Chinese market will change considerably, and the company will lose business opportunities.

In other words, if the president of the company fails to fully understand the Chinese market and make final business decisions by himself/herself, it will be difficult to succeed in business in China. Therefore, the president needs to visit China on business at least five or six times a year.

However, to put it into practice, you will need an initial trigger. For those business managers who have only visited Beijing and Shanghai once or twice a year, I would recommend visiting Wuhan, Chongqing, Chengdu or Xian once, and feel the massive changes currently taking place in the Chinese economy.

In addition, let's consider the reasons why the number Chinese tourists visiting Japan continues to increase sharply.

Apparently, what comes to our mind are only negative factors, such as the Chinese stock plunge last year, the recent appreciation of the yen against the Chinese yuan, the frictions related to the South China Sea and the declining Chinese economy.

However, despite these factors, Chinese tourists visiting Japan are increasing at a furious rate. Last year, there were 4.99 million visitors, an increase of 2.1 times compared to the previous year. The first half of this year has already seen 3.076 million visitors, an increase of 41.2% on the same period last year.

The background to this increase is the rapid growth of the middle class in China, which is the target customer for Japanese companies in the Chinese market.

When you read a newspaper, please take a look at China-related information included in articles in the corporate information section, such as announcements of financial results, as well as news on the Chinese economy in the international section. Recently, the polarization of Japanese companies' stance toward business in China has become noticeable. Therefore, it is important to pay attention to the information of companies that are successful in China.

I hope that reviewing business in China from these perspectives will prevent as many Japanese companies as possible from suffering from the Galapagos syndrome in the Chinese market.

(This article was translated from the Japanese transcript of Mr. Seguchi's column published by JBpress on August 18, 2016.)