Column Global Economy 2015.11.30

An evaluation of the TPP

First...

An agreement has been reached in the TPP negotiations. It could be said that this is the result of both Japan and the US' determination to do so. For the Abe administration, the TPP was the most important issue of the structural reform policies known as The Third Arrow. President Obama, who lacks outstanding achievements during his presidency, also regarded the TPP as a great achievement of his administration.

President Obama's confrontational attitude towards the US Congress and lack of lobbying or consensus building process has been criticized. However, for the agreement of the TPA bill which shifts the authority of trade negotiations from Congress to government, President Obama took a positive attitude and personally tried to persuade Representative Pelosi, the Minority Leader of the House of Representatives. This was because agreement on the TPA was necessary in order to achieve an agreement in the TPP negotiations.

In addition, the US suffered the embarrassment of several allies, including the UK, joining the China-led AIIB. Therefore there was a concern over the possibility that US influence in the Pacific region may be greatly reduced.

This time, President Obama made an active approach to leaders of various countries in order to achieve an agreement in the TPP negotiations. How should we evaluate the TPP agreement approved through such a process?

Abolition of tariffs on a wide range of items

The news that the price of imported foods will be lowered has been emphasised in the reporting from Japan. The items on which tariffs will be abolished, such as oranges and apples, have been announced in addition to the five sensitive items such as rice and wheat. Subsequently, reports of the advantages to consumers and the disadvantages to the agricultural sector have been reported concurrently.

However, regarding agricultural products, tariffs on 24% of items have already been abolished, and the rates of tariffs on 48% of items are lower than 20%. Therefore, little will be gained by the abolition of these tariffs. Also, regarding items such as oranges, Japanese agriculture worked out a countermeasure and developed produce unique to Japan such as dekopon to compete with imported items since the import restrictions were abolished. Because of this, most farmers will not feel threatened. The same is true for cherries. Japanese cherries and those produced in the US can be regarded as totally different in the Japanese market.

The price of Japan's request for exceptions

On the other hand, tariffs on the five sensitive items (except for beef) are at over 100%. These items make up only 9% of all agricultural products. However, rice, wheat, sugar, butter and skim milk powder are staple foods and many are used as ingredients in bread, snacks and many other processed products. The present tariffs on these items will be maintained. Even if Japan agrees a Free Trade Agreement with the EU in the future, the present tariff rate of 300% on butter produced in Echire, France will remain unchanged. It will be 16 years before the 38.5% tariff on beef becomes 9%.

Due to the number of exceptions to tariff abolition it requested, Japan had to agree that the tariff of 2.5% on US cars will be lowered after 15 years and then abolished 25 years later. When I gave a lecture in the Japan Press Club this September, an agricultural journalist asked me whether there is a necessity of joining such an agreement with few merits. However, I guess Japanese agricultural sector brought this upon itself.

Will there be any influence on agriculture?

Regarding agriculture, there will be little influence on rice which will continue its present tariff, or on beef and pork for which the tariff was lowered. The reports or opinions which say that TPP will influence on Japanese agriculture are wrong. In a sense, Japanese negotiators did negotiate well.

Influences on beef and pork

Regarding beef, it was agreed that the present tariff of 38.5% will be reduced to 9% over 15 years. However this will have little influence. In 1991, the quantitative trade restriction was abolished and shifted to the tariff only system. The tariff at that time was 70%. The present tariff is half of this. However the volume of Wagyu beef production has not been reduced but been increased from 180 thousand tons which was the level before the liberalization, to 230 thousand tons.

The beef of bulls born from a female Holstein and raised large with imported feed from the US has been produced in order to compete with imported beef. This is sold as "Japanese domestic beef" in supermarkets. Since the liberalization, the Japanese beef industry artificially inseminated female Holstein with Wagyu bulls and produced high quality hybrid beef. Recently, fertilized eggs of Wagyu have been used for production of Wagyu from female Holstein cows.

Holstein bulls still occupy one third of all Japanese domestic beef production. However, the total value is low, just 70 billion yen from the total value of beef production of 520 billion yen, because of the low unit price of bulls. In addition if the price of a bull is lowered due to a tariff reduction, the Japanese government has a subsidy system whereby calves farmers will be compensated for the loss of revenue. As a result, there would not be any negative effects from a price fall.

Moreover, the yen has depreciated by 50% against the dollar and there is no advantage to a tariff of 38.5% on beef. Caused by rise in prices of imported beef, the price of domestic beef has been increasing steadily and has almost doubled from the level between 2008 and 2012. Japanese beef industry can profit from this situation even if the tariff is abolished.

Regarding pork, it was agreed that the tariff of 482 yen per kilogram of low-price pork will be reduced to about 50 yen, and the tariff of 4.3% on high-quality pork will be abolished over 10 years. However, there is a complicated differential tariff system for pork and traders are using this wisely. They mix high-quality and low-quality meat and import it to Japan, paying only the low tariff of 4.3%. The reduction of the tariff on pork sounds big but there will be little actual effect.

How about rice?

At present, the minimum access (zero-tariff import quota) of rice is 770 thousand tons, and due to the US' request, 100 thousand tons from this is brought to market for direct human consumption. Its tender system is called Simultaneous Buy and Sell Tender System (SBS). Foreign suppliers (sellers) and Japanese buyers together tender bids at the same time. The bids which offer the higher margins (the price difference between the buyer's price and the seller's price) are allowed to import rice. The price of the buyer sets the wholesale price in Japan, and the price of the seller sets the import price from the US to Japan; the difference is the price gap between the domestic and overseas markets. When there is a price gap between domestic and overseas markets, traders are always active. Except for the years I will discuss next, this import quota was always completely taken up or filled.

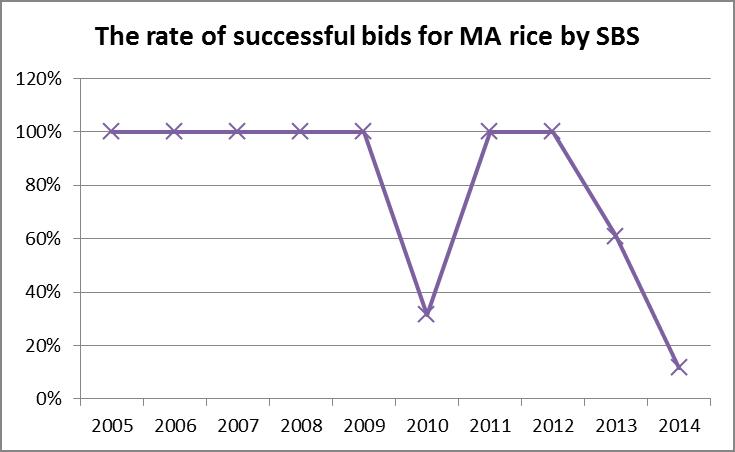

In 2010, when the price of domestic rice dropped by 12%, the take-up or fill rate of this import quota was 31%; in 2013, when the price of domestic rice receded by 13%, it was 61%. However in 2014, when the price of domestic rice receded by 12%, the take-up ratio of this import quota was 12%, which was only12 thousand tons of imports. Especially, the last time-March this year-, there were only 216 tons worth of successful bids in spite of the Japanese government offering 88,610 tons. The take-up ratio of that import quota was 0.2%.

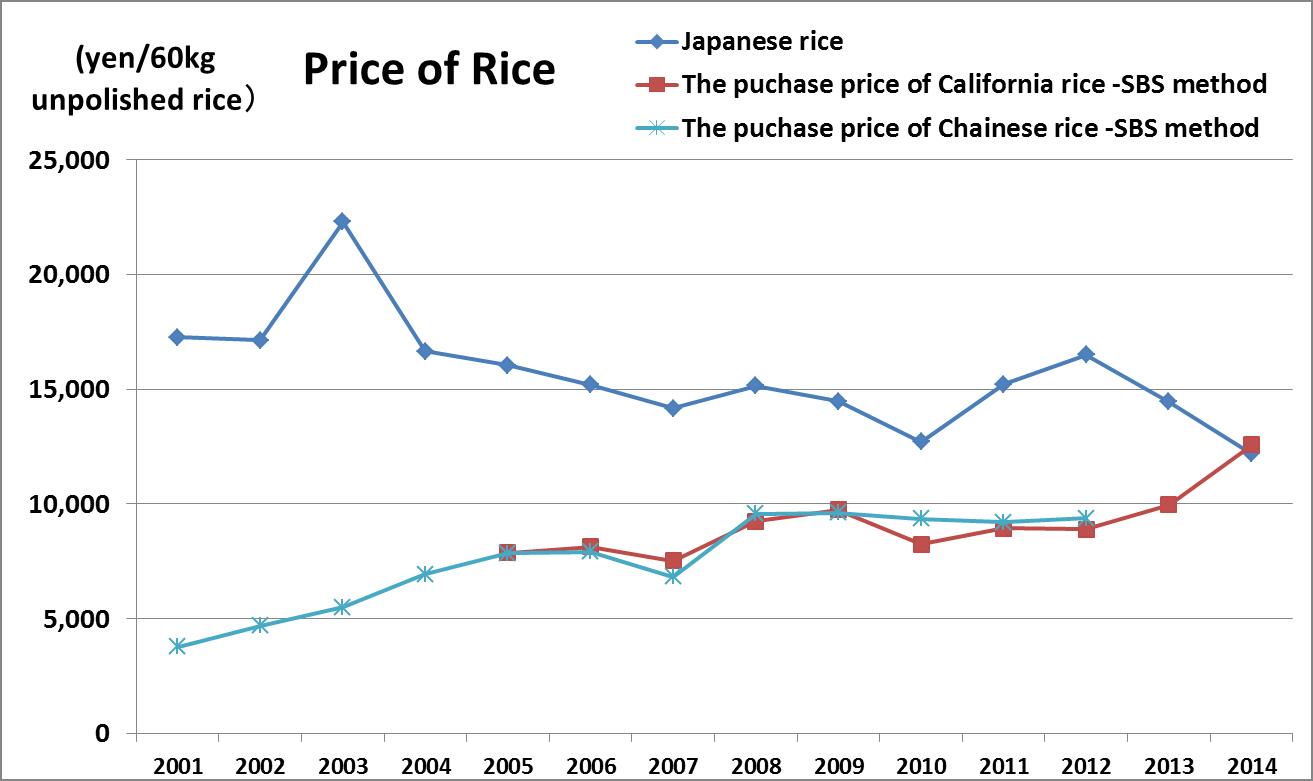

As the following graph shows, the price gap between domestic and overseas markets has disappeared.

Chinese rice which used to be imported in large quantities has lost its price competitiveness and it has not been imported to Japan since fiscal year 2013. The import price of California rice in fiscal year 2014 was 12,582 yen. The price of domestic rice has been falling since September in 2014, and it was 11,921 yen in April of 2015. The price gap had not only disappeared, the situation had been reversed. Moreover, the quality of domestic rice had been valued 20% to 30% higher than California rice in the Japanese market. So, the domestic rice was more of a bargain than merely the numbers showed. Some trading companies consider exporting Japanese rice to California.

In the TPP negotiations, a new SBS quota of 70 thousand tons for the US and 8.4 thousand tons for Australia has been established. Even the present quota of 100 thousand tons is not fully used so there is no point or use in adding to such a quota.

The volume of rice imports will increase if Japan expands acreage reduction. In this case, an equal amount of domestic rice to imported rice would be purchased to be sold as animal feed at a low price so there will be no effect on agriculture. Farmhouses in the US and Australia are the ones who gain, and the ones who lose and take on the financial burden are us, the Japanese taxpayers.

What should Japan have negotiated for?

Even if the rice tariff was abolished in the TPP negotiations, it would not have influenced Japanese rice farming. If the abolition of the tariff on agricultural products was Japan's aim in the negotiations, there was no negative affect on the negotiations regarding automobiles. This is necessary for Japanese agriculture too.

There is a phrase in economics: "The Tariff Is the Mother of Trusts." If the tariff is abolished, Japan cannot maintain the Acreage-Reduction Program of Rice which raises the price of domestic rice higher than that of imported rice. In another words, the Acreage-Reduction Program will be automatically abolished.

The gap in the price of rice in domestic and overseas markets has narrowed and been reversed due to the price of domestic rice has become lower in 2014 and the rice price overseas rose. In such a situation, Japan can export rice at a higher price than domestic price. So it would not be necessary to maintain the Acreage-Reduction policy and keep a lower domestic price. If Japan abolishes the Acreage-Reduction policy, and if the price of domestic rice declines to around 8,000 yen, Japan will be able to export rice on a larger scale. If the amount of exports increase, the amount supplied to the domestic market will decline, and the price of domestic rice will go up. In case where the export price of rice is 12,000 yen, the domestic rice price will also go up to the same level and the production of domestic rice will expand.

To look at the short term, the Japanese government would only need to pay about 200 billion yen compensation directly from public finances to full time-farmers affected by the price decline. Japan can cut 400 billion yen, which was earmarked for the Acreage-Reduction subsidy, and use part of it instead as financial resources for the compensation. After the rice price rises, they would not need to pay this compensation. Moreover, part-time farmers whose scale are small and cannot cover their expenses from the revenue of rice sales will quit farming and lend their lands to full-time farmers. If more efficient full-time farmers take over that land and expand their scale, they will become more cost-efficient. At present, due to the Acreage-Reduction policy, the improvement of varieties in order to increase the yields is forbidden for governmental researchers, and the average amount of rice yield in Japan is 60% smaller than that of California. The costs are defined as dividing the cost per area by yields. So if yields increase, caused by abolition of the Acreage-Reduction policy, the cost will be reduced. Then the competitiveness of Japanese domestic rice will improve due to expansion in scale and the increase in yields.

Even if Japan tries to protect itself with high tariffs the scale of the domestic market will shrink due to the decrease in population. Japanese agriculture cannot survive if it focuses only on the domestic market. In a situation where high quality Japanese rice is more competitive in price by abolition of the Acreage-Reduction policy, Japan does not need a tariff on rice. On top of that, Japan can develop overseas markets by exporting rice. This is the way to reform Japanese agriculture.

If Japan had abolished the tariff on rice, the abolition of Acreage-Reduction would have been realized. Again, Japanese agriculture has lost the opportunity for its revitalization. Some full-time farmers have been requesting the abolition of the tariff on rice. However such a request was not reflected in the TPP negotiations.

Are there any merits of the TPP?

Of course, there are some merits.

First is the increase of access to overseas markets. There are some exceptions such as automobiles exported to the US, but regarding farm products and industrial products, which Japan exports, there is merit due to the tariff reductions. The number of convenience stores and branch offices of banks will continue to expand. Also, regarding government procurement such as public projects, the scale of access will expand in the US, Australia, Canada, Singapore, Peru and Chile. In other countries, Japan can develop new markets.

Second is the establishment of new rules in areas the WTO does not concern itself with or strengthening of rules established by the WTO. Examples of this are regarding protection of intellectual property rights such as prevention of trading counterfeit goods; forbidding demand of technology transfer or local content at the time of investment; improvement in transparency of establishing measures for plant quarantine and food safety and establishment of forums for dispute settlement on these measures; ensuring equal, competitive conditions between government owned corporations and overseas companies; and the Cumulative Rule of Origin which allows preferential treatment in the reduction or abolition of tariffs to items where the level of total added value in an area is higher than a certain rate.

Third is the Free Trade Agreement, and only in cases where Japan participates in this agreement will it obtain any benefits. On the other hand, in cases where Japan does not participate in this it will be at a disadvantage. The leaders of Canada and Mexico made a decision to participate in the TPP at the same time as the then Prime Minister Noda announced that Japan was going to participate in the pre-negotiations of TPP. This is one example. The more the TPP expands, the more countries who want to participate in the TPP increase. Moreover, negotiations for free trade agreements between Japan, China and South Korea and between Japan and the EU will speed up.

These are the benefits for Japan. However the high level agreement aimed for at the beginning, such as the abolition of all tariffs could not be realized. We cannot call TPP the trade agreement for the 21st century.

Another meaningless domestic countermeasure for the TPP

I heard that Japanese government will take countermeasures for farmers disadvantaged by the TPP. History repeats itself. After the GATT Uruguay Round negotiations were agreed Japan raised 6.01 trillion yen for domestic countermeasures.

I participated in these GATT Uruguay Round negotiations. At that time, a big issue was tariffication: non-tariff measures such as quantitative import restrictions being replaced with tariffs. Japan could obtain the exception for rice in this tariffication. However, Japan had to agree to the minimum access which had increased to 8% of total consumption from 5% in the case of tarrification.

To accept this, the then Hosokawa administration had got an agreement in cabinet that they could maintain domestic rice demand under this situation. They agreed that the government would purchase the same amount of domestic rice and designate it as animal feed or overseas aid so that they would not need to reduce domestic rice production. Japan had maintained the existing import restrictions so there would be no damage on Japanese agriculture. Also, they did not need to lower the rice price. As a result countermeasures were unnecessary. In fact, there was no negative effect.

However the Liberal Democratic Party of Japan had raised a huge amount of funds for countermeasures after their return to power. These countermeasures were ridiculous and pointless. The reason given for this was that Japan needed public works such as structural improvement in order to rationalize agriculture. The truth was that Japan did not need agricultural rationalization.

After all, municipalities were not sure how to spend the huge public funds and wasted them on building things like public spas. As a result, agricultural infrastructure has not been improved. If Japan had tried seriously to improve agricultural infrastructure at that time, the TPP would not be such a big issue for Japan.

Again, countermeasures will be taken in spite of there being no damage from the TPP. There is an insistence that the measure is not for protecting Japanese agriculture but for improving it. It is explained in a different way but it is the same excuse as last time. After the Abe administration was established, measures to encourage the transfer of farmland to full time farmers, which was introduced with great fanfare, did not work due to a lack of farmers prepared to lease out their land. I heard that the government is planning to expand these measures in the future.

By the way, why do you think the leasing of farmland has not occurred? It is because even small scale farmers whose expenses are high do not stop producing rice, because the government maintains the high price of rice. However, some farmers started giving up their land due to the fall in rice prices last year. Nevertheless the Japanese government tries to strengthen Acreage-Reduction and raise the rice price. There is no point in wasting public funds like this.

In the same way it didn't after the GATT Uruguay Round, agricultural rationalization or expansion will not happen despite a lot of public funds being thrown into agricultural projects. The scale of agricultural public work was greatly reduced by Ichiro Ozawa to create funds for the Individual Income Support system established by the Democratic Party of Japan. However, to restore these public works is one of the targets for the agricultural sector of the Liberal Democratic Party of Japan. I guess that it won't be structural improvements but other projects which are not directly related to agriculture, such as improving drainage facilities for communities, will be advanced this time again.

Of course, if I say that the TPP does not affect Japanese agriculture, this could also be interpreted as "Minister Amari did a good job in negotiations". Then there will be no need for the Diet members specializing in agriculture in the Liberal Democratic Party to promote any countermeasures for the TPP. Still, in order to win the Upper House election next year, unnecessary agricultural projects will have to be carried out. The people affected by the waste are us, the Japanese taxpayers.

(This article was translated from the Japanese transcript of Mr. Yamashita's column.)