Column 2019.10.31

The US dollar supremacy

The reality of the global currency market

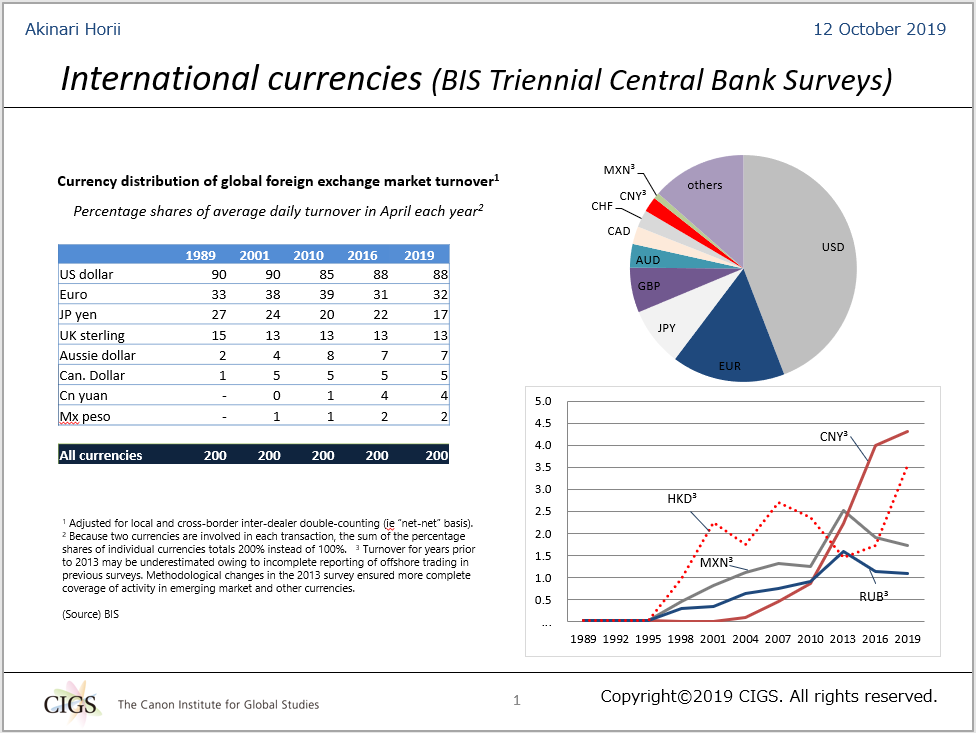

The global currency market has hardly changed in terms of currency distribution since the mid-1980s, when I was an economist at the BIS and published a BIS Economic Paper entitled "the reserve currency diversification." Let me explain by using the tables and graphs attached, which I constructed out of the central bank survey conducted by 53 central banks around the globe and aggregated by the BIS.

The daily turnover in the global forex market amounted to $6.6 trillion in April 2019. The BIS shows its currency distribution by percentages, whose total being 200% rather than 100% because it takes a pair for any currency exchange. On that basis, the US dollar captures 88% in the 2019 survey. The dollar's proportion remained virtually unchanged at 90% or a little less since the BIS began this survey in 1989. The second and third currencies actively traded on the global market are the euro and the Japanese yen. In 1989 the Deutschemark, French franc, and other EMS currencies had a combined share of 33% whereas the euro captured 32% in 2019. The yen had a share of 27% in 1989, which dropped to 17% by 2007 (not shown in this table), whose number has since fluctuated around 20%.

In short, the international currency market has hardly changed as far as the distribution of major currencies is concerned. Despite a repeated concern over a decline in US dollar in the international monetary system, the dollar has continued to play the vehicle currency role for the global currency market.

During the past decade, the RMB's presence increased dramatically. In 2001 the RMB ranked 35 on the currency league table with a negligible percentage share, but moved up to 8 with 4.3% share in 2019. Other emerging economies' currencies also increased percentage shares as illustrated in the graph on the right-bottom panel. Despite these salient increases, however, the presence of emerging economies' currencies is still pretty small in contrast to the size of their GDP and international trade of goods and services.

Conditions for the vehicle currency

In order for a currency to be used widely in the international markets, Jeff Frankel, Peter Kenen and other academic experts pointed out several conditions: (i) economic size; (ii) developed financial markets; (iii) confidence in the value of the currency; and (iv) inertia.

First of all, the economic size does not immediately entail a wide international use of the currency. Take the US dollar for example. In the late 19th century the US economy overtook the UK economy, and so did the German economy, but both the US dollar and the Reichsmark failed to impress the market while pound sterling continued to be the international currency. It was only after the First World War that the dollar began to glitter, and only after the Second World War was its overwhelming status established.

In my opinion, market confidence matters a lot for an actively used international currency. It is not only confidence in the value of the currency but confidence in its integrity that matters. The integrity of currency is maintained only when it functions properly as a means of exchange, unit of account, and store of value.

To be a little more specific, the monetary authorities have to create and maintain a system so as to ensure a reliable means of payment and wide, deep financial markets, supported by many down-to-earth elements, e.g., banknote counterfeit deterrence capability, legal stability and transparence of rules and regulations as well as law enforcement capability over financial fraud and other wrongdoings, and last but not least the political and economic independence of the central bank from both domestic and international pressures.

Potential competitors to the US dollar

Now let us turn to potential competitors of the US dollar. First, the RMB. It is obvious that there is a long, long way for the Chinese currency to go before it gains confidence in the market on all the accounts I discussed above. It is highly unlikely that the RMB becomes the vehicle currency in this century.

What about the euro? Of course, the euro has a natural appeal and in fact it is the second international currency. In order for the euro to play a bigger role, however, its financial markets need to become much wider and deeper. German bunds' market is the most actively traded market in euros at the moment but its size is small and liquidity is thin in comparison with US Treasuries and JGBs. If it were a large single issue denominated in euros, that would attract more international investors. Governments within the EU could begin such an attempt by issuing euro bonds collectively, not substituting for individual sovereign bonds immediately but covering a small part of EU's expenditures for common purposes, e.g., common defense, refugees' assistance, space programs before encompassing a wider array of their budgets step by step. This idea has long been floated, but only a little progress has been made in this regard.

What about the SDR or others? Suffice it to quote Charles Kindleberger, who referred in 1985 to the SDR as the artificial language Esperanto in finance while he compared gold with Latin and the US dollar with English or, to be more precise, American English. I thought that the analogy was pithy and I continue to do so after three decades.

US foreign policy and impact on the US dollar

Several years ago the US government under President Obama tried to use its clout over the global financial system as economic sanction against Russia and Iran. It was reported then that the US might even try to limit Russian banks' access to SWIFT, the global message transfer system of inter-bank transactions. Even before Mr. Trump became POTUS, the Chinese began to worry about the possibility of its application to China and tried to modernize RMB payment and settlement systems, widening the scope for international use of the RMB.

In recent years the Chinese concerns have become greater. For example, Dr. Yu Yongding, a former member of the PBOC monetary committee, wrote an article on a Japanese magazine in July 2019, saying that the US might deprive Chinese banks of their access to SWIFT or CHIPS (Clearing House Interbank Payments System) and therefore China should internationalize the RMB so as to minimize US policy impact.

If such financial controls were used widely by the US government for its foreign policy purposes, that would damage the market confidence in the US dollar, thereby depreciating its supreme status in the global financial system. The US dollar supremacy has thus far supported competitiveness of US financial industries, ease at which the US government and other Americans can borrow without exchange risks, economies of scale and network. In comparison with such "exorbitant privilege" as M. Giscard d'Estaing claimed 50 years ago, short-term gains on the US foreign-policy front seem trivial if anything.

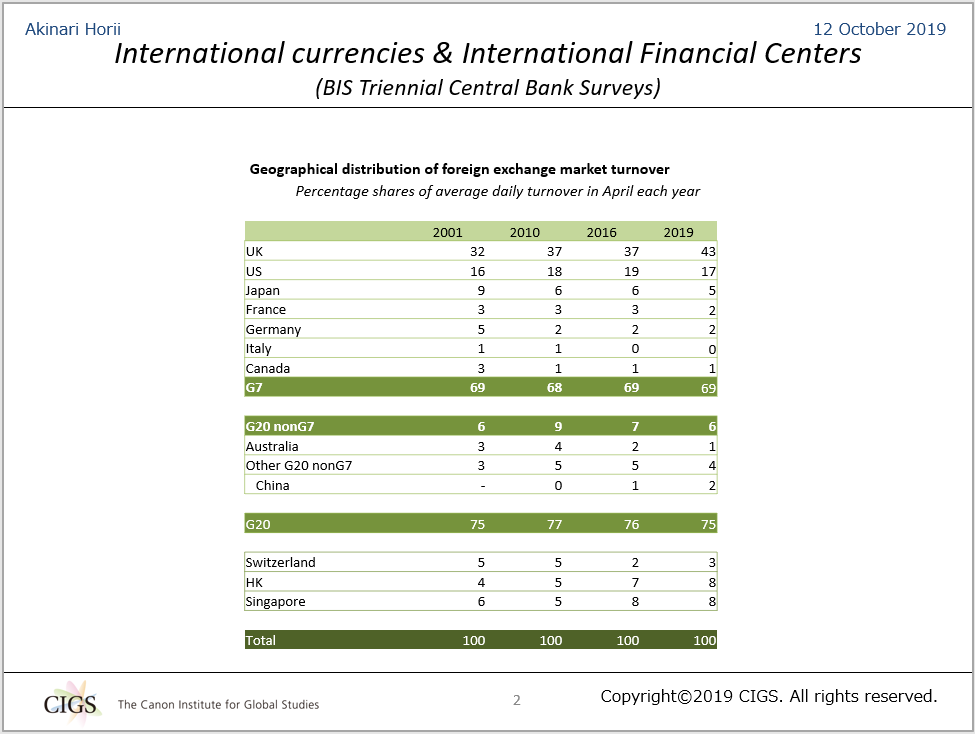

Finally, with regard to hubs of international finance, the second table attached illustrates the market share of global forex transactions. London captures the lion's share. Wall Street does less than 20% all through, followed by Hong Kong and Singapore in 2019. Let us see how Brexit and the recent turmoil in Hong Kong will affect this picture.