Event Report Global Economy

CIGS Workshop:"Achieving Fiscal Balance in Japan" by Dr. Imrohoroglu

April 9, 2013,

15:00

- 17:00

Venue: CIGS Meeting Room 3

(Dr. Imrohoroglu, Dr. Kobayashi from the left)

Presentation

Presentation by Dr. Imrohoroglu(PDF:1.4MB)

Workshop's outline

Title: "Achieving Fiscal Balance in Japan"

Speaker: Dr. Selahattin Imrohoroglu

(International Senior Fellow, CIGS /

Academic Director and Assistant Dean, IBEAR MBA Program, Marshall School of Business, University of Southern California)

Moderator: Dr. Keiichiro Kobayashi, Research Director, CIGS

Outline of the speech

Japan is facing an aging population and already has the highest debt to GDP ratio among advanced economies. Further government spending is expected and there are serious concerns about the potential for Japanese government bonds (JGBs) to become a significant global issue.

In this paper we build a micro-data based, large-scale overlapping generations model for Japan in which individuals differ in age, gender, employment status, income, and asset holdings, and incorporate the Japanese pension rules in detail. We estimate age-consumption and age-earnings profiles from the Family Income and Expenditure Survey data, assume complete markets and use these to generate tax revenues and transfer payments for government accounts. We calibrate the model so that it produces the main macroeconomic indicators for 2010. Using existing pension law and fiscal parameters and the medium variants of fertility and survival probability projections, we produce predicted time paths for JGBs and the pension fund.

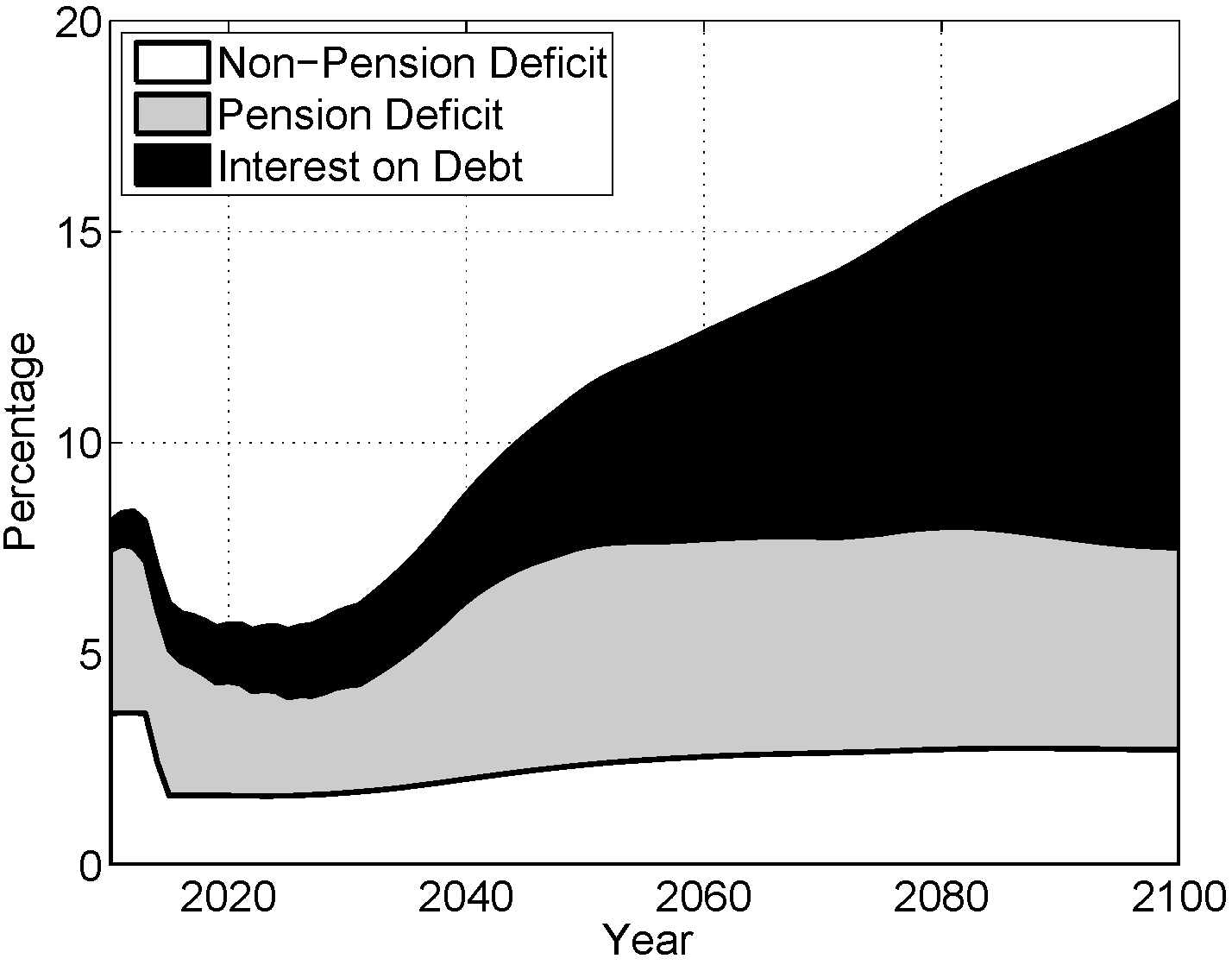

Pension and non-pension deficits contribute about the same, just about 4 percentage points each (see the graph below), to new borrowing requirements over the next few years, with net interest on debt playing a much smaller role, thanks to the low real interest rate on JGBs in the current economic environment.

With the consumption tax rate expected to rise from 5% to 10% in 2014-2015, there is a significant improvement in the non-pension deficit and then a gradual rise over time as non-pension transfers and health expenditures start to rise. There is an initial, significant decline, and later, a smooth decline in the pension deficit. However, in about 25 years the pension deficit starts to rise again, eventually stabilizing annually. Net interest payments on JGBs eventually dominate net borrowing requirements despite the low 1% interest rate; the stock of debt is just too large.

These findings suggest that no single policy can have a major impact on fiscal sustainability. Two key suggestions that emerge from our analysis are 1) further pension reform, and, 2) policies that raise female labor force participation.

CIGS Workshop is a presentation of the progress for the study which CIGS researchers are doing. They take comments from other researchers, advisors, and outside commentators, and they make use of them for their future study.