Column Finance and the Social Security System 2021.07.28

【Aging, safety net and fiscal crisis in Japan】No.324:During the COVID-19 pandemic, the investment return of public pension reserves has reached its highest ever level

In this column series, Yukihiro Matsuyama, Research Director at CIGS introduces the latest information about aging, safety net and fiscal crisis in Japan with data of international comparison

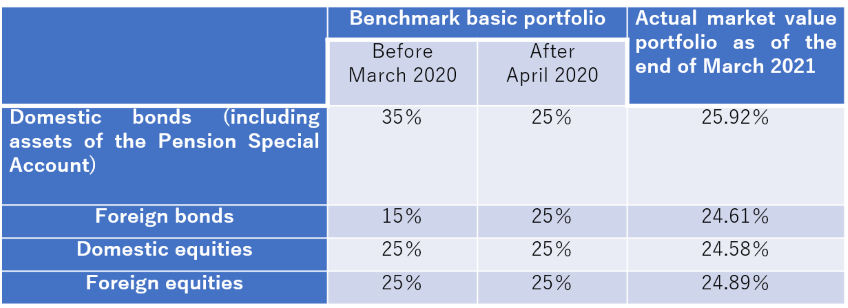

The Government Pension Investment Fund (GPIF) released an annual report showing investment results (Overview of Fiscal 2020). As explained in Column No.252, the investment return rate of public pension reserves in FY2019 (April 2019-March 2020) was -5.22%, and a large loss of JPY 8 trillion (USD 73 billion) was recorded due to the fall in stock prices around the world in the first quarter of 2020, when the COVID-19 pandemic first began. The GPIF changed its benchmark basic portfolio in April 2020, which focuses on reducing domestic bonds from 35% to 25% and increasing foreign bonds from 15% to 25%, while also maintaining domestic and foreign equity at 25% each (Table 1). This means taking greater risk in an investment environment with growing volatility in stocks and exchange rates. However, due to the sharp recovery in stock prices, falling interest rates (rising bond prices), and depreciation of the yen, the investment return rate in FY2020 reached 25.15%, and the return reached a record high of JPY 37,799 billion (USD 344 billion).

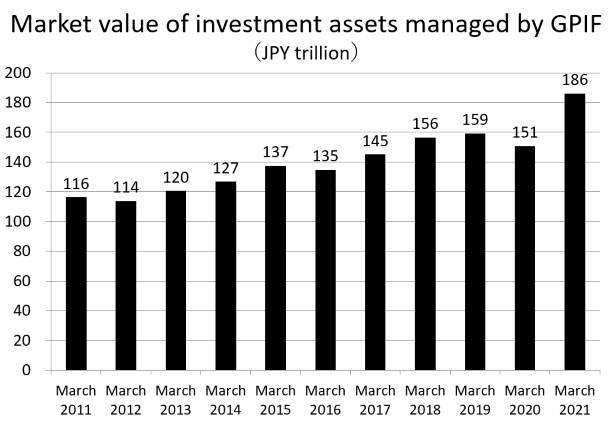

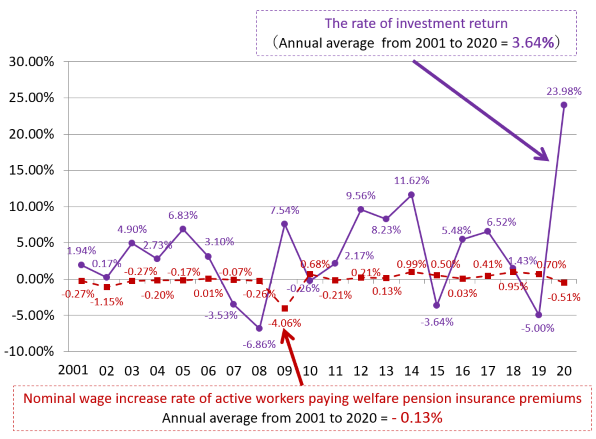

As a result, the market value of public pension reserves managed by the GPIF increased from JPY 151 trillion (USD 1,369 billion) by the end of March 2020 to JPY 186 trillion (USD 1,692 trillion) by the end of March 2021 (Figure 1). The public pension system's finances are based on the assumption that the investment return rate should exceed the nominal wage increase rate. The average investment return rate in the past 20 years was 3.64% (Figure 2). The average nominal wage increase rate during the same period was -0.13%. Therefore, it can be concluded that the GPIF has achieved its aforementioned goal. However, the long-term decline in the income of active workers who pay public pension insurance premiums is a major problem that is shaking the foundation of the public pension system.

Table 1: Portfolio allocation of pension reserves managed by the GPIF and the Pension Special Account

Source: Government Pension Investment Fund, Overview of Fiscal 2020

Figure 1: Total assets managed by the Government Pension Investment Fund

Source: Government Pension Investment Fund, Overview of Fiscal 2020

Figure 2: Investment return and nominal wage increase rate

Source: Government Pension Investment Fund, Overview of Fiscal 2020