Column Finance and the Social Security System 2021.07.21

【Aging, safety net and fiscal crisis in Japan】No.323:Regional financial institutions are being forced to undergo structural reforms due to population decline

In this column series, Yukihiro Matsuyama, Research Director at CIGS introduces the latest information about aging, safety net and fiscal crisis in Japan with data of international comparison

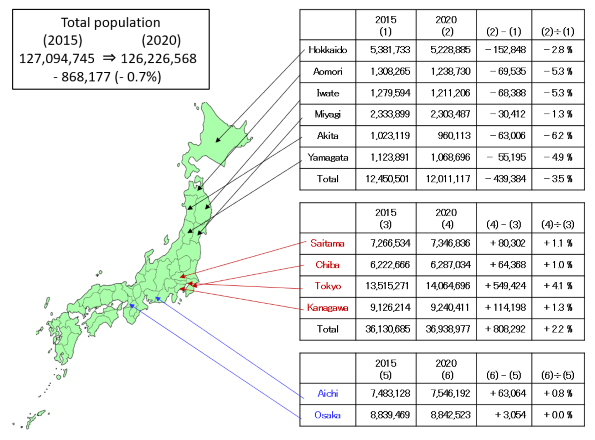

The government has been conducting a census every 5 years since 1920. The most recent results of the 2020 census, which were announced in June 2021, showed that the population of Japan decreased by 868,177 over the last 5 years (-0.7%) (from 127,094,745 as of October 2015 to 126,226,568 as of October 2020). While Japan has experienced an era of depopulation since 2008, the concentration of people in metropolitan areas has continued. For example, as shown in Figure 1, the population of Tokyo increased by 4.1% from 13,515,271 in October 2015 to 14,064,696 in October 2020. The population of Saitama, Chiba, and Kanagawa prefectures, which are adjacent to Tokyo, also increased by more than 1% throughout the same period. The population of Aichi and Osaka prefectures, which are metropolitan areas like Tokyo, has also increased. In contrast, the six prefectures of Hokkaido, Aomori, Iwate, Miyagi, Akita, and Yamagata, which are located in the northern part of the Japanese archipelago, have experienced the highest levels of population decline. Most notably, the rate of population decline in Akita was 6.2% during this time.

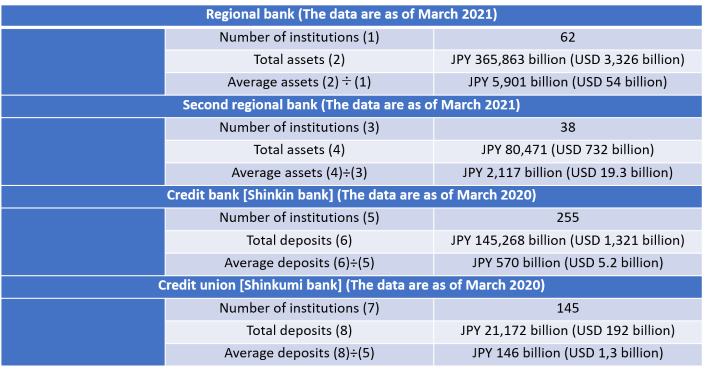

It is easy to imagine that a declining population in rural areas would jeopardize the survival of regional financial institutions. In Japan, there are four types of regional financial institutions: regional banks, second regional banks, credit banks, and credit unions (Table 1). When Prime Minister Suga took office in September 2020, he pledged to proceed with the business integration of regional banks. Since the management of these regional banks is facing challenges under the zero interest rate policy, their business integration and group formation are progressing. However, the second regional banks, credit banks, and credit unions, which are smaller and have weaker governance than regional banks, are the ones that need to carry out structural reforms more urgently.

Figure 1: Regional disparities of population change

Source: Ministry of Internal Affairs and Communications (MIC).

Table 1: Types and characteristics of regional financial institutions

Source: The Regional Banks Association of Japan; The Second Association of Regional Banks; The National Association of Shinkin Banks; The National Association of Shinkumi Banks.