Column Finance and the Social Security System 2021.07.19

【Aging, safety net and fiscal crisis in Japan】No.320:Increasing requests for payment deferment or exemption from national pension premiums due to COVID-19

In this column series, Yukihiro Matsuyama, Research Director at CIGS introduces the latest information about aging, safety net and fiscal crisis in Japan with data of international comparison

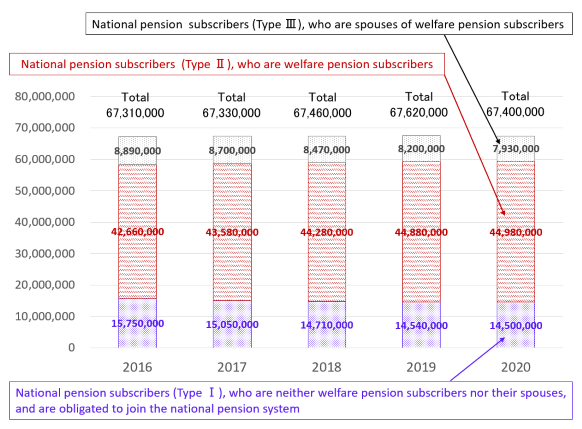

In June 2021, the Ministry of Health, Labour and Welfare released the latest data on national pensions. The national pension is a basic pension system that includes all registered citizens of Japan between 20 and 59 years old, regardless of their nationality; not only is subscription mandatory, but so is premium payment. Figure 1 shows the three types of national pension subscribers. Type Ⅱ are employed by companies or government agencies and are subscribers of the welfare pension, and their premiums are paid automatically from their monthly salary. The welfare pension is a system in which the national pension is used as a basic pension, and another pension is added (see Column No. 45). Type III are spouses of Type Ⅱ subscribers, who are not themselves Type Ⅱ subscribers, and their premiums are included in the premiums paid by the Type Ⅱ subscribers.

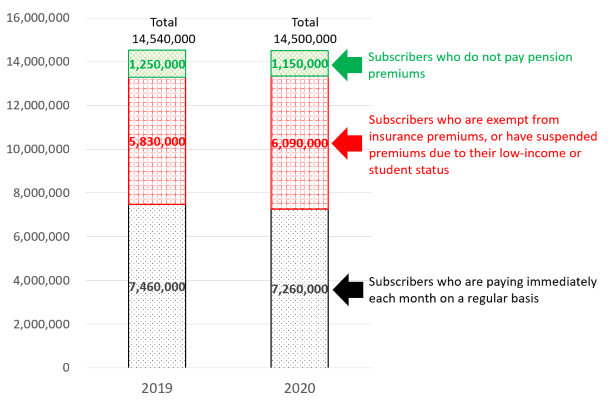

Type I subscribers are self-employed people including farmers, fishermen, and non-regular or small-enterprise employees who are not given the opportunity to join the welfare pension system by their employer. Among them, the number of subscribers who are exempt from pension premiums or have suspended premiums due to their low-income or student status increased by 260,000 between 2019 and 2020 (from 5,830,000 to 6,090,000), as shown in Figure 2. This is considered to be a result of non-regular employees and small-business employees applying for premium exemptions or payment deferment due to a sharp income decline caused by the COVID-19 pandemic-related economic stagnation.

Figure 1. Number of national pension subscribers

Source: Ministry of Health, Labour and Welfare

Figure 2 Breakdown of national pension subscribers (Type Ⅰ)

Source: Ministry of Health, Labour and Welfare