Column Finance and the Social Security System 2021.07.14

【Aging, safety net and fiscal crisis in Japan】No.317:The employment insurance reserve fund is likely to disappear

In this column series, Yukihiro Matsuyama, Research Director at CIGS introduces the latest information about aging, safety net and fiscal crisis in Japan with data of international comparison

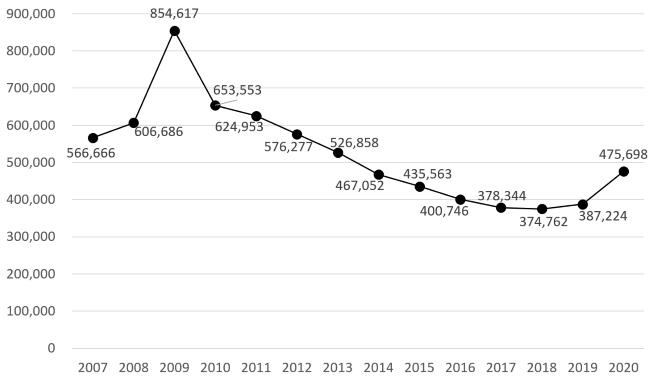

Employment insurance is a system that pays unemployed people benefits for a certain period of time, provided that workers pay insurance premiums when they are employed. Although the number of recipients initially increased after the Lehman shock in 2008, it continued to decrease in line with the falling unemployment rate until 2018 (Figure 1). However, it increased from 387,224 in 2019 to 475,698 in 2020 due to the economic stagnation caused by the COVID-19 pandemic.

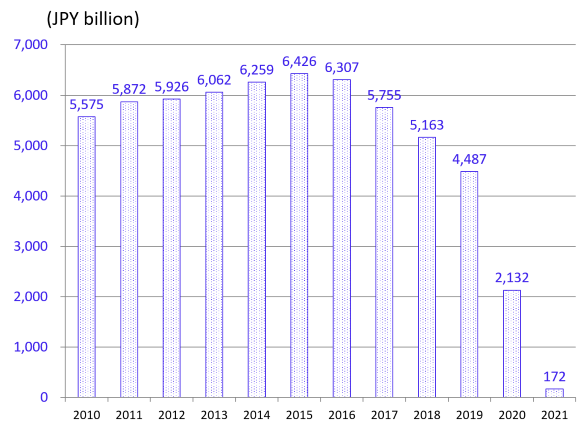

As explained in Column No. 124, the employment insurance reserve fund, which is one of the sources of unemployment benefits, reached a record high of JPY 6,426 billion (USD 58.4 billion) in 2015. Then, the government decided to lower the employment insurance premium rate from 1.6% to 0.6% in 2018 with the aim of halving the reserve fund by 2022. However, as shown in Figure 2, the reserve fund is expected to drop sharply to JPY 172 billion (USD 1.6 billion) by the end of 2021, since much of it will be used for employment measures during the pandemic.

Figure 1 The number of recipients of employment insurance

Source: Ministry of Health, Labor and Welfare

Figure 2 The employment insurance reserve fund

Source: Ministry of Health, Labor and Welfare