Column Finance and the Social Security System 2021.04.20

【Aging, safety net and fiscal crisis in Japan】No.303: Do we need to work until the age of 70 to maintain the social security system?

In this column series, Yukihiro Matsuyama, Research Director at CIGS introduces the latest information about aging, safety net and fiscal crisis in Japan with data of international comparison.

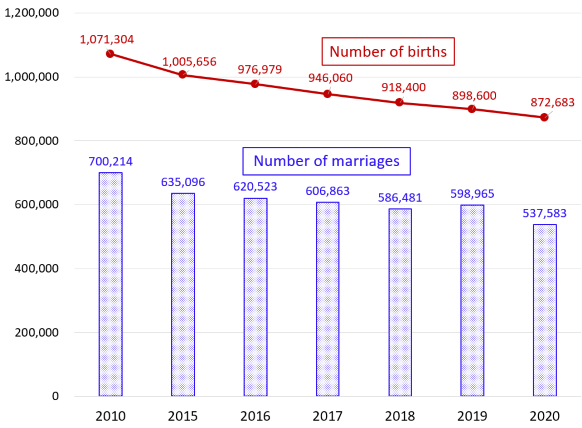

Although the number of marriages had steadily declined in Japan, it increased by 2.1% from 586,481 in 2018 to 598,965 in 2019 (Figure 1). This situation is attributed to the fact that the new Emperor took the throne in 2019, and the name of the era, which is one of the symbols of Japanese culture, changed from Heisei to Reiwa. As this revision was considered a celebration, many couples got married at this time. However, the number of marriages in 2020 was 537,583, which represented a 10.2% decrease from the previous year, since people were unable to hold wedding celebrations due to COVID-19. This number cannot be expected to recover in 2021, because the pandemic is increasing in severity and the younger generation is facing further challenges due to falling incomes.

The financial outlook for social security systems such as pensions, medical care, and long-term care is based on the "Population Projection for Japan: 2016-2065," which was prepared by the National Institute of Population and Social Security Research in 2017. The institute predicted that the number of births would be 921,000 in 2019 and 902,000 in 2020. However, the actual number of births was 898,600 and 872,683 in the two years, respectively. Since then, the fourth wave of COVID-19 has begun, thereby raising public anxiety. In addition, the government has not taken active measures to relieve the anxiety of pregnant women by supporting medical institutions that are responsible for prenatal care. Therefore, the number of births in 2021 is expected to be even lower than that in 2020.

Figure 1 Number of births and marriages

Source: Ministry of Health, Labor, and Welfare

Even without the current fast-falling birthrate, the difficulties of maintaining the current social security system are quite clear. A testament to this reality is the fact that the government amended the Elderly Employment Stabilization Law to delay the retirement age from 65 to 70 years, with the goal of increasing people’s ability to help themselves and be the financial resource bearers of the social security system (this amendment came into effect on April 1, 2021). Before the amendment, the law stipulated that the retirement age should be 60 years or older, but it also suggested that employees maintain their positions until the age of 65. As such, the revised law is different in that it makes this retirement delay a legal obligation, rather than a suggestion. Moreover, employment opportunities up to the age of 70 are provided through one of the following five methods:

- Raise the retirement age to 70 years.

- Abolish the retirement age program.

- Introduce continuous employment up to the age of 70 through re-employment or a work extension program.

- Introduce a program to continuously conclude business consignment contracts until the age of 70.

- Introduce a program that allows employees to engage in social contribution projects while they continue to be supported by their employers up to the age of 70.