Column Finance and the Social Security System 2020.10.15

【Aging, safety net and fiscal crisis in Japan】No.289: High inheritance tax rates could be raised further

In this column series, Yukihiro Matsuyama, Research Director at CIGS introduces the latest information about aging, safety net and fiscal crisis in Japan with data of international comparison.

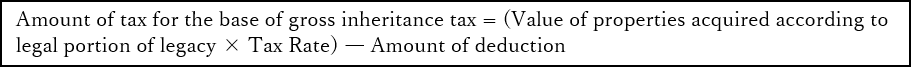

The amount of inheritance tax in Japan is calculated using the following formula.

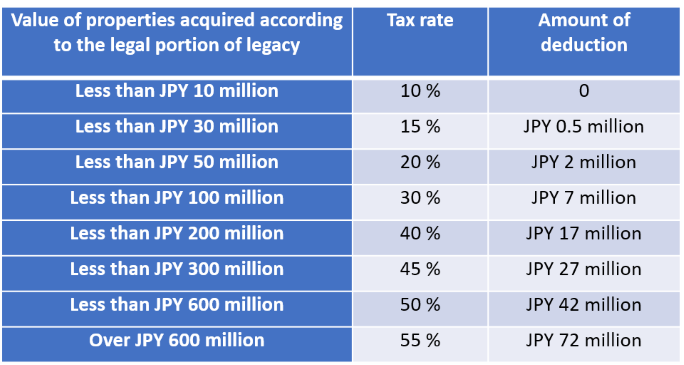

According to data of the Ministry of Finance, which compared international inheritance tax rates in January 2020, Japan’s tax rate for inherited properties with a value exceeding JPY 600 million (Table 1) is much higher (55%) than in other countries. For example, the US government raised the maximum inheritance tax rate to 40% in 2012. However, the actual tax rate is 0% up to a taxable value of about US$ 23 million. The base deduction have increased from US$ 5 million to US$ 10 million for the period between 2018 and 2025, and will then be revised annually to adjust for inflation.

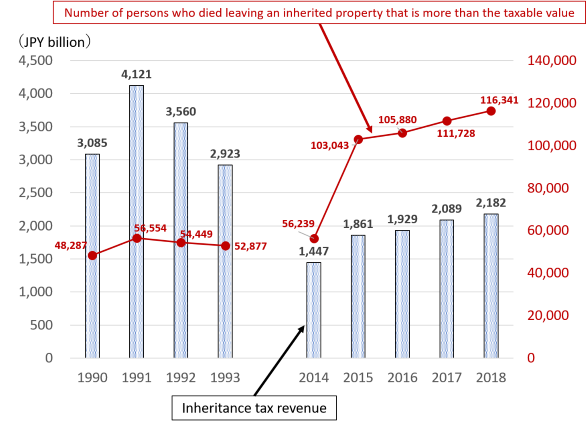

The revenue from inheritance tax was recorded as JPY 4,121 billion in 1991, but then declined until 2014 as land prices and stock prices fell. Inheritance tax revenue in 2018 was JPY 2,182 billion (Figure 1), only 3.6% of the total tax revenue (JPY 60,356 billion). However, the wealth redistribution function of inheritance tax is becoming more important as a means of correcting widening inequality. The government significantly reduced the basic deduction for inheritance from JPY 50 million + JPY 10 million multiplied by the number of legal heirs to JPY 30 million + JPY 6 million multiplied by the number of legal heirs in 2015. As a result, the number of people who died and left behind inherited property greater than the taxable value increased from 56,239 in 2014 to 103,043 in 2015. Moreover, the government raised the period of stay abroad for the whole family (a condition for Japanese people to be exempt from inheritance tax) from 5 years to 10 years in 2017. This is significant in that more than 60% of household financial assets, estimated to be JPY 1,883 trillion in June 2020 (Column No. 288), are held by the elderly. Given that the budget deficit has grown significantly due to COVID-19, which makes fiscal consolidation even more difficult, people must be aware of the possibility of further increases in the inheritance tax rate.

Table 1 Rates of inheritance tax, etc.

Source: Ministry of Finance

Figure 1 Inheritance tax revenue and number of persons who died leaving an inherited prpperty

Source: Ministry of Finance