Column Finance and the Social Security System 2020.09.10

【Aging, safety net and fiscal crisis in Japan】No.273: The hometown tax donation system

In this column series, Yukihiro Matsuyama, Research Director at CIGS introduces the latest information about aging, safety net and fiscal crisis in Japan with data of international comparison.

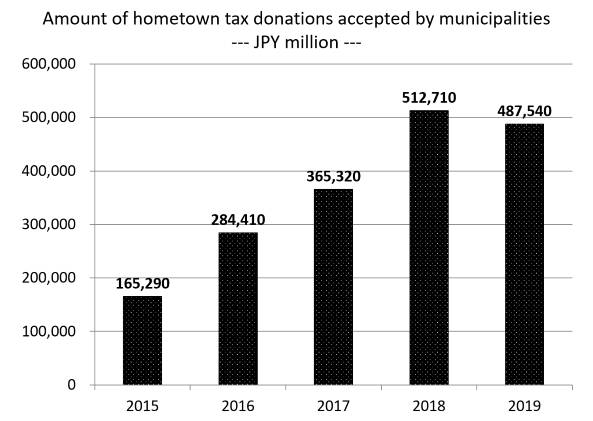

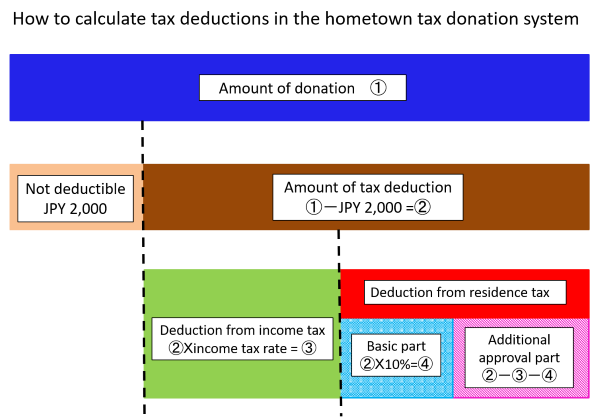

The market size of the hometown tax donation system reached JPY 512,710 million (US$ 4,747 million) in 2018 (Figure1), but decreased to JPY 487,540 million (US$ 4,514 million) in 2019 due to the partial revision of the system. The original purpose of this system, which was created by amending the local tax law in 2008, was to relieve municipalities whose tax revenues decreased as their population moved to urban areas (this structure is demonstrated in Figure 2). If a taxpayer selects a municipality and makes a donation, the taxpayer can deduct an amount equal to the donation amount minus JPY 2,000 from the income tax and residence tax. In terms of the timing of this deduction, there is a rule that income tax is deducted from the year of donation and residence tax is deducted from the tax of the following year.

The reason for the market size growth is that the municipalities began to compete for the content of return items (often local specialties) to obtain donations. Taxpayers making donations can get relatively high rewards at JPY 2,000. Therefore, instead of taxpayers making donations to their hometown, they often choose to donate to the municipality with the highest reward.

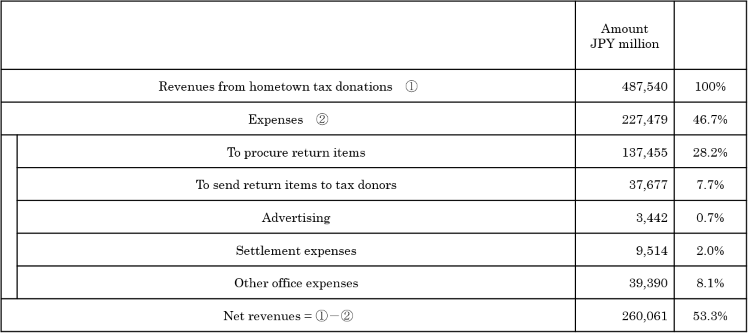

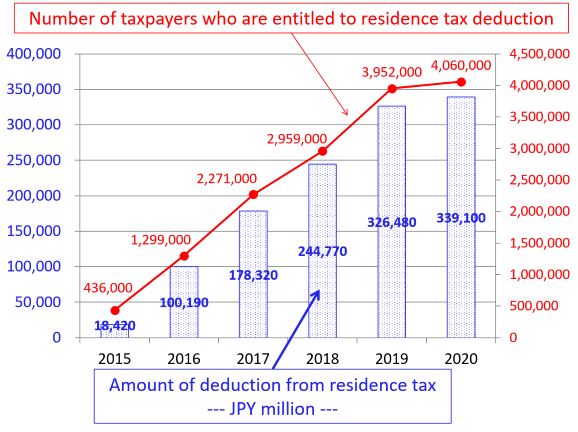

Table 1 shows the structure in which the difference between the revenues and expenses of municipalities in this system results in a net increase in tax revenue. For example, the net tax increase in 2019 (JPY 260,061 million) is calculated by deducting the reward expenses (JPY 227,479 million) from the donation revenues (JPY 487,540 million). The financial resources for this system are borne by the national government (in which income tax deduction reduces tax revenues), and the municipalities where the donors live (in which residence tax deduction reduces their revenues). Figure 3 shows that the total number of taxpayers who donated in 2019 (i.e. those that will receive a residence tax deduction in 2020) was 4,060,000, with the total deduction amounting to JPY 339,100 million.

Figure 1 Amount of hometown tax donations accepted by municipalities

Source: Ministry of Internal Affairs and Communications.

Figure 2 Structure of the hometown tax donation system

Source: Ministry of Internal Affairs and Communications.

Table 1 Revenues and expenses in municipalities that received donations

Source: Ministry of Internal Affairs and Communications.

Figure 3 Data on residence tax deductions

Source: Ministry of Internal Affairs and Communications.