Column Finance and the Social Security System 2020.09.01

【Aging, safety net and fiscal crisis in Japan】No.268: The structural reform of the corporate pension system

In this column series, Yukihiro Matsuyama, Research Director at CIGS introduces the latest information about aging, safety net and fiscal crisis in Japan with data of international comparison.

As explained in Column No. 45, the pension system in Japan has a three-layer structure. The first layer is the common basic pension, that is, the National Pension. The second layer is the welfare pension for employees of private companies and public organizations. The third layer is the corporate pension, which consists of the Employees’ Pension Fund, the Defined Benefit Corporate Pension, and the Defined Contribution Pension (corporate type). There are two additional pensions for self-employed people: the Defined Contribution Pension (for individuals) and the National Pension Funds.

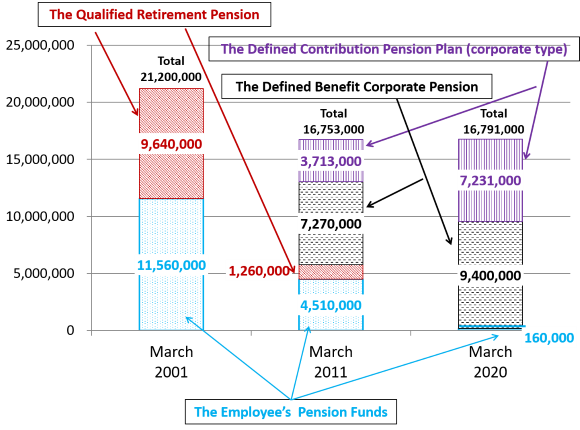

Figure 1 shows the structural reform of corporate pension system. The number of corporate pension members was 21,200,000 in March 2001, which was the sum of 11,560,000 members of the Employees’ Pension Fund and 9,640,000 members of the Qualified Retirement Pension. The government established the Defined Contribution Pension (corporate type) in 2001 and the Defined Benefit Corporate Pension in 2002 to replace the Employees’ Pension Fund. In the 2004 revision of the Pension Law, the government decided to abolish the Qualified Retirement Pension in March 2012 in order to encourage companies to move to the Defined Contribution Pension (corporate type) and the Defined Benefit Corporate Pension. As a result of these reforms, the number of corporate pension members in March 2020 was 9,400,000 for the Defined Benefit Corporate Pension, 7,231,000 for the Defined Contribution Pension (corporate type), and 160,000 for the Employees’ Pension Fund.

Under the Employees’ Pension Funds and the Qualified Retirement Pension, companies are obliged to make additional contributions when the investment yield of pension funds falls below what is expected. One of the objectives of pension reform is to free companies from this investment risk by increasing the number of subscribers to the Defined Contribution Pension (corporate type). However, the decrease in the total number of corporate pension members from 21,200,000 in March 2001 to 16,791,000 in March 2020 means a decline in corporate welfare for employees.

Figure 1 Number of corporate pension members

Source: The Pension Fund Association