Column Finance and the Social Security System 2020.08.17

【Aging, safety net and fiscal crisis in Japan】No.259: The spread of COVID-19 has put the survival of department stores in danger

In this column series, Yukihiro Matsuyama, Research Director at CIGS introduces the latest information about aging, safety net and fiscal crisis in Japan with data of international comparison.

The Go to Campaign to encourage domestic tourism started on the 22nd of July, after the government’s restrictions on going out to prevent the spread of COVID-19 had been lifted. Department store sales are attracting attention as one of the indicators of the degree of recovery in personal consumption, and television news shows that many customers are visiting department stores.

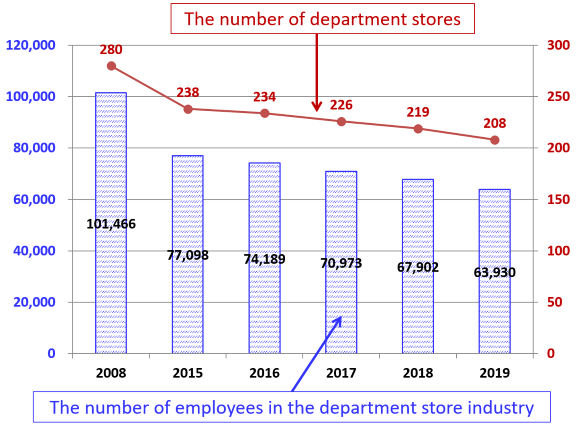

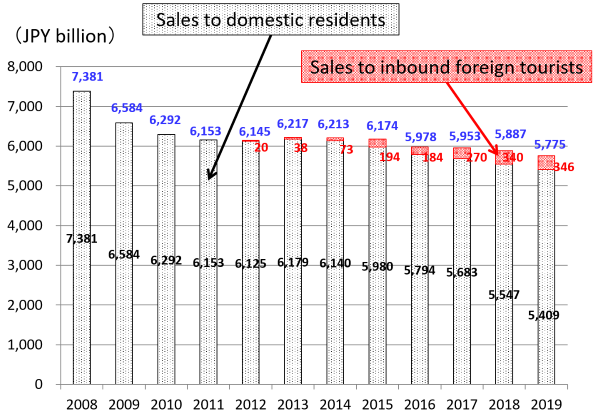

The definition of a department store in commercial statistics is “a business category in which clothing, food, and housing product groups handle between 10% and 70% of the business and face-to-face sales account for at least 50% on the sales floor area.” The peak of the department store industry was in 1991, when the bubble economy burst, with total sales reaching JPY 9,713 billion (US$ 90 billion). At that time, many people found value in buying expensive goods at department stores. However, since then, the department store industry has not been able to respond to changes in customers’ values and purchasing behavior as a result of failing to transform to meet their needs (simply because it is convenient to have access to large-scale facilities in good locations across urban areas). As a result, their business continues to shrink. As shown in Figure 1, the number of stores decreased from 280 in 2008 to 208 in 2019. The number of employees decreased from 101,466 to 63,930 during the same period. In 2019, sales were JPY 5,775 billion (US$ 53.5 billion), which was down more than 40% compared to the total sales of JPY 9,713 billion in 1991 (Figure 2).

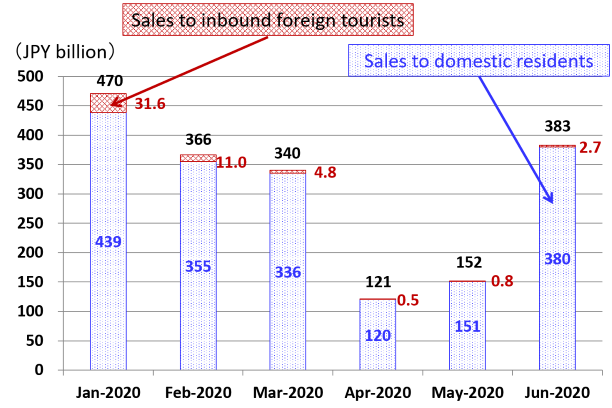

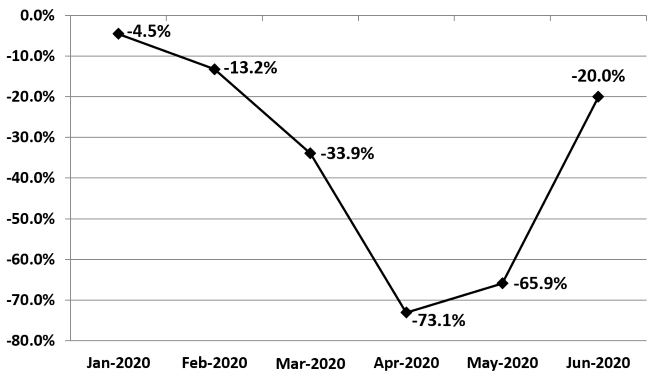

It was the purchasing power of inbound tourists that offset the decline in sales and supported the operation of department stores. Of the JPY 5,775 billion department store sales in 2019, sales to inbound tourists accounted for JPY 346 billion (US$ 3.2 billion) (in other words, 6%). However, due to the government’s immigration restrictions on foreigners triggered by the COVID-19 pandemic, monthly sales to inbound tourists fell to JPY 2.7 billion (US$ 25 million) in June 2020 (Figure 3). Sales to domestic residents have started to recover, but sales in June were still at a level 20% less than the same month of the previous year (Figure 4). If economic stagnation is prolonged under the second and third waves of COVID-19, it is feared that the risk of bankruptcy of well-established department stores in Japan will increase, as has happened overseas.

Figure 1 The number of stores and employees in the department store industry

Source: Japan Department Stores Association

Figure 2 Sales in the department store industry

Source: Japan Department Stores Association

Figure 3 Monthly sales in the first half of 2020

(Source: Japan Department Stores Association)

Figure 4 Rate of change in sales for the respective month compared to the same month of the previous year

(Source: Japan Department Stores Association)