Column Finance and the Social Security System 2020.07.28

【Aging, safety net and fiscal crisis in Japan】No.252: A JPY 8 trillion loss in public pension investment

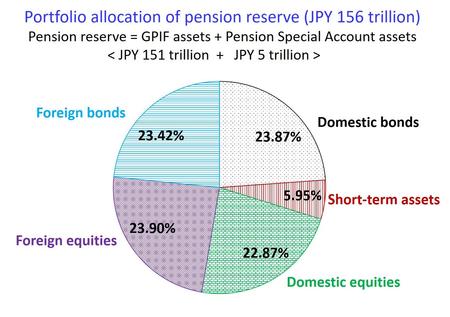

In March 2020, the public pension reserve was JPY 156 trillion, which is calculated as the sum of JPY 151 trillion managed by the Government Pension Investment Fund (GPIF) and JPY 5 trillion managed by the Pension Special Account. The Pension Special Account is a program that handles the administration of pension benefits. Figure 1 shows the portfolio allocation of the pension reserve. As domestic and foreign equities account for 46.77% of the total assets, it can be said that Japan's public pension system is actively taking risks.

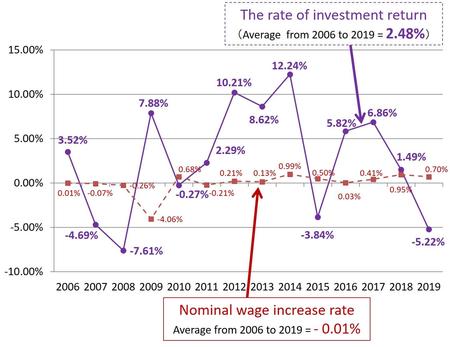

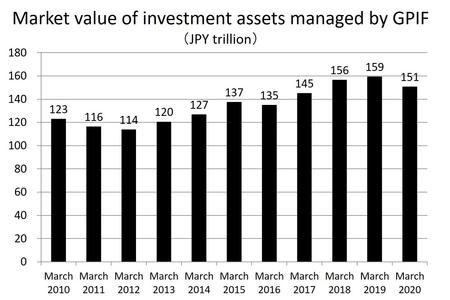

As is well known, the global stock price plunged in March 2020 due to the spread of coronavirus disease. The GPIF investment return for the 2019 fiscal year (April 2019-March 2020) reflected this, as it reached a level of −5.22% (Figure 2); similarly, the market value of the assets managed by GPIF decreased from JPY 159 trillion in March 2019 to JPY 151 trillion in March 2020 (Figure 3).

The finances of the public pension system are based on the assumption that the rate of investment return should exceed the rate of nominal wage increase. This was not the case in FY2019, as the nominal wage increase rate was 0.70%, and the investment return rate was −5.22%. However, over the 14-year period from 2006 to 2019, the average nominal wage increase rate was −0.01%, while the average investment return rate was 2.48%. Therefore, the soundness of pension finances has not been significantly impaired by the losses in FY2019.

Figure 1 Portfolio allocation of pension reserve

*Please click the table image to find the original size image.

Source: The Government Pension Investment Fund, Overview of Fiscal 2019

Figure 2 Investment return and nominal wage increase rate

*Please click the table image to find the original size image.

Source: Government Pension Investment Fund, Overview of Fiscal 2019

Figure 3 Total assets managed by the Government Pension Investment Fund

*Please click the table image to find the original size image.

Source: The Government Pension Investment Fund, Overview of Fiscal 2019