Column Finance and the Social Security System 2020.07.13

【Aging, safety net and fiscal crisis in Japan】No.243: Government bond issuance would further expand as a result of COVID-19 measures

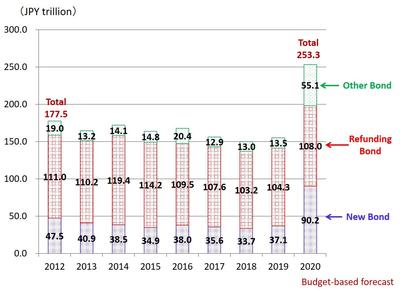

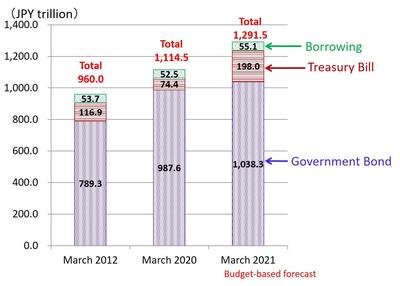

The government decided to introduce emergency economic measures for the COVID-19 crisis on April 7th (Column No.217). These first measures were criticized for being inadequate; therefore, second measures were submitted to the Diet and approved on June 7th. The problem is that the financial resources for these measures depend on the issuance of government bonds. According to the Ministry of Finance, the amount of government bond issuance in FY2020 (April 2020-March 2021) would reach JPY 253.3 trillion (US$ 2.35trillion), which greatly exceeds the record high of JPY 177.5 trillion (US$ 1.64 trillion) in 2012 (Figure 1). The total debt, including the Treasury Bill and borrowing, would increase from JPY 1,114.5 trillion (US$ 10.32 trillion) in March 2020 to JPY 1,291.5 trillion (US$ 11.96 trillion) in March 2021.

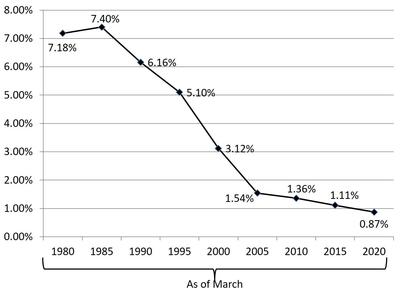

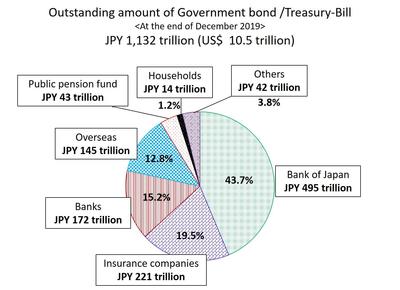

Japan's finances are in a structural deficit. Nevertheless, there are two factors that make it possible to issue additional government bonds. The first is that the interest rate burden on government bonds is small due to the ultra-low interest rate policy. As shown in Figure 3, the weighted average interest rate of government bonds was 0.87% in March 2020. The second factor is that the Bank of Japan continues to buy government bonds. As shown in Figure 4, at the end of December 2019, the Bank of Japan held 43.7% of all government bonds.

The government assumes that the tax revenue in FY2020 would reach a record high of JPY 63.5 trillion (US$ 588 billion) in the above budget. As shown in Column No.242, corporate operating profits decreased by 32% in the first quarter of 2020 (January 2020-March 2020).

Therefore, it is feared that corporate tax revenue in FY2020 would be much lower than initially expected, and the government would be forced to issue new bonds, as shown in Figure 1.

Figure 1 Annual amount of issued government bonds

*Please click the table image to find the original size image.

*Please click the table image to find the original size image. Source: Ministry of Finance

Figure 2 Central Government Debt

*Please click the table image to find the original size image.

*Please click the table image to find the original size image. Source: Ministry of Finance

Figure 3 Weighted average interest rate of government bonds

*Please click the table image to find the original size image.

*Please click the table image to find the original size image. Source: Ministry of Finance

Figure 4 Breakdown of government bond holders

*Please click the table image to find the original size image.

*Please click the table image to find the original size image. Source: Ministry of Finance