Column Finance and the Social Security System 2020.05.21

【Aging, safety net and fiscal crisis in Japan】No.220: The collapse of long-term care services following the medical collapse due to COVID-19

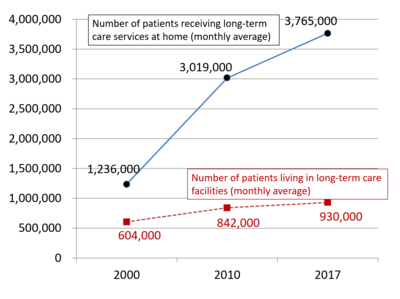

Japan started the public long-term care insurance system in 2000. Despite various issues, such as securing financial and human resources for long-term care services, the market continues to grow rapidly. The number of patients living in long-term care facilities increased from 604,000 in 2000 to 930,000 in 2017 (Figure 1). Similarly, throughout the same period, the number of patients receiving this service at home increased from 1,236,000 to 3,765,000.

However, the spread of COVID-19 is shaking up the system. Some long-term care facilities have become clusters of COVID-19. While members of staff are getting infected, other members of staff are retiring out of fear of becoming infected themselves. Furthermore, many of the staff members who provide long-term care services to the elderly at home are women. As schools have been closed based on the government's declaration of a state of emergency, many of them are finding it difficult to continue working while having to take care of their children. Another concern is that if the number of infected people continues to increase, the risk of care staff transmitting COVID-19 to the elderly who receive long-term care services at home will also rise.

Figure 1 Number of patients of public long-term care insurance services

*Please click the table image to find the original size image.

*Please click the table image to find the original size image.

(Source: Ministry of Health, Labour and Welfare)