Column Finance and the Social Security System 2020.01.30

【Aging, safety net and fiscal crisis in Japan】No.214: The effective burden ratio of patients in the long-term care insurance system is too low, but...

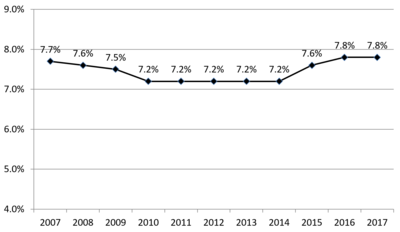

Figure 1 illustrates that the effective patient burden ratio in the long-term care insurance system, which is the percentage of patient's copayment for long-term care expenses, was 7.8% in 2017. This is very low compared to Germany and Korea, which have introduced long-term care insurance systems similar to Japan, with around 30% and 20% effective patient burden ratios, respectively. With the increase in the number of elderly people, the ratio must be increased to stabilize the finances of the long-term care insurance system.

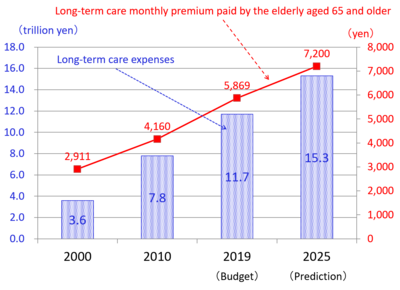

Furthermore, as shown in Figure 2, long-term care expenses have increased from 3.6 trillion yen (USD 32.7 billion) in 2000, when the long-term care insurance system was introduced, to 11.7 trillion yen (USD 106.4 billion) in 2019. This is projected to exceed 15 trillion yen (USD 136.4 billion) by 2025. As such, the monthly premium paid by elderly people of age 65 years and older is expected to increase from 2,911 yen (USD 26) in 2000 to 7,200 yen (USD 65) in 2025. Therefore, increasing the effective patient burden ratio as well as the monthly premium has become a major political issue.

Figure 1 Effective patient burden ratio in the long-term care insurance system

(Source)Annual report of the long-term care insurance system, Ministry of Health, Labor and Welfare

Figure 2 Long-term care expenses and monthly premium

(Source)Ministry of Health, Labor and Welfare, Ministry of Finance