Column Finance and the Social Security System 2020.01.15

【Aging, safety net and fiscal crisis in Japan】No. 210 The effective burden ratio of patients in medical insurance is decreasing

In Japan's public health insurance system, the ratio of patients' co-payment is generally 30% for those aged 69 and under, 20% for those aged 70 to 74, and 10% for those aged 75 and older. As an exception, the ratio of patients aged 70 years and older who earn the same income level as the working generation is 30%. The standard income that is considered to be the same level as the working generation is 3.83 million yen (USD 34,800) for single-person households, and 5.2 million yen (USD 47,300) for households with two or more people.

In addition to this principle, there is a burden reduction program in which, when a patient's medical expenses for a month exceed a certain amount, the excess amount is paid by the government. The upper limit is determined according to age and income.

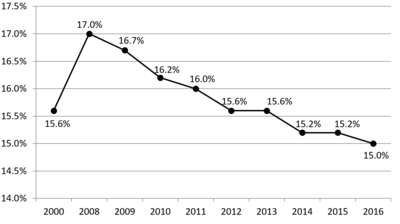

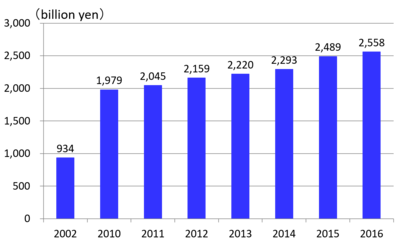

Figure 1 illustrates the trend of effective patient burden ratio, which is the percentage of the patient's co-payment of the total medical expenses. The rise from 15.6% in 2000 to 17.0% in 2008 is the result of health reform conducted by the Koizumi administration (April 2001-September 2006). Afterward, it declined, reaching 15.0% in 2016. This is due to the increase of the elderly who enjoy the benefit of a lower co-payment ratio and the surge in the amount of the burden reduction program subsidies (Figure 2).

If this situation continues, it will not be possible to maintain either health insurance or national finances. Therefore, the government, in an interim report on the All-Generation Social Security Review Conference released in December 2019, indicated that the co-payment ratio of patients aged 75 years and older, who have a certain amount of income, should be increased from 10% to 20%. However, since only a small percentage of the elderly are subject to a rate of 20%, it will likely be ineffective for fiscal consolidation.

Figure 1 Effective patient burden ratio

(Source) Ministry of Health, Labour and Welfare, Basic data on medical insurance

Figure 2 Amount of burden reduction program subsidies

(Source) Ministry of Health, Labour and Welfare, Basic data on medical insurance