Column Finance and the Social Security System 2019.07.26

【Aging, safety net and fiscal crisis in Japan】No.206:Huge fiscal deficit despite the record high tax revenue

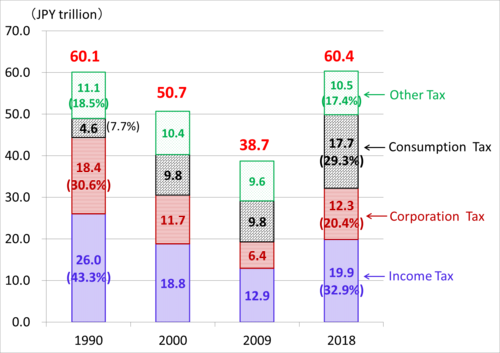

In July 2019, the Ministry of Finance announced that its national tax revenue in 2018 was the highest ever. As Figure 1 shows, the tax revenue of JPY 60.4 trillion in 2018 exceeded the JPY 60.1 trillion in 1990, which was just before the collapse of the economic bubble. Meanwhile, the ratio of consumption tax revenue to total tax revenue increased from 7.7% in 1990 to 29.3% in 2018. This is the effect of raising the consumption tax rate, which was 3% in 1990, to 5% in 1997 and 8% in 2014.

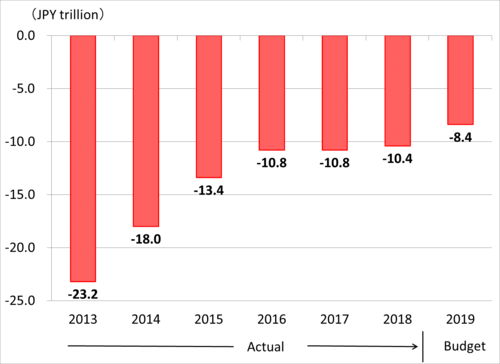

However, the Japanese people should realize that the government did not escape its huge fiscal deficit, despite the record high tax revenue. As in Figure 2, the primary balance in 2018 was a deficit of JPY 10.4 trillion, and the government expects a deficit of JPY 8.4 trillion in 2019. The primary balance is the balance between tax revenues plus other revenues and expenditures minus government bond expenses (expenses to repay the principal on government bonds and to pay interest). In other words, it is an indicator showing the extent that the tax revenues at that time can cover the policy expenses required at that time.

International organizations, such as the OECD and IMF, pointed out that it is necessary to raise the consumption tax rate to around 20% for fiscal consolidation in Japan. The government is expected to raise the consumption tax rate from 8% to 10% in October 2019. However, Prime Minister Shinzo Abe stated, "the consumption tax hike above 10% will freeze for 10 years," when addressing the House of Councilors election in July 2019. Opposition parties oppose the raise from 8% to 10%. In such circumstances, it cannot be ruled out that politicians do not have the will and ability to explain the inconvenient truth to the public and carry out reforms for fiscal consolidation.