Column Finance and the Social Security System 2019.07.26

【Aging, safety net and fiscal crisis in Japan】No.204:Percentage of national pension premium payments is improving, but still low

In June 2019, the Ministry of Health, Labor and Welfare released the latest data on national pensions. As in Column No.32, the national pension is a basic pension system to which all registered citizens of Japan aged between 20 and 59 - regardless of nationality - must subscribe and for which they must pay premiums.

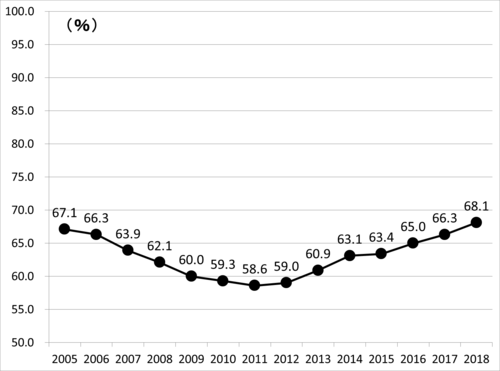

The number of national pension subscribers is 67.45 million at the end of March 2019. Among them, 14.52 million people - who are neither welfare pension subscribers nor their spouses - were obligated to join the national pension system. Furthermore, 5.74 million of the 14.52 million are exempt from insurance premiums, or have suspended premiums due to their low-income or student status. Therefore, 8.78 million people are obligated to pay national pension premiums. The monthly premium is 16,410 yen (149 US$; 1 US$ = 110 JPY) as of 2019. The problem is that less than 70% of the people in question pay their pension premiums without delay, and this percentage has been increasing since 2011 (Figure 1).

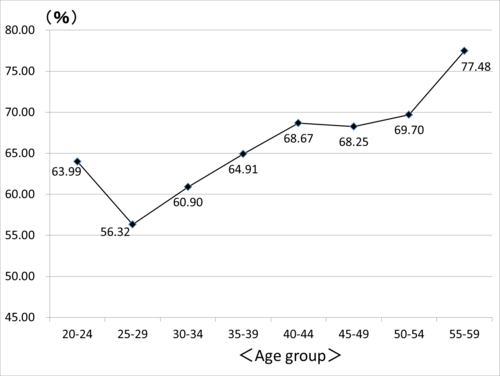

The ministry calculates two types of national pension premium payment groups. The first is the percentages of premiums paid immediately each month on a regular basis, called the Current year payment percentage. In 2018, 68.1% of pension subscribers paid the premiums due during the year immediately. Figure 2 reports this percentage by age group. In the 25 to 29 year old group, 56.32% of pension subscribers paid the premiums due during the year on time, which is significantly lower than that of 55 to 59 year old group.

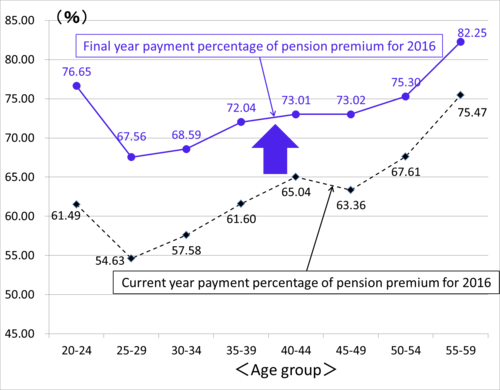

The second payment group includes the percentage of premium payments two years after the deadline, called the Final year payment percentage. This is a result of government efforts to strongly urge payment delinquents to pay. While the current year payment percentage of the premiums due in 2016 was 65.0%, the final year payment percentage confirmed in 2018 is 74.6%. Thus, 9.6% of the pension subscribers paid the premiums for 2016 after the deadline. Figure 2 shows this fact by age group. It is interesting to note that the proportion of late payments for the younger groups, who are said to have increasing distrust of the pension system, is surprisingly large.