Column Finance and the Social Security System 2019.06.13

【Aging, safety net and fiscal crisis in Japan】No.192: National Health Insurance Fiscal Balance in 2017

In April 2019, the Ministry of Health, Labour and Welfare released a report on the National Health Insurance (NHI) fiscal balance in 2017. As explained in Column No. 19, NHI is a mandatory requirement for all citizens aged 74 years or younger who are not enrolled in workplace insurance.

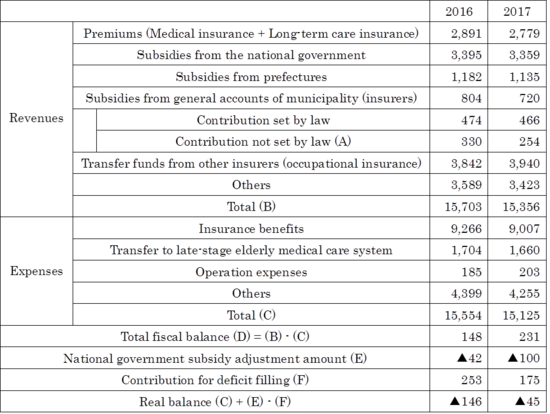

As shown in Table 1, the NHI fiscal surplus increased from JPY 148 billion in 2016 to JPY 231 billion in 2017. However, in order to assess the real fiscal balance, it is necessary to adjust the amount by adding the national government subsidy adjustment amount to it, and then deducting the contribution for deficit filling. The contribution for deficit filling is included in the contribution not set by law category as a subsidy that a municipality adds at its own discretion. The source of this additional subsidy is tax, which means that people who are not NHI members are forced to compensate for the deficit. The real balance improved in 2017 from a deficit of JPY 146 billion in 2016, but was still negative at JPY 45 billion.

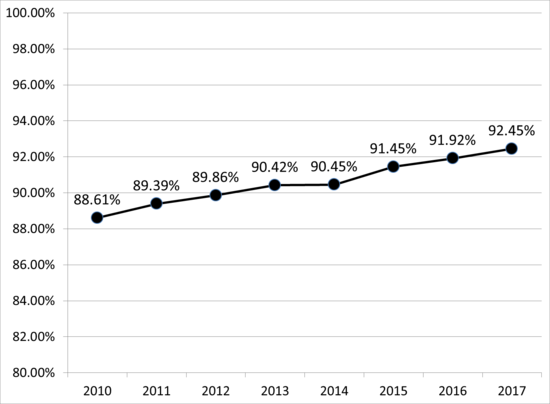

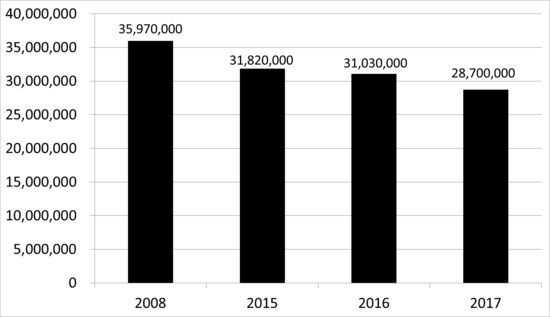

As shown in Figure 1, the percentage of those who paid NHI premium in accordance with the rules improved from 91.92% in 2016 to 92.45% in 2017. However, the amount of premium income decreased from JPY 2,891 billion in 2016 to JPY 2,779 billion in 2017, as the number of insured people decreased (Figure 2). The decrease in the number of participants is attributed to the transition from NHI to the Latter-Stage Elderly Medical Care System at age 75 as well as the decline in new NHI enrollments.