Column Finance and the Social Security System 2019.05.31

【Aging, safety net and fiscal crisis in Japan】No.191: Financing of health insurance societies is expected to deteriorate further after 2022.

There are two kinds of medical insurance providers for private company employees: health insurance societies, for employees of large companies, and the Japan Health Insurance Association, for employees of small-medium companies. As I explained in Column No. 145, the average premium rate of health insurance societies rose from 8.5% in 2005 to 10.63% in 2017. In April 2019, the Federation of Health Insurance Societies released a report on the 2019 budget tabulation result for the entire sector of health insurance societies and the fiscal forecast for 2022.

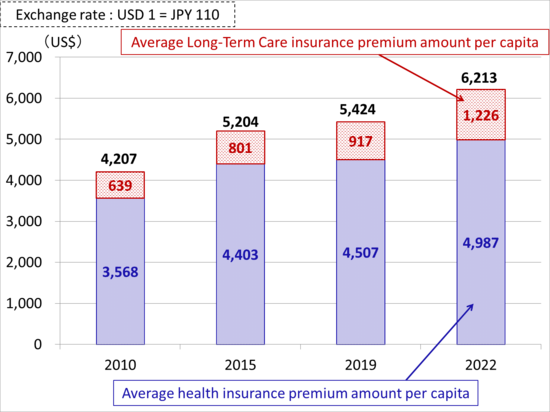

The working generation bears most of the health care costs for older adults through paying health and long-term care insurance premiums in addition to taxes. As shown in Figure 1, the average premium amount for health insurance society members in 2019 is USD 5,424 annually (exchange rate: USD 1 = JPY 110), consisting of USD 4,507 for health insurance and USD 917 for long-term care insurance. The employer and the employee each bear half of this amount.

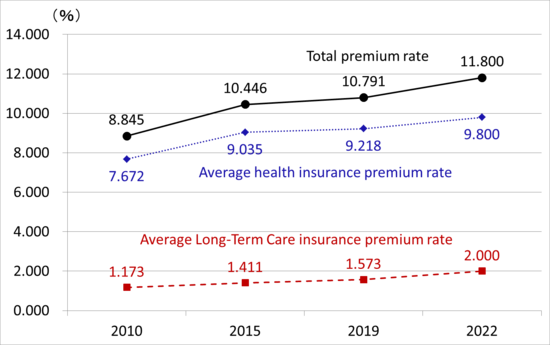

The Federation expects this average total premium to reach USD 6,213 in 2022. Thus, the total premium rate for health insurance and long-term care insurance will jump from 10.791% in 2019 to 11.800% in 2022 (Figure 2). The background is that the baby boomer generation will be over the age of 75 years from 2022, and at the same time, the decline in the working population will accelerate.

Figure 1: Average premium amount per capita

Source: Federation of Health Insurance Societies

Figure 2: Average premium rate

Source: Federation of Health Insurance Societies