Column Finance and the Social Security System 2019.04.18

【Aging, safety net and fiscal crisis in Japan】No.176: Japan has room to raise the national burden ratio

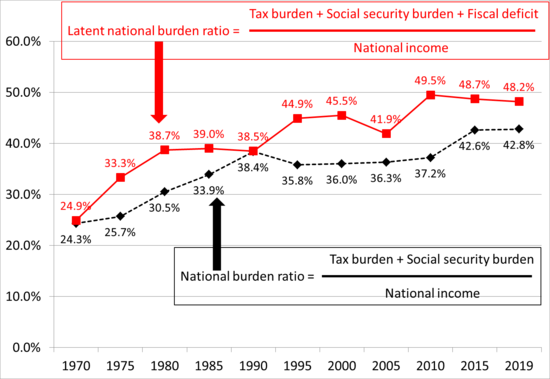

In February 2019, the Ministry of Finance released an estimate of the national burden ratio in Fiscal Year 2019. There are two definitions of the national burden ratio. The first definition is calculated by dividing the total amount of tax and social security expenses paid by the public by the national income. The second definition is the national burden ratio of the first definition plus the ratio of the fiscal deficit to the national income. The fiscal deficit entails postponement of the current generation's burden for management by future generations, creating the illusion that the national burden is partially exempted. Therefore, the latter is called the latent national burden ratio.

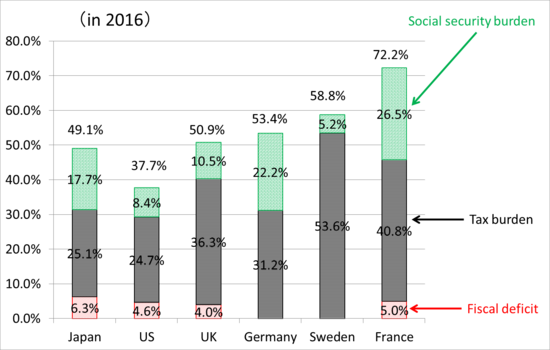

As shown in Figure 1, Japan's latent national burden ratio is projected to increase from 24.9% in 1970 to 48.2% in 2019. The Ministry of Finance also provides an international comparison of the latent national burden ratio in 2016 (Figure 2). Japan's latent national burden ratio is lower than those of the UK, Germany, Sweden, and France. Therefore, it seems reasonable to request that the public raise the consumption tax rate to 20% like that of Europe to ensure the soundness of the social security system, which is dependent on the issue of deficit bonds.

Figure 1. Historical trend of Japan's national burden rate.

Source: Ministry of Finance

Figure 2. International comparison of national burden ratio

Source: Ministry of Finance