Column Finance and the Social Security System 2019.01.22

【Aging, safety net and fiscal crisis in Japan】No.145: Why are health care insurance premiums rising?

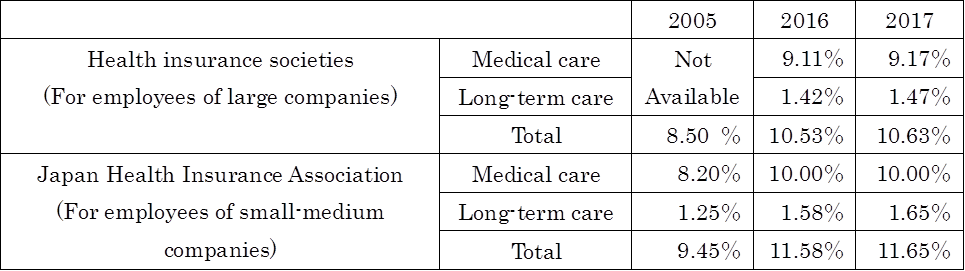

As explained in Column No. 19, there are two kinds of medical insurance for private company employees: health insurance societies, for employees of large companies, and the Japan Health Insurance Association, for employees of small-medium companies. As shown in Table 1, the average premium rate of health insurance societies rose from 8.5% in 2005 to 10.63% in 2017. That of the Japan Health Insurance Association also increased from 9.45% to 11.65%.

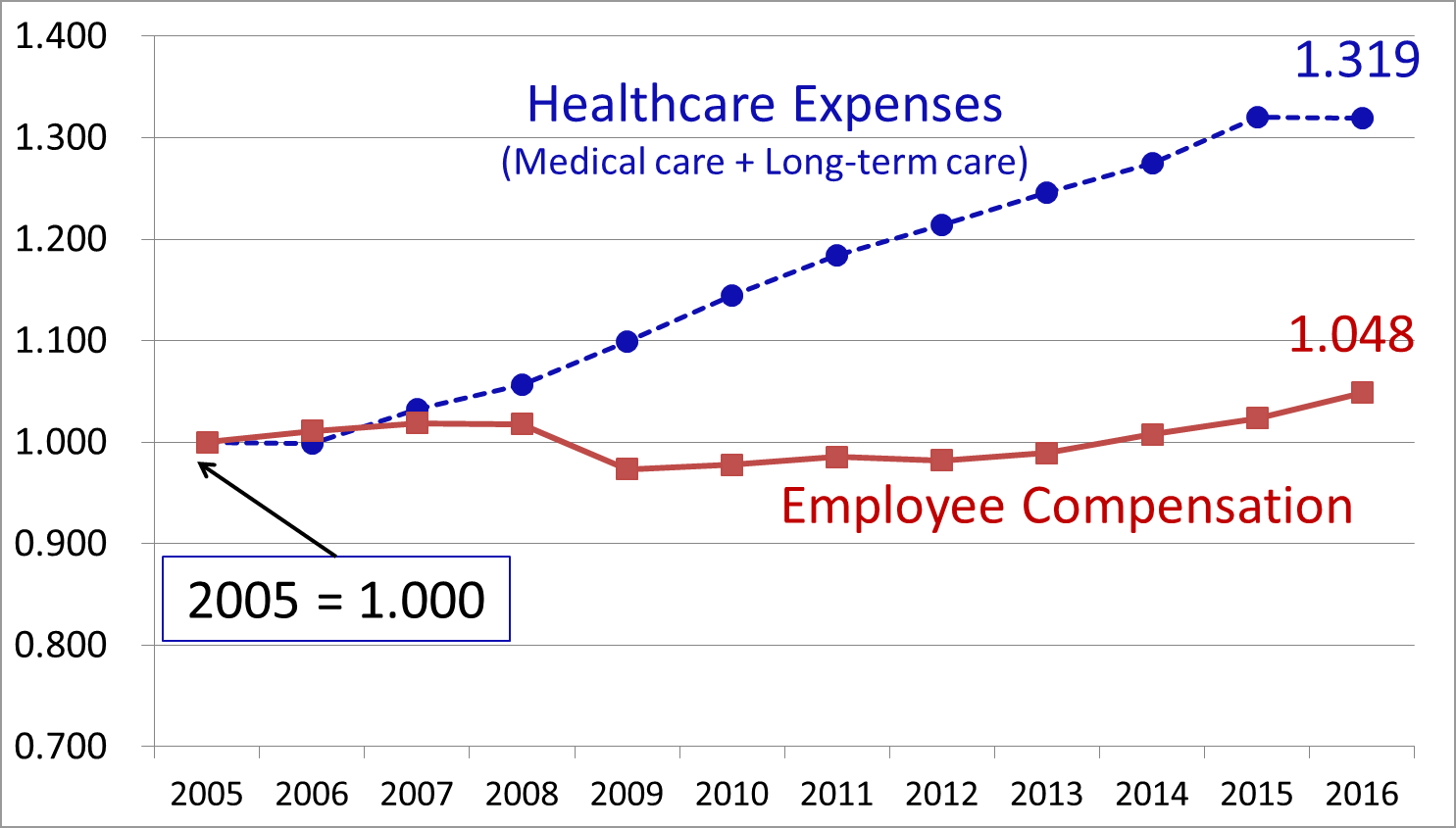

There are three reasons for these increases. First, the funding for medical expenses of the elderly, which is soaring as the number of the elderly is increasing, is included in the premiums paid by company employees. Second, the employees aged 40 years and older are obliged to pay premiums for long-term care insurance. From the perspective of securing financial resources for social security, the third reason is more serious. As shown in Figure 1, while healthcare expenses are soaring, employee compensation has hardly increased.

Table 1: Employee healthcare insurance premium rates

Note: The total does not necessarily match because it has been rounded to two decimal places.

Source: Cabinet Office and Ministry of Health, Labour and Welfare

Figure 1: The increasing gap between the rates of healthcare expenses and employee compensation

Source: Cabinet Office and Ministry of Health, Labour and Welfare