Column Finance and the Social Security System 2018.12.27

【Aging, safety net and fiscal crisis in Japan】No.144: Budget Deficit and Consumption Tax Rate

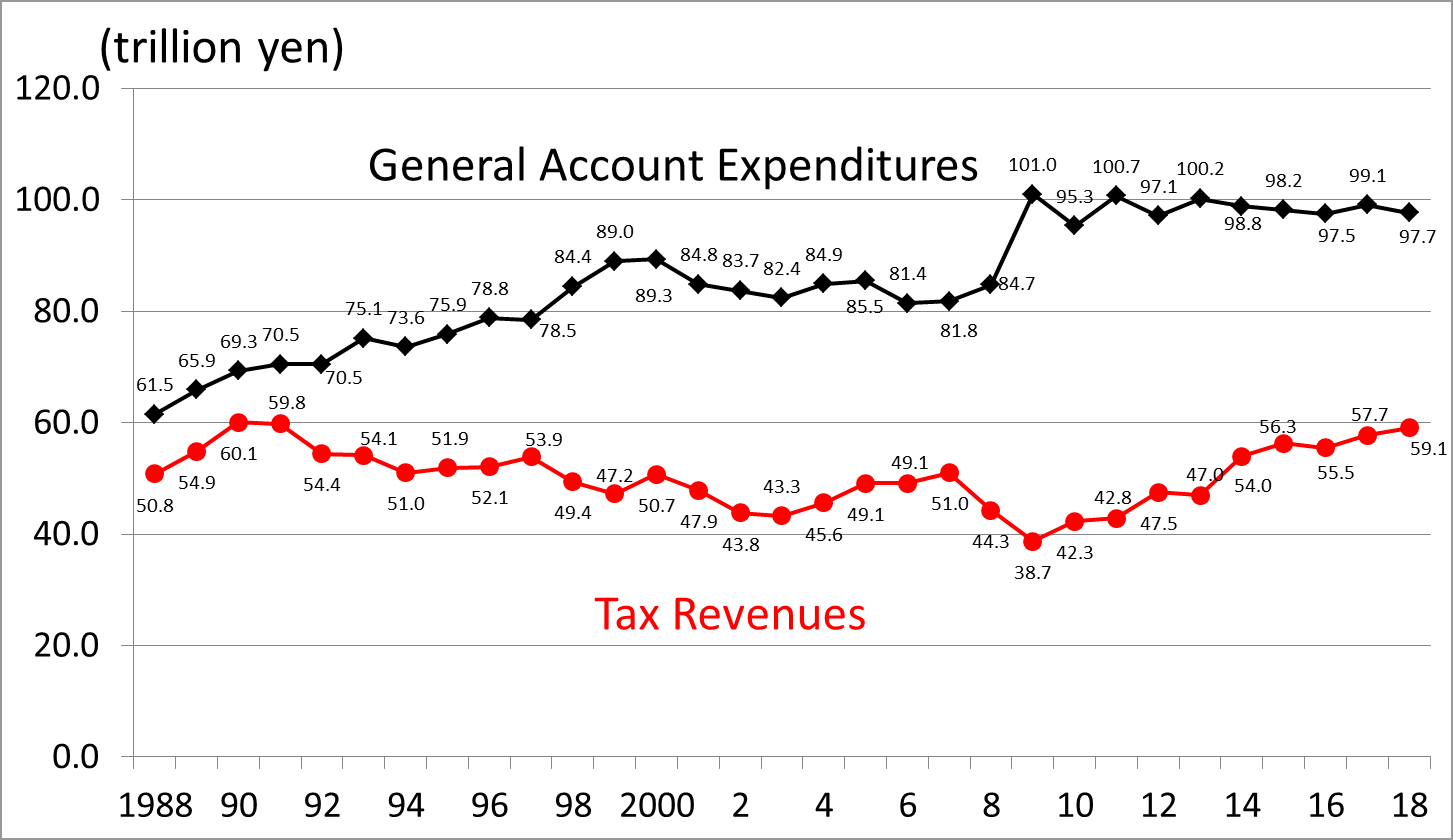

Figure 1 shows the trend of tax revenue and general account expenditure over the past 30 years. The tax revenue in 1990, just before the bubble economy burst, was 60.1 trillion yen. Tax revenue has subsequently declined since then, but it is expected to recover to 59.1 trillion yen in 2018. On the other hand, the general account expenditure has continued to increase and reached approximately 100 trillion yen. The main reason for this expenditure is the increase of social security expenses. There is therefore still a huge budget deficit.

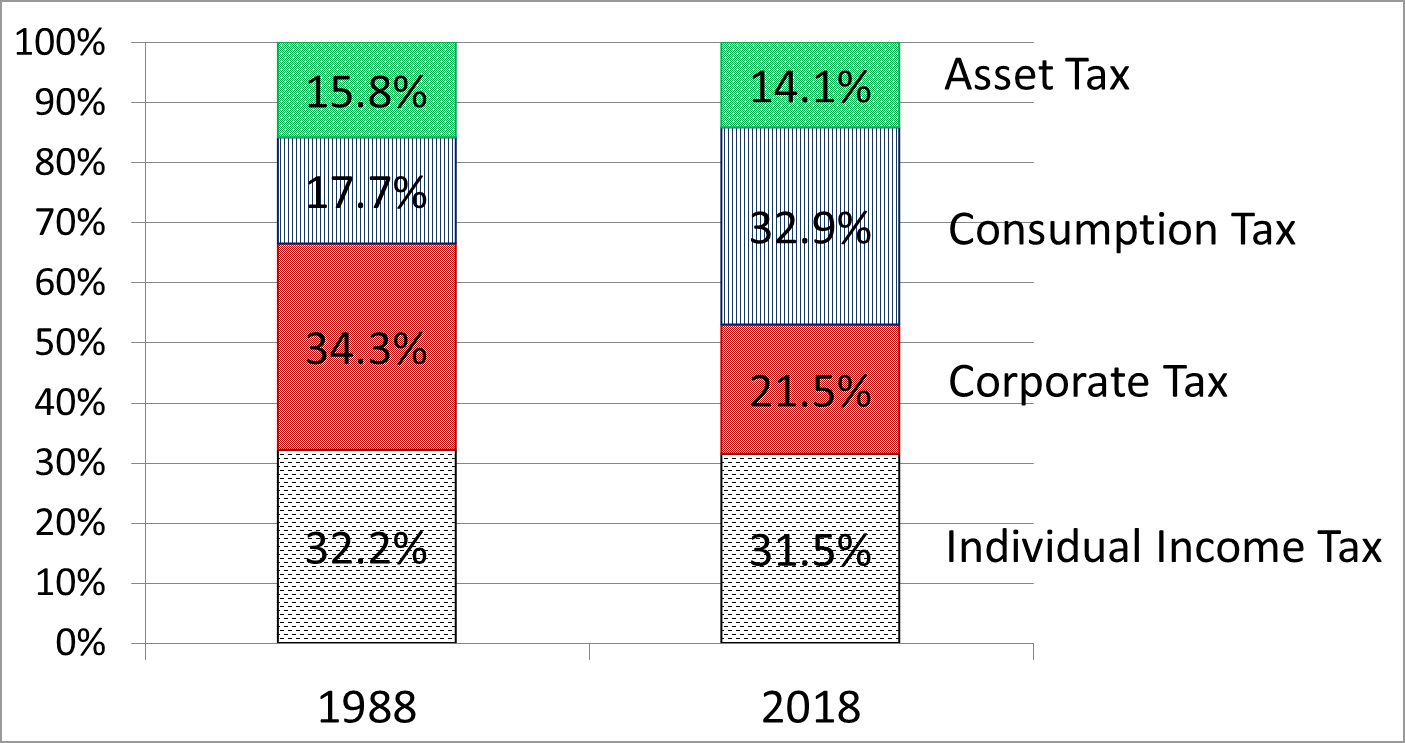

Figure 2 shows the tax revenue structure. The proportion of consumption tax to total tax revenues has increased from 17.7% in 1988 to 32.9% in 2018. The Abe administration plans to raise the consumption tax rate from 8% to 10% in October 2019. However, in order to secure social security finance, which will continue to increase, and to reduce the budget deficit, it is necessary to raise the consumption tax rate to 20% or more as soon as possible.

Note: Data until FY2016 are on a settlement basis, data in FY 2017 are on an estimated basis, and data in FY2018 are on a budgeted basis.

Source: Ministry of Finance

Figure 2: Tax Revenue Structure

Note: Data until FY1988 are on a settlement basis, and data in FY2018 are on a budgeted basis.

Source: Ministry of Finance