Column Finance and the Social Security System 2018.12.27

【Aging, safety net and fiscal crisis in Japan】No.143: Financial Structure of Long-Term Care Insurance

The Japanese government founded a public long-term care insurance system in 2000. In Column No. 7, (Probability to Require Long-term Care Services), I explained the conditions for receiving long-term care services and the probabilities that the elderly are provided with those benefits by age group and gender. In this column, I will explain the financial structure of long-term care insurance.

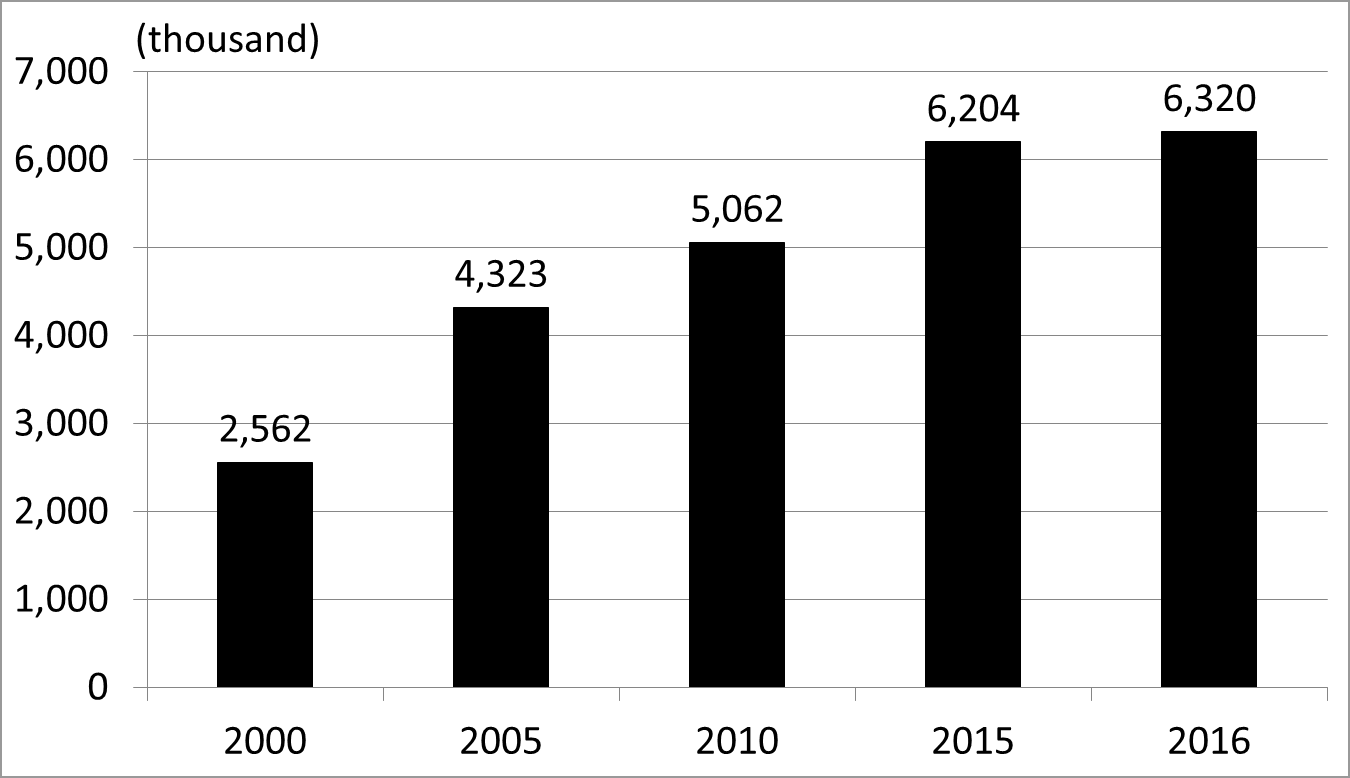

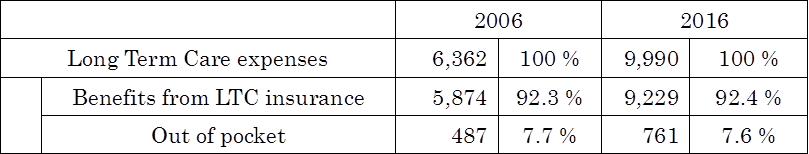

As shown in Figure 1, the number of persons who were entitled to receive benefits from long-care insurance increased 2.5 times from 2,562,000 in 2000 to 6,320,000 in 2016. As a result, long-term care expenses amounted to 9,990 billion yen in FY2016. Among them, the ratio of the amount borne by the beneficiaries was 7.6%. (Table 1)

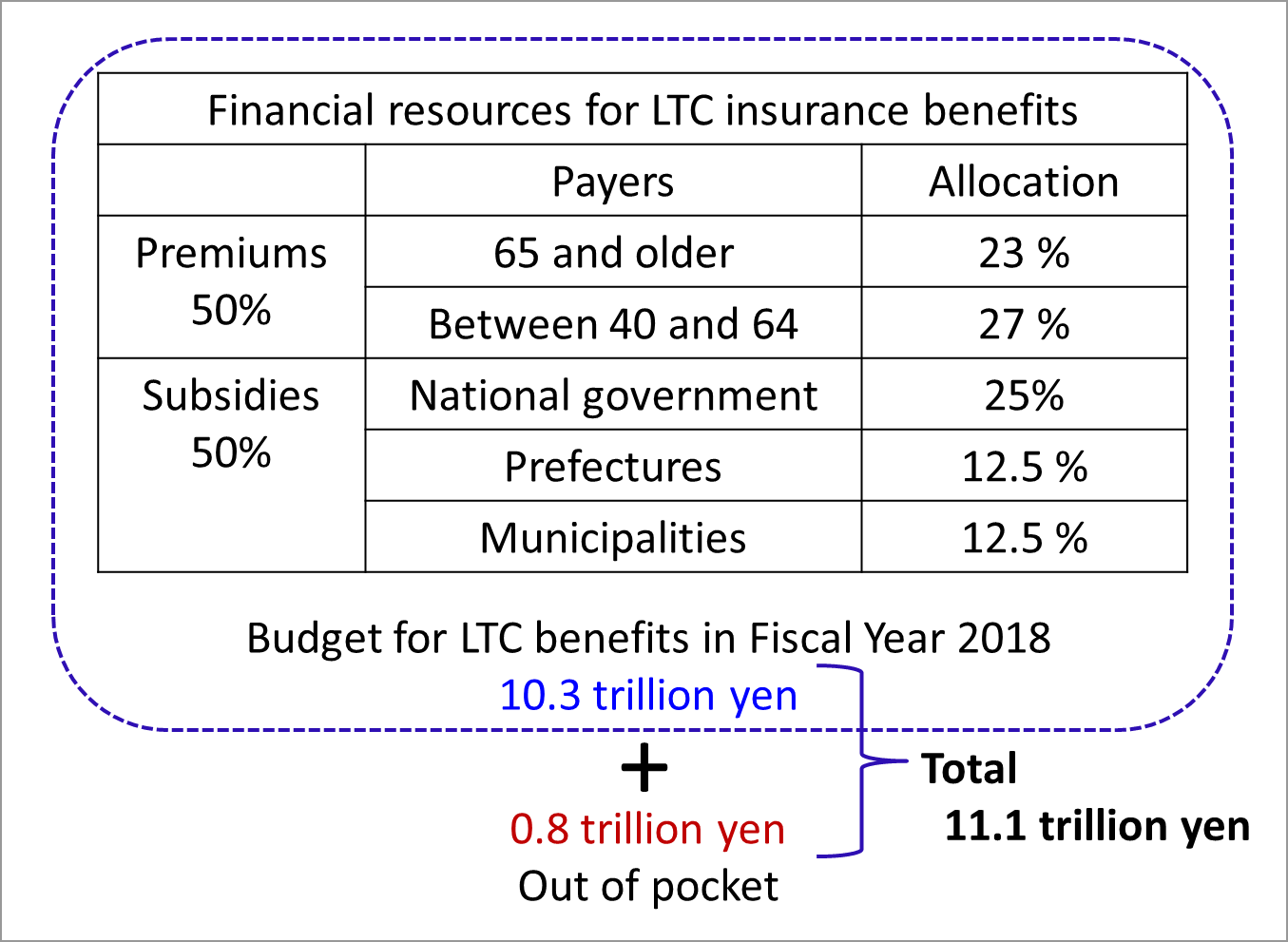

Figure 2 shows the composition of finance excluding the payment of beneficiaries from the long-term care expenses. Looking at the base budget in FY2018, the burden ratio by premium is 27% for the working generation of 40 to 64 years old and 23% for those aged 65 and older. It means that, similar to medical insurance, the working generation is responsible for the majority of financial resources for long-term care insurancewn.

Source: Ministry of Health, Labor, and Welfare

Table 1: Long Term Care expenses (billion yen)

Note: The total does not necessarily match because it has been rounded off.

Source: Ministry of Health, Labor, and Welfare

Figure 2: Financial structure of LTC Insurance

Source: Ministry of Finance