Column Finance and the Social Security System 2018.12.04

【Aging, safety net and fiscal crisis in Japan】No.138: Extending age criteria for elderly to 75 years or older

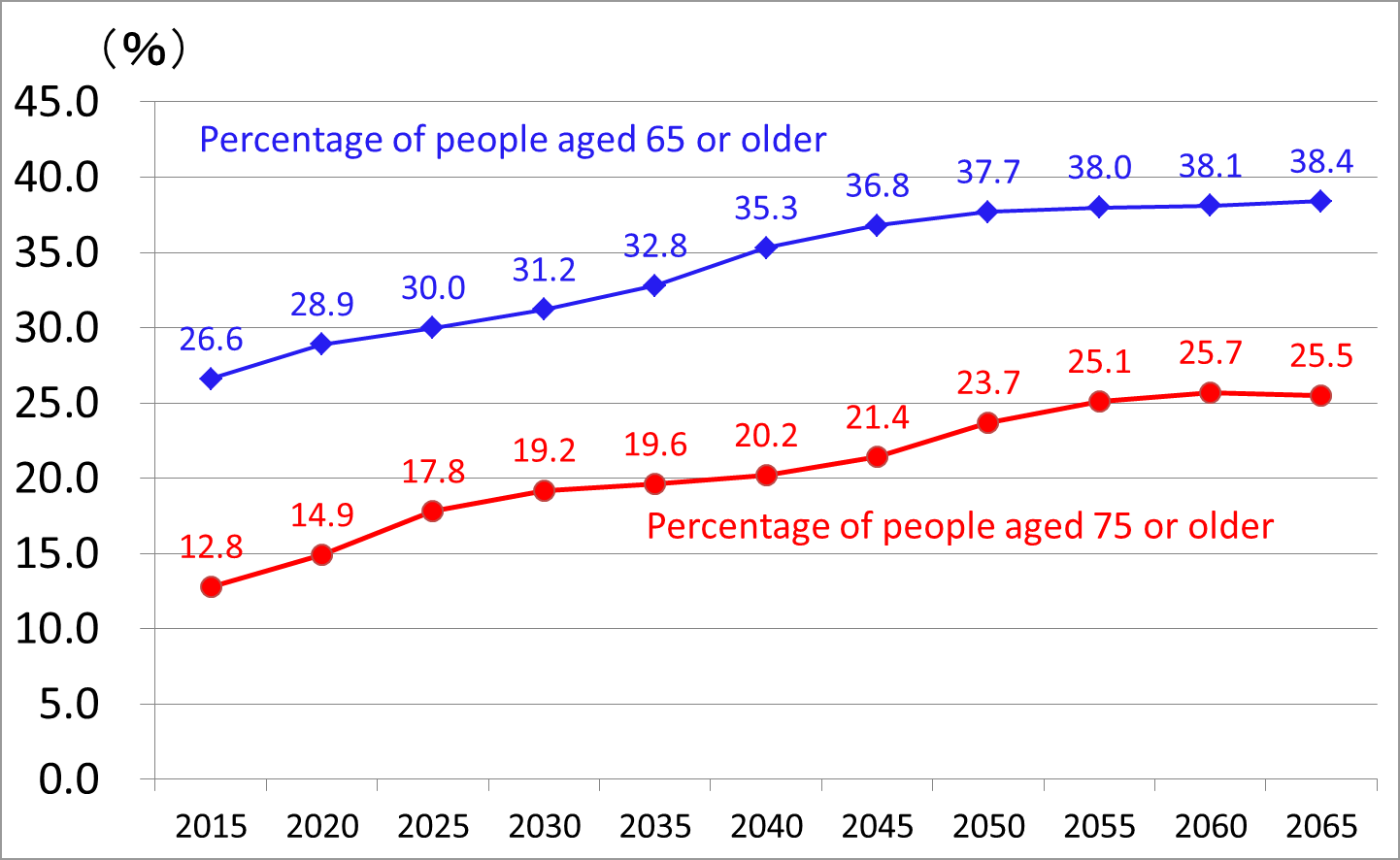

In Japan, the percentage of the population aged 65 years or older is expected to reach 38% in 2055 from 26.6% in 2015. Therefore, a cause for concern is that it will be difficult to secure financial resources for public safety nets such as pension, medical insurance, and long-term care insurance. As a way to overcome this difficulty, it seems necessary to change the definition of the elderly, which is the premise of design for social security programs, from 65 years or older to 75 years or older.

The average life expectancy in 1953, when I was born, was 61.9 years for men and 65.5 years for women. During my childhood, a person aged over 65 years looked very old. Now I have turned 65. I feel that I can maintain about the same level of physical strength as people aged 55 years in the 1950s and continue to work for another 10 years.

The government has begun to consider making a social system to support healthy and motivated elderly to continue working. In 2017, the percentage of individuals working between 65 and 69 years of age was 54.8% for men and 34.6% for women. The percentage of individuals working between 70 and 74 years of age was 34.2% for men and 20.9% for women. On the other hand, the percentage of the elderly over the age of 75 years is predicted to stabilize after their proportion reaches 25% in 2055. Therefore, if we become a society where people can work until around the age of 75 years, then we may enable people to achieve overall stability in their lives.

Figure 1: Prediction of the percentage of the elderly

Source: National Institute of Population and Social Security Research, [Population Projections for Japan: 2016 to 2065] April 2017