Media Global Economy 2018.10.01

The winners and losers in the US-China trade war - Let us evaluate in detail who has more to lose, the US or China

The Trump administration will eventually impose additional tariffs on all Chinese imports, triggering an all-out trade war between the two countries. Many people care about which of the two will suffer a more serious setback than the other. I suppose that those who regard the row as a struggle for supremacy between the two are particularly concerned about the issue.

Based on common sense and taking it into consideration that while the economy of the US, whose GDP is larger than that of China, has been strong, China's export/GDP ratio (19%) is higher than that of the US (8%) and China exports more to the US than it imports from the US, it appears that China will be hurt more than the US. There are actually some interpretive articles expressing similar views.

In this article, I will explain how we should see the US-China trade war, hoping that a sound and level-headed judgment will be made.

It is "additional tariffs," not an "import ban"

Recent steps taken in the trade war include simply imposing additional tariffs, not prohibiting imports.

The Japanese government once adopted import prohibitions or restrictions on agricultural products such as rice, beef and dairy products, whereby imports of such products were either completely banned or subject to import quotas. In the recent trade war, the US and China have simply slapped 25% tariffs on each other's goods.

In cases where all exporters provide goods of the same quality, an importer chooses the one that offers the goods at the lowest price. If the importer levies an additional 25% tariff on the exporter's goods, but the import price onto which the additional tariffs are passed remains lower than the price of goods either imported from any third country free from additional tariffs or produced domestically, the importer continues to buy from the exporter (despite the somewhat negative impact of the higher import price, i.e. a decrease in import volume).

Let me be a little more specific on the matter, using actual figures. Let us assume that the US currently imports 1 million toys for 10 dollars each only from China; and that Thailand can export 0.1 million toys to the US if the price is 12 dollars; Vietnam, 0.4 million toys, 13 dollars; and Indonesia, 0.5 million toys, 14 dollars (assume also that even if the price rises, the exportable quantity will not change and that there is no domestic production).

If the US were to impose an additional 25% tariff on Chinese toys, the import price would increase to 12.5 dollars. As a result, Thailand would be able to export 0.1 million toys to the US, because Thai toys would have become cheaper than their Chinese counterparts. However, neither Vietnam nor Indonesia would be able to, as their products would remain more expensive than Chinese toys. If an increase in the import price of Chinese toys to 12.5 dollars decreases total demand for imported toys from 1 million to 0.9 million, the US would import 0.1 million toys from Thailand and 0.8 million toys from China. Although the number of toys imported from China would fall, the US would not stop buying from China.

However, if additional tariffs of 50% were levied on Chinese toys, the import price would increase to 15 dollars. On this basis, if the domestic toy price in America were to rise to 14 dollars and total demand for imported toys dropped to 0.7 million, the US would start buying 0.1 million toys, 0.4 million toys and 0.2 million toys, respectively from Thailand, Vietnam and Indonesia, while no longer importing toys from China.

As seen above, it is not clear to what extent exports from a country whose goods are subject to higher tariffs will decrease, because it depends on the types of goods, the additional duties to be imposed, the export prices of competing countries, the status of production and export from other exporting countries (and the supply by domestic production, if any), and the decline in demand from the importing country due to higher tariffs. Actually, the extra 25% tariff that China has levied on US soybeans has boosted the country's soybean imports from other soybean suppliers such as Brazil. However, although the volume of soybeans imported from the US has plummeted, a certain volume of American soybeans continues to enter China.

There are quite a few agricultural products imported into Japan that are subject to tariffs of 100% or higher on an ad valorem basis. However, although the import tariff on French butter, Échiré, is over 200%, importers purchase the product, even paying the high tariff (consumers buy butter imported for 100 yen at a price higher than 300 yen), since Échiré butter is in strong demand from some consumers in Japan. Also, in the recent trade row, products of a higher quality than their counterparts produced in other countries, and those which cannot be produced by any other countries are expected to continue to be imported, even though an extra 25% tariff is slapped on them.

Despite being called a "war," it will not hurt either the US or China as seriously as an actual war would

It is said that 60-70% of current world trade is accounted for by trade in parts and intermediate goods. In other words, the trading system in previous times, in which countries engaged in the entire manufacturing process from parts through end products on their own and traded the finished products with each other, has now changed to one in which countries trade parts and components with each other to assemble finished products in certain countries for trading.

Japan was once said to be conducting processing trade. It imported raw materials to manufacture finished products and sold them to foreign countries. Nowadays Japan trades not only raw materials but also parts and components which are used to manufacture finished products somewhere else in the world. We referred to this mechanism as global supply chains.

Specifically, China, for instance, imports parts from other countries such as Japan, Taiwan, Korea, Thailand and the US, combines them with self-made parts to produce end products, and exports them to the US. Having so far assembled vehicles in China and exported them to the US, Ford is now considering moving assembly plants to countries other than China to avoid the additional 25% tariff. In this case, if the price of a Ford vehicle is 10,000 dollars and the added value created by assembly in China is 1,000 dollars, damage incurred by China due to Ford's transfer of its place of production is not 10,000 dollars, but only 1,000 dollars.

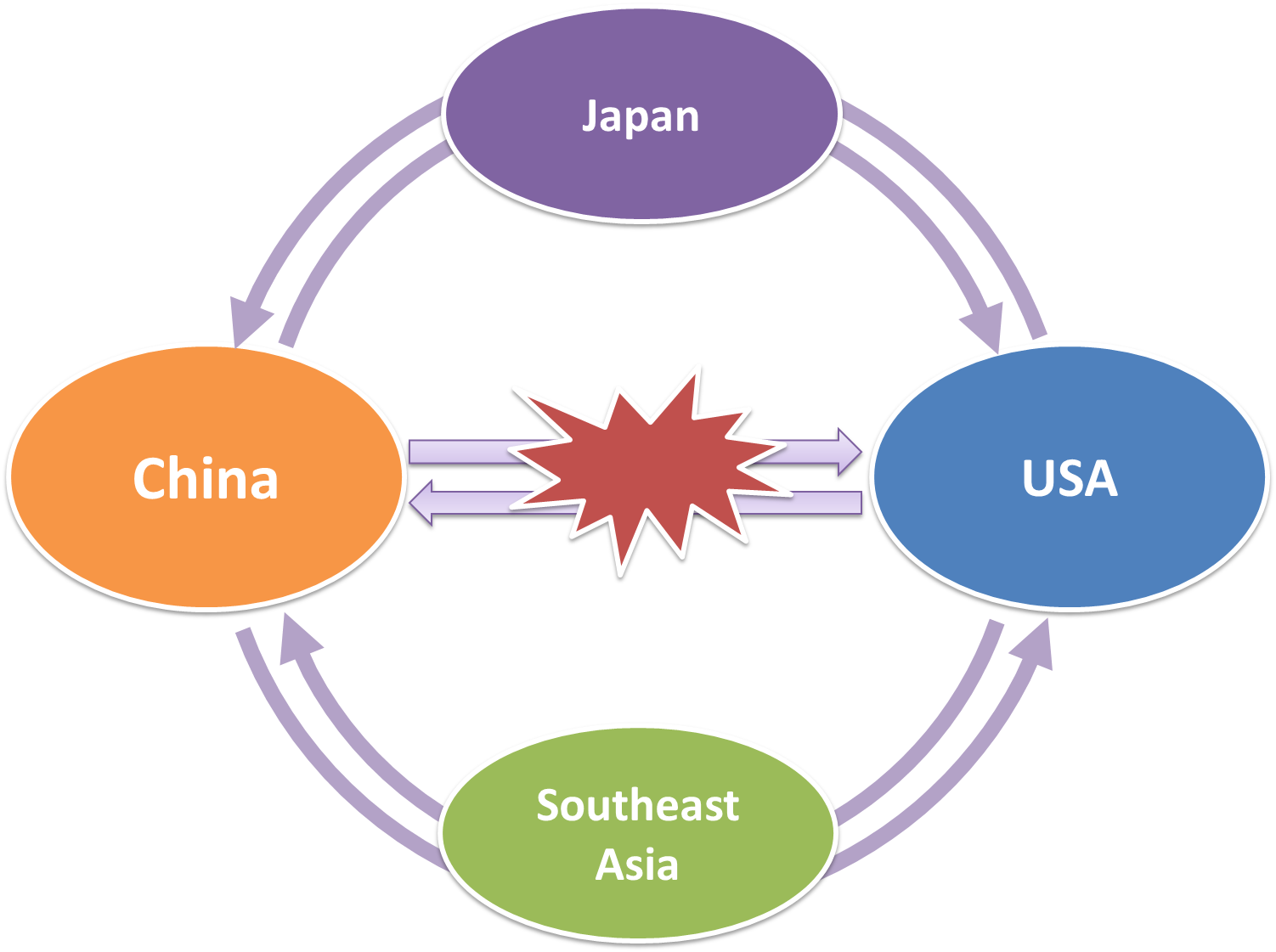

In the above chart, if the trade route connecting China and the US deteriorates due to additional tariffs, it is possible to gather parts produced in China, the US, and other countries, in Japan and Southeast Asia to assemble finished products and export them to the US or China. Of course, no finished product factories will be transferred to other countries if the cost of producing in and exporting from China (the US) remains lower, even after the extra tariffs have been passed onto the cost. China (the US) will suffer less serious damage.

As just described, since global supply chains have now become more flexible than before owing to the parts trade, it is possible to, even if one trade route is disrupted, supply products using other routes. Damage to the production of a country subject to higher tariffs is also limited to the extent of the decline in added values created by the country. Even if import prices increase, consumers' access to affected goods is ensured through the other routes. Taking this into consideration, we realize that although the US-China trade dispute is called "war," the two countries do not hurt each other as seriously as they would in an actual war.

While producers and consumers in the US and China are negatively affected by the trade war to some extent, third countries to which production bases move will benefit from it. Viewed from the perspective of Japan, one of the third countries involved, despite the possible adverse impact of the trade war, i.e. a decline in exports to the two countries caused by a slight decrease in their GDP, there also exist some positive effects of transfers of places of production.

Furthermore, Japanese companies which have been competing with their American or Chinese rivals will reap an indirect benefit through expanded export from the worsening export conditions of their rivals, as is witnessed by the fact that the number of American-made BMW and Mercedes-Benz vehicles exported to China has decreased due to higher tariffs levied by China, whereas that of Lexus models shipped from Japan to China has increased.

Agriculture will receive a heavy blow as an exception

However, there are exceptions to flexible supply chains.

The reason why the US ban on sales of parts to China's ZTE threatened its survival is because there were no countries other than the US that supplied parts to the Chinese tech company. As seen in this case, when there are no alternate sources of supply and it is difficult to transfer the place of production in the short run, importers in China and the US cannot help but import from the other country, even paying the additional tariffs. In this case, consumers and companies using imported goods in an importing country that has slapped higher tariffs with the intention of attacking the other country will take a hit. It is akin to shooting oneself in the foot.

The more important exception is the case where it is impossible to move the factors of production across borders. A typical case of this is agriculture.

Agriculture is closely tied to a very specific factor of production, land. Unlike parts, land cannot be traded. It is impossible for US farmers to export farmland to Japan and ship agricultural products produced in Japan to China. If such measures were feasible, American farmers would be able to get paid for exported farmland (usage fees). However, this being impossible, US farming households and agriculture-related industries will, when their exports drop, incur losses roughly equal to the total value of agricultural products left unexported.

It is American soybean farmers who incur such losses.

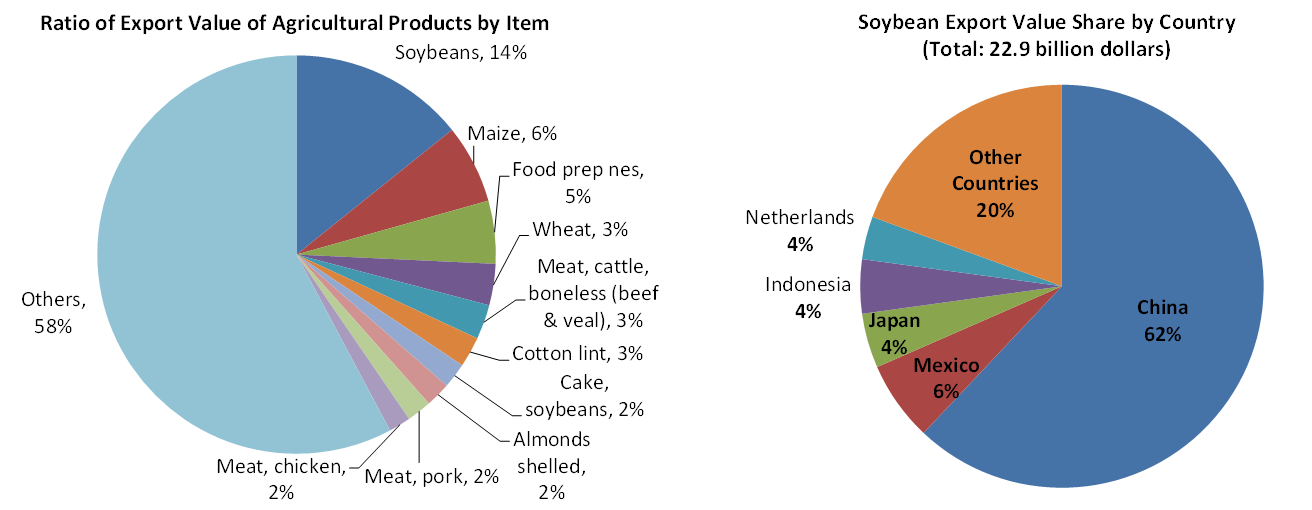

As shown in the charts (2016), soybeans account for the largest proportion of US agricultural exports, and the largest amount of US soybeans is sold to China. Although the effects of the US-China trade war vary across industries, there is almost no doubt that the US agricultural industry will sustain damage (refer to: "The US wants to put an end to the trade war with China as quickly as possible"). Meanwhile, Brazilian farmers who have competed with their US rivals stand to gain substantially.

The US-China trade war will have only a limited effect

Taken together, the following conclusion is drawn.

In contrast to the situation after the Great Depression where many countries slapped higher tariffs on goods imported from the rest of the world, only the US and China have hit each other with high tariffs in this recent trade war. In this respect, the damage caused by the US-China trade row to the world economy is not as serious as that caused by the trade war after the Great Depression.

It is true that American and Chinese industries will be affected, but it is not clear how much damage individual industries will suffer, as it depends on prices, the status of production, etc. of other exporting countries.

In addition, with a significant proportion of world trade accounted for by trade in parts and intermediate goods, even if the trade route between the US and China is disrupted, we can still gather parts from somewhere so that finished products can still be delivered to both countries. In this case, the US and China will see their respective GDP's decrease only by an amount equal to the added value which assembly steps would otherwise have created.

On the other hand, third countries to which places of production have been transferred from the US or China will get the benefits. However, of all export industries, the (US) agricultural industry will suffer a major setback, because it cannot move its place of production.

A free trade agreement (FTA) is designed to mutually reduce tariffs between two or more countries. In contrast to this, the US and China have raised tariffs on each other's goods, as if they had entered into an "anti-FTA," thanks to which third countries can export their goods to them with tariffs on their exports remaining relatively low. The dispute between the US and China over soybeans has indirectly benefited Brazil, while that over beef, Australia, and that over automobiles, Japan.

Apart from products which only the other party in the trade war can supply, disadvantages created for consumers in the importing country are limited compared with the case where tariffs on imports from countries all around the world are raised because they can find other sources of supply.

Some regard the US-China trade war as a fight for supremacy picked by the US with China taking up the gauntlet. However, even if such a motive is hidden behind the trade war, I do not think that either the US or China will actually deliver a fatal blow to the other, thereby attaining supremacy.

(This article was translated from the Japanese transcript of Dr. Yamashita's column in "Webronza" on September 11, 2018.)