Column Finance and the Social Security System 2018.06.08

【Aging, safety net and fiscal crisis in Japan】No.125: The Fiscal Balance of Occupational Accident Insurance

Occupational accident insurance is a system that pays necessary benefits to support workers and bereaved families affected by injuries at work or while commuting, illness, or accidental death. For example, all medical expenses for injuries or illnesses certified as covered by the occupational accident insurance benefits will be borne by this system instead of by public health insurance. Pension benefits are also paid to the bereaved families.

Due to the probability of occupational accidents varying considerably depending on the type of occupation, the insurance premium rate of occupational accident insurance is decided by the nature of the occupation. As a result, the insurance premium rate for April 2018, for example, varies from 0.25% for the financial industry and telecommunications industry to 8.8% for the mining industry. The insurance premiums are fully paid by employers and there is no financial burden on the employees.

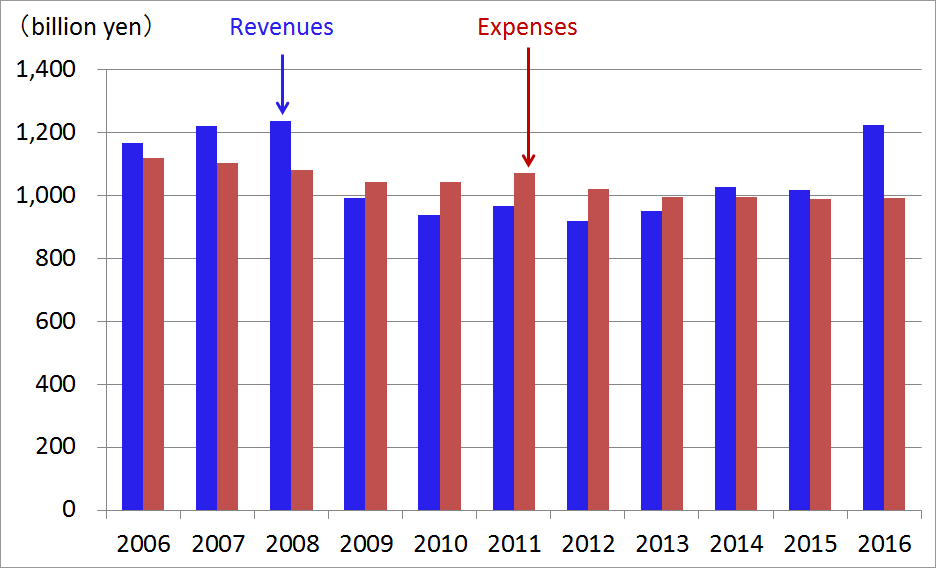

Unlike employment insurance (see Column No. 124), the benefits of occupational accident insurance are unaffected by the unemployment rate, so its fiscal balance is stable (Figure 1).

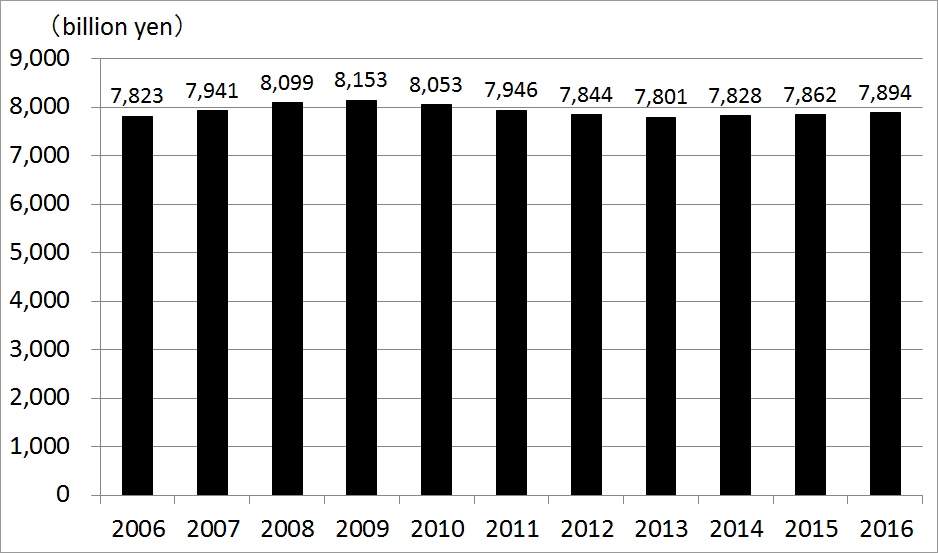

In addition, it has a reserve fund of about 8 trillion yen as of 2016 as a source of survivors' pension.

Figure 1: Revenues and expenses in occupational accident insurance

Source: Ministry of Health, Labor and Welfare

Figure 2: Reserve fund of the occupational accident insurance

Source: Ministry of Health, Labor and Welfare