Column Finance and the Social Security System 2018.06.08

【Aging, safety net and fiscal crisis in Japan】No.124: The Fiscal Balance of Employment Insurance

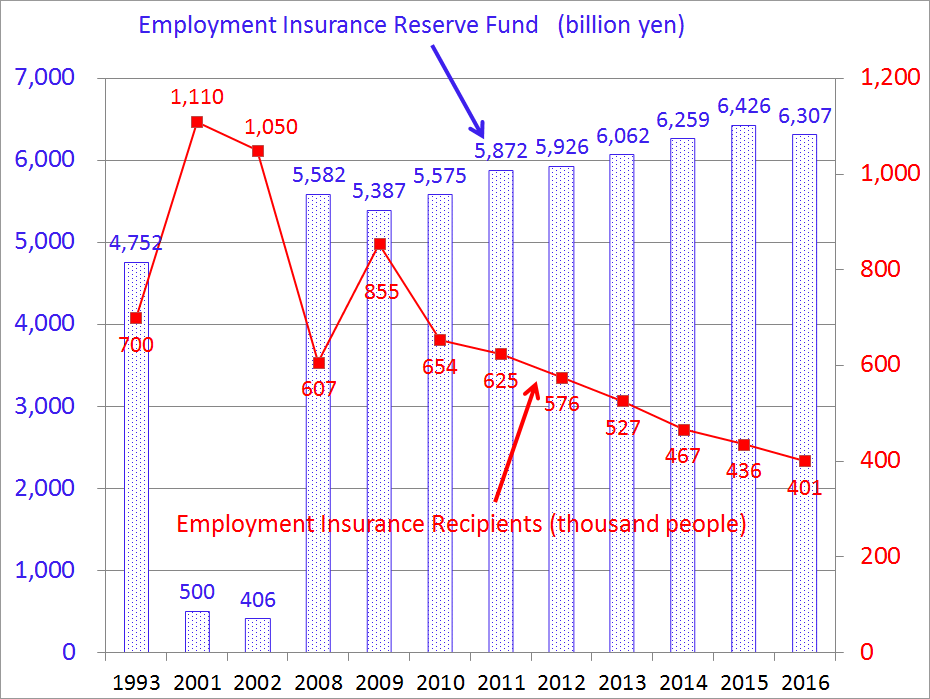

Employment insurance is a system that pays unemployment benefits for a certain period in the event of unemployment, provided that workers paid the insurance premiums while employed. Figure 1 shows the amount of reserve fund the number of people who received unemployment benefits from 1993 to 2016. Considering the economic bubble collapse in 1991, the number of recipients increased sharply from 0.7 million in 1993 to 1.1 million in 2001, and the reserve funds decreased from 4,752 billion yen in 1993 to 406 billion yen in 2002. Due to these circumstances, the government raised the unemployment insurance premium rate incrementally from 0.8% in 1993 to 1.6% in 2005.

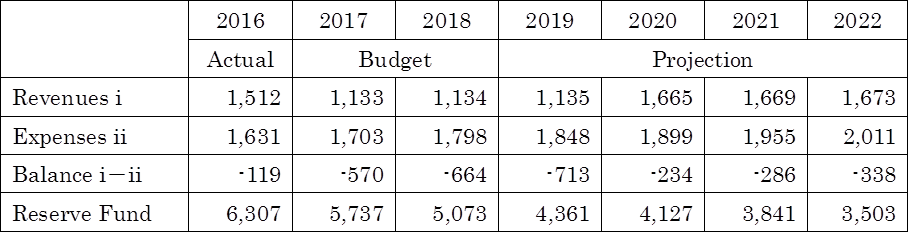

Although the number of recipients increased again due to the Lehman shock in 2008, it continues to decrease as the unemployment rate declines. As a result, the reserve fund reached a record high of 6,426 billion yen in 2015. The government lowered the insurance premium rate to 0.6% in 2018 due to these circumstances. Additionally, the government plans to reduce the reserve fund to 3,503 billion yen in 2022 (Table 1).

Figure 1: Reserve fund and number of recipients in employment insurance

Source: Ministry of Health, Labor and Welfare

Table 1: Fiscal projection of employment insurance

Source: Ministry of Health, Labor and Welfare