Column Finance and the Social Security System 2018.05.28

【Aging, safety net and fiscal crisis in Japan】No.115: Percentage of General Government Gross Debt to GDP

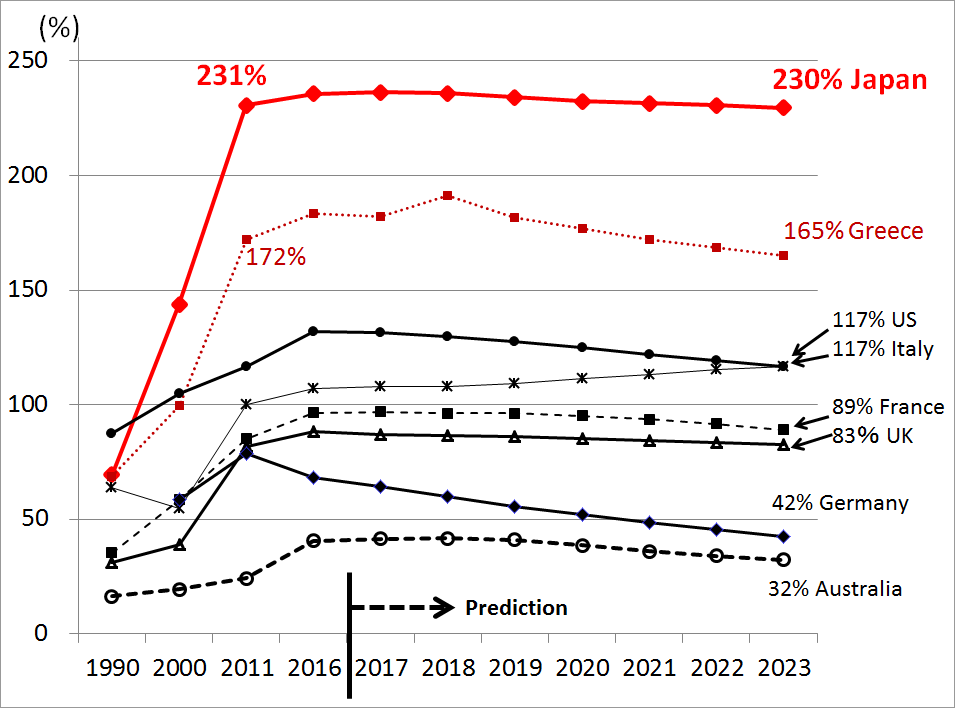

There are two stages in the process of fiscal collapse in a country. The first stage is a structural collapse. The second stage is a situation in which government bond buyers disappear, government financing becomes difficult, and interest rates rise sharply. Figure 1 shows the percentage of general government gross debt to GDP based on a report that the International Monetary Fund released in April 2018. Japan's percentage (around 230%) surpassed Greece, which was financially broken in 2011. This means that the Japanese government's finance has already been in a state of structural collapse.

The question is whether Japanese government bond buyers are gone and whether interest rates start to rise sharply and, if so, when? As mentioned in Column No.72, the Bond Dependency Ratio, which is the proportion of the issuance of government bonds in general account revenues, remains high at 34.5% in the 2018 budget. Moreover, the Abe administration again postponed the target period of the basic fiscal balance, which is one of the cornerstones of fiscal reconstruction, from 2025 to 2027. In this way, if the government continues to avoid a radical reform of the social security system and postpone the period of fiscal balance, there will be ample time for the financial market to assume that the government has no intention or ability to rebuild public finance. I predict that this will occur in around 2025.

Figure 1: Percentage of general government gross debt to GDP

Source: International Monetary Fund World Economic Outlook Database