Column Finance and the Social Security System 2018.05.14

【Aging, safety net and fiscal crisis in Japan】No.104: Fiscal Balance of Health Insurance Societies

The Japanese occupational health insurance system includes the Health Insurance Societies for large company employees, the Japan Health Insurance Association for small/medium company employees, and the Mutual Aid Associations for civil servants. In April 2018, the National Federation of Health Insurance Societies released a report on financial issues based on the 2018 budget prepared by each health insurance society.

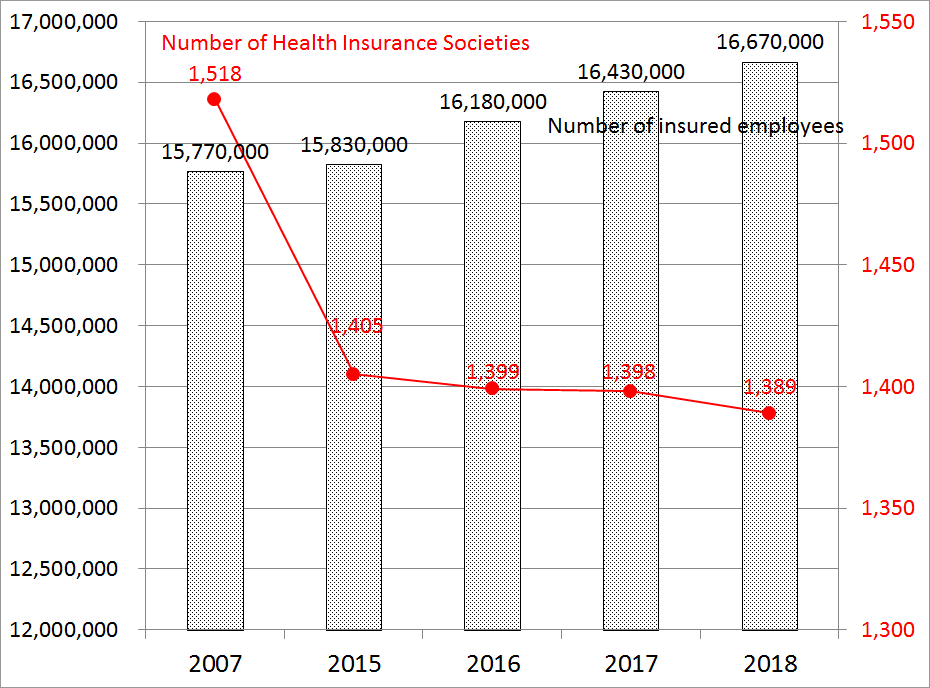

As shown in Figure 1, the number of employees insured by health insurance societies has continued to increase since 2015. This reflects an increase in the number of employees in large companies due to factors such as improvements in the work environment. However, the number of health insurance societies declined from 1,518 in 2007 to 1,389 in 2018. This was influenced by an increase in health insurance societies whose premium rate of insurance has become higher than that of the Japan Health Insurance Association. It is reasonable for an employer under such circumstances to dismiss the health insurance society and have employees participate in a health insurance association.

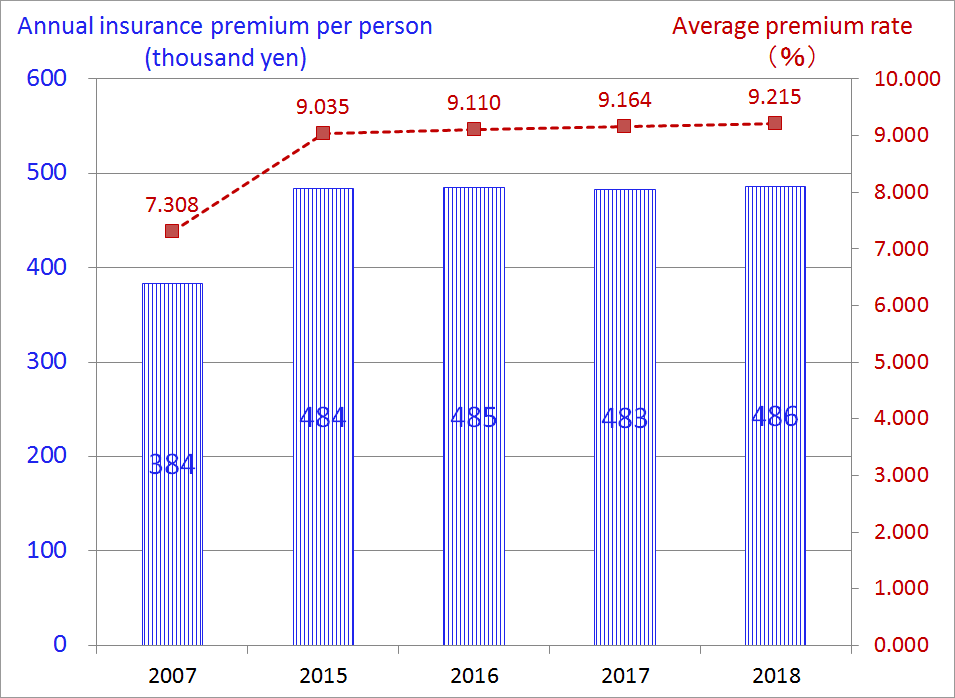

As shown Figure 2, the annual insurance premium per person increased 27% from 383,612 yen in 2007 to 486,042 yen in 2018. The average premium rate also increased from 7.308% to 9.215% during the same period. The number of health insurance societies with a premium rate of 10% or more in 2018 is 313. However, the premium rate of insurance of the health insurance associations, which is decided by prefecture, is in the ranges from 9.63% (Niigata Prefecture) to 10.61% (Saga Prefecture) in 2018.

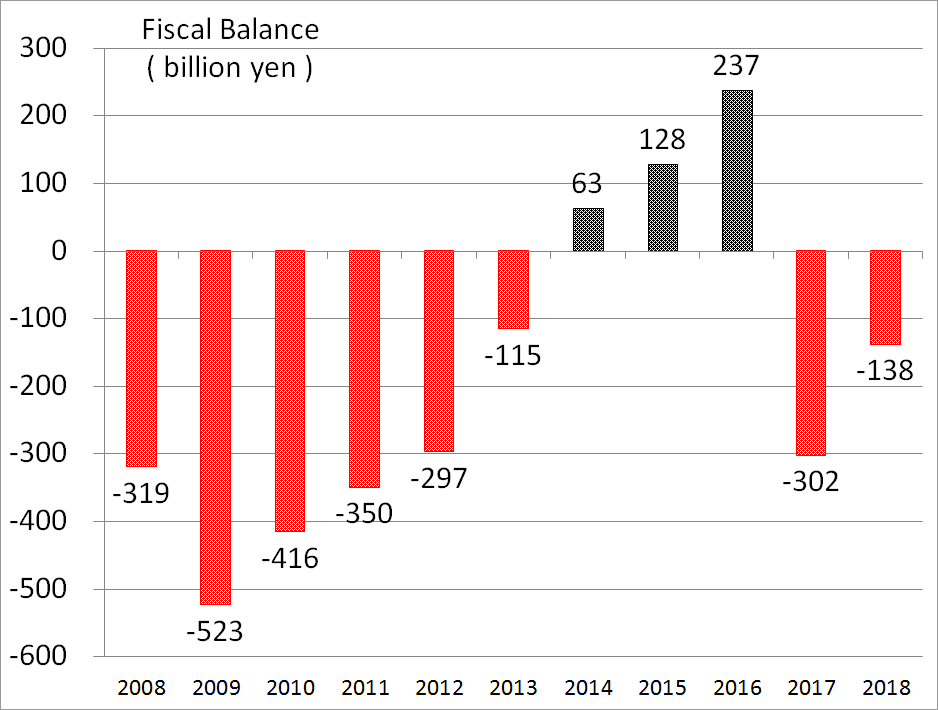

Despite the growth of the insurance premium rate, the fiscal condition of health insurance societies is vulnerable. The National Federation of Health Insurance Societies forecasts that the deficit in 2018 will be 138 billion yen (Figure 3). The main reason for this is that contributions to medical care for the elderly continue to increase. For example, an amount of 3,493 billion yen, which accounts for 43.1% out of the 8,101 billion yen premium income in 2018, is expected to be used for subsidies for elderly medical care. In addition, among employees insured by health insurance societies, those over 40 are obliged to bear the long-term care insurance premium, whose average rate is 1.519%.

Figure 1: Number of Health Insurance Societies and Insured Employees

Source: National Federation of Health Insurance Societies

Figure 2: Annual Insurance Premium per person and Average Premium Rate

Source: National Federation of Health Insurance Societies

Figure 3: Total Fiscal Balance of Health Insurance Societies

Source: National Federation of Health Insurance Societies