Column Finance and the Social Security System 2018.03.26

【Aging, safety net and fiscal crisis in Japan】No.75: Local Government Finance

Out of the GDP value of 532 trillion yen in fiscal 2015, the local government's economic activity is 58.6 trillion yen, or 11.0% of the GDP. This is larger than the 21.8 trillion yen of spending by the national government (after excluding 45.6 trillion yen of social security).

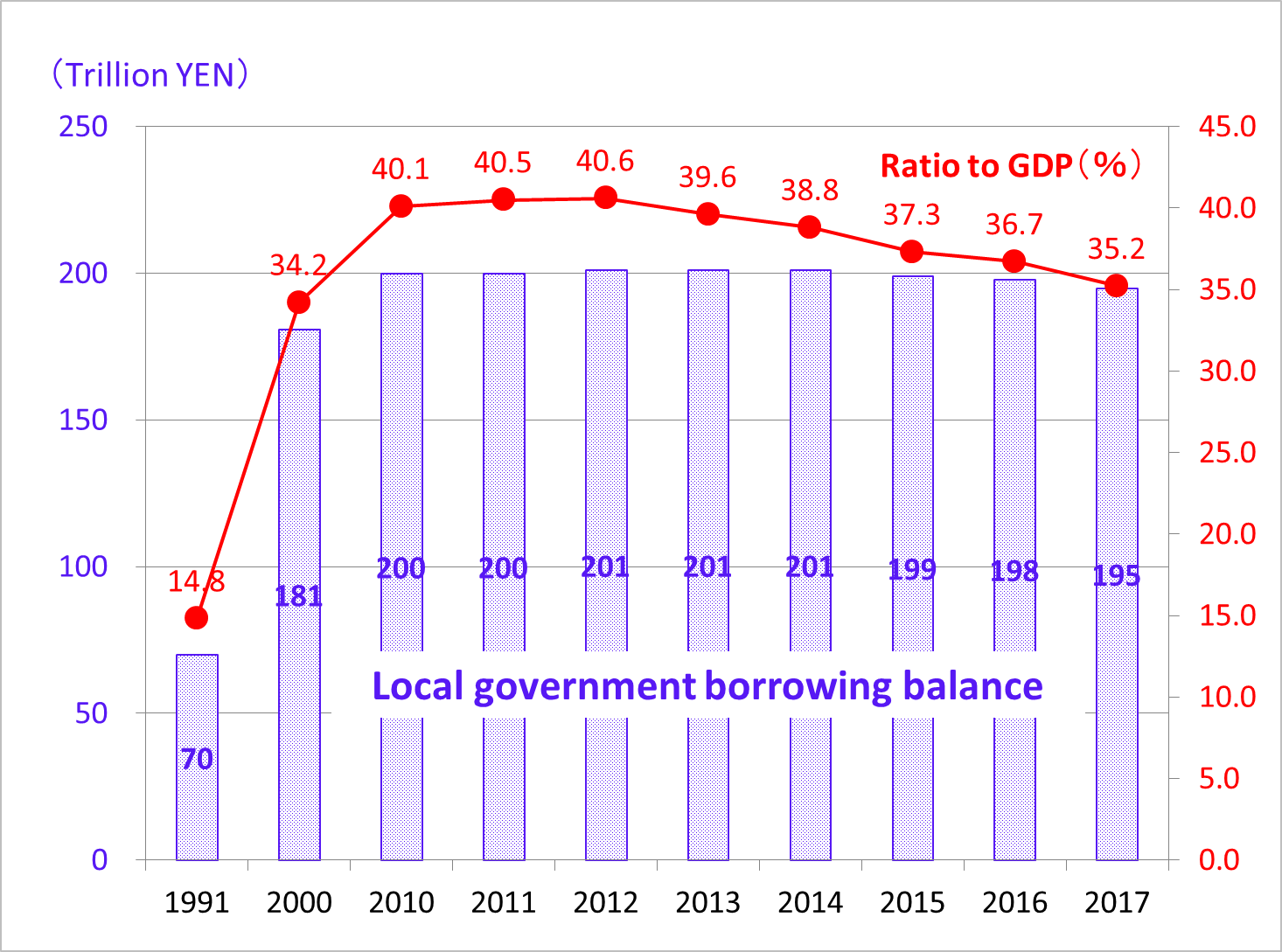

As shown in Figure 1, the outstanding borrowing of local governments has increased sharply since 1991, when the bubble economy burst, but has seen a moderate decline recently. As a result, the ratio of outstanding borrowings to GDP has also declined.

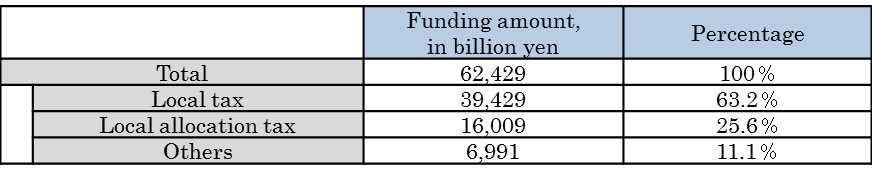

However, as shown in Table 1, the local allocation tax, which is a subsidy from the national government, accounts for 25.8% of the general resources of local governments. Therefore, if the national government falls into a situation in which it is forced to issue deficit bonds at high interest rates, local governments will face serious financing shortages.

Source: Ministry of Internal Affairs and Communications