Column Finance and the Social Security System 2018.03.23

【Aging, safety net and fiscal crisis in Japan】No.74: National Burden Ratio

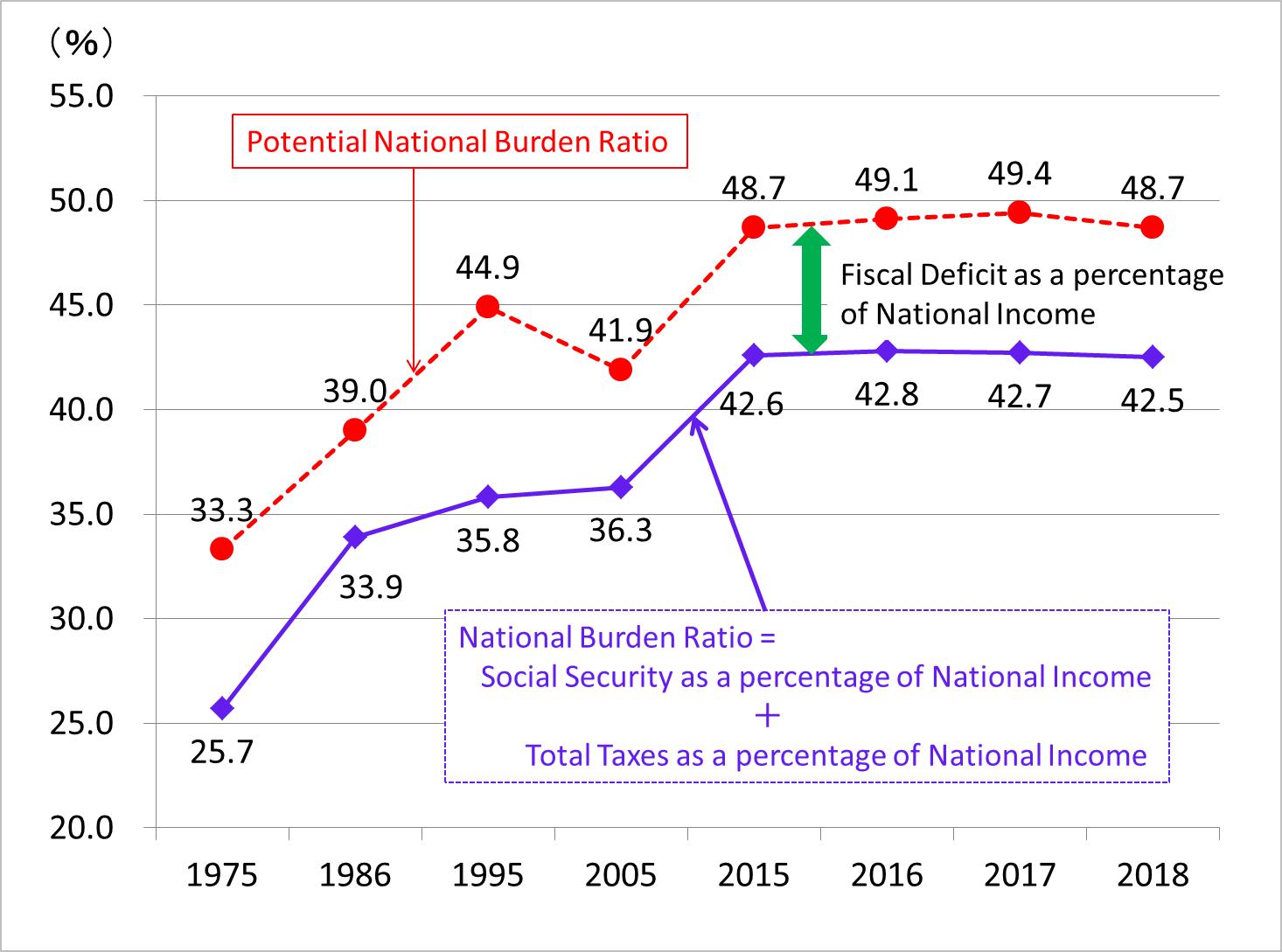

Based on 2015 data, the Ministry of Finance announced the 2018 estimate of Japan's national burden ratio and the international comparison. The national burden ratio is the sum of total tax burden and social security burden to national income. The sum of this ratio and a percentage of fiscal deficit to national income is referred to as the "Potential National Burden Ratio."

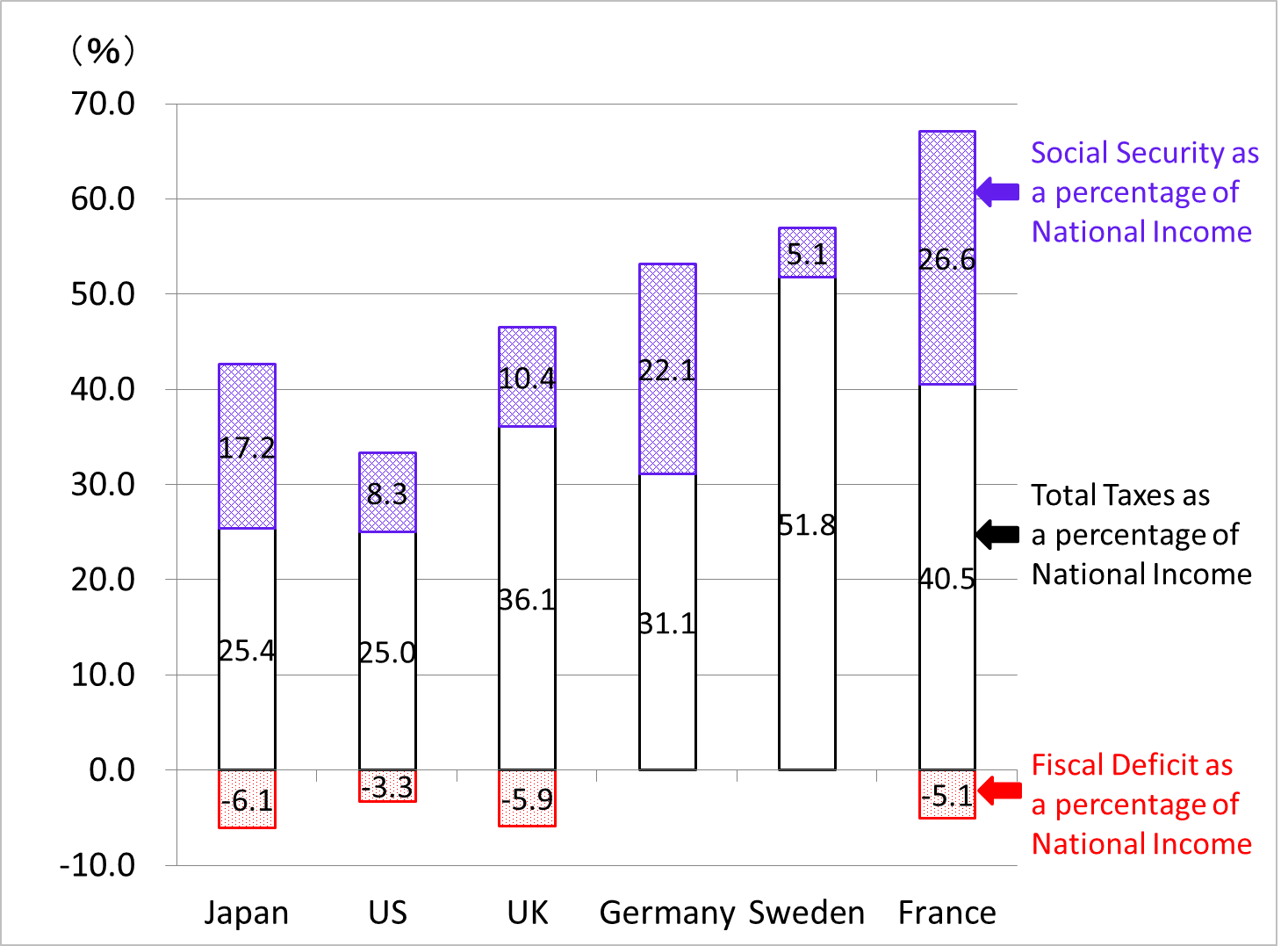

As shown in Figure 1, according to the 2018 budget, the national burden ratio of Japan is 42.5%, and the Potential National Burden Ratio is 48.7%. Japanese social security benefits are as generous as in Britain, Germany, Sweden, and France. On the other hand, as shown in Figure 2, the potential burden ratio of Japan is lower than in the aforementioned European countries. Therefore, Japan seems to need to raise the public burden.

(Source)Ministry of Finance

(Source)Ministry of Finance