Column Finance and the Social Security System 2018.03.23

【Aging, safety net and fiscal crisis in Japan】No.73: A fiscal collapse risk will increase in response to rising interest rates

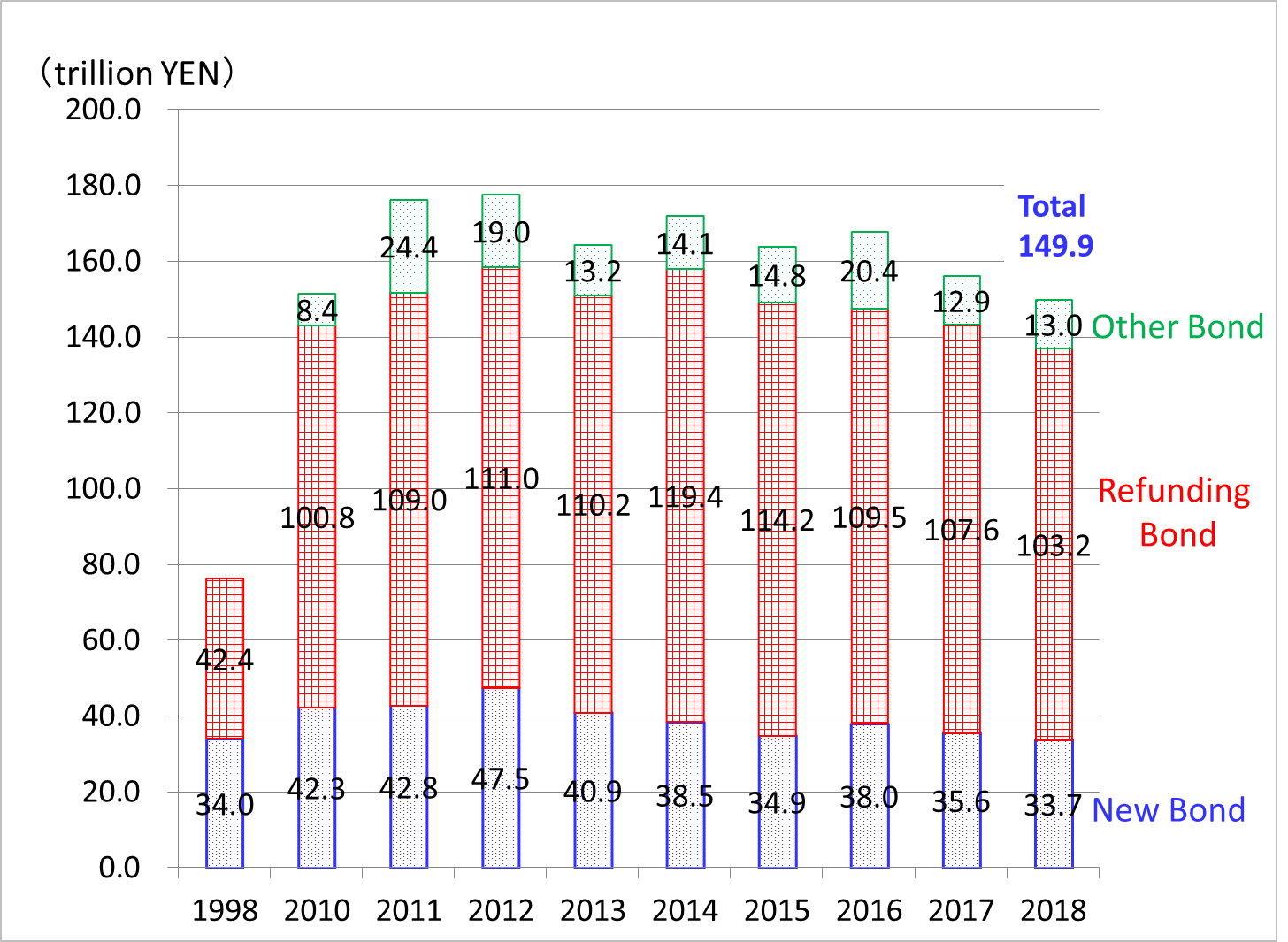

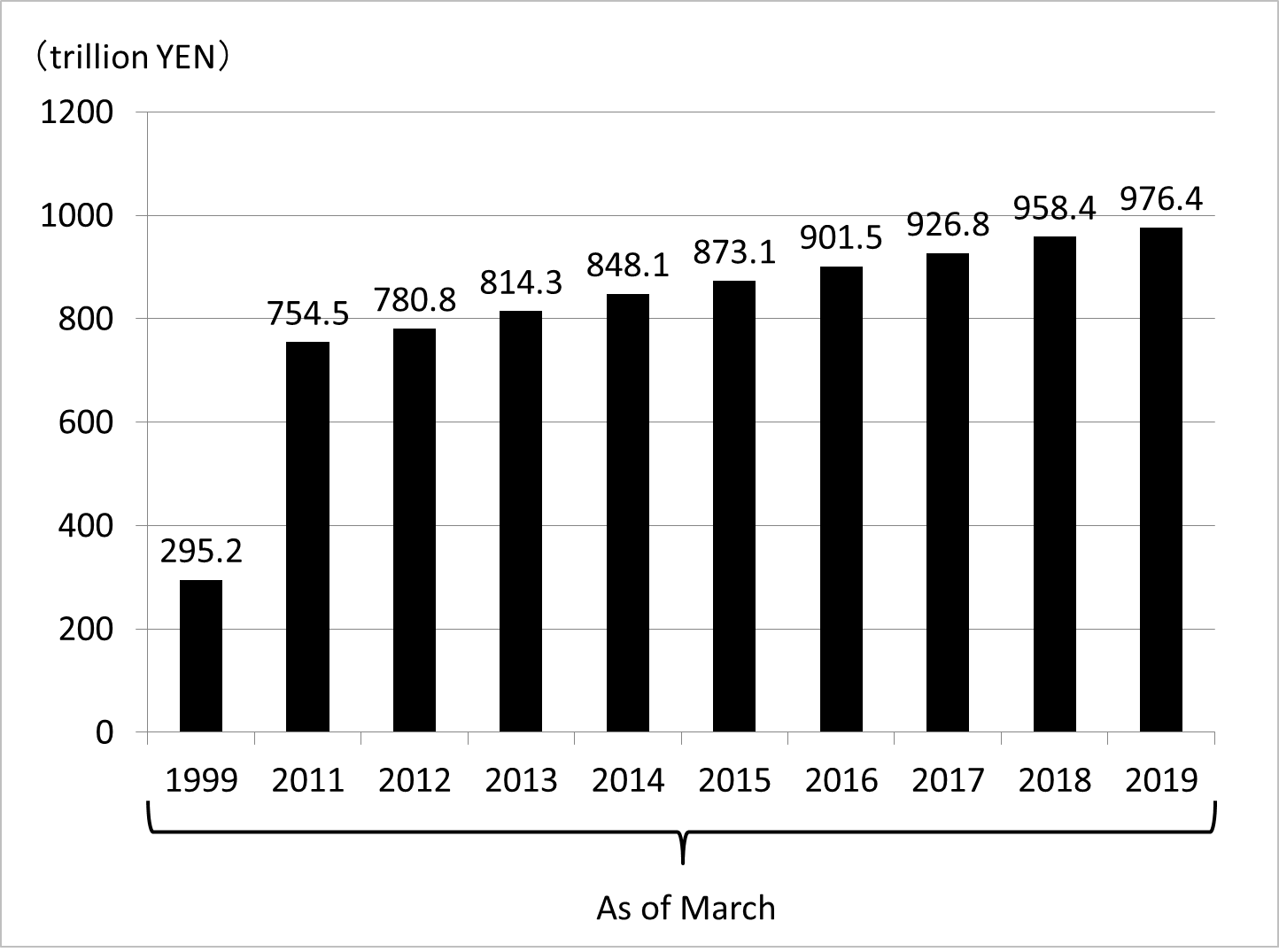

According to the 2018 budget shown in Column No.72, the annual figure for issued government bonds is 149.9 trillion yen (Figure 1), and the outstanding amount of Japanese government bond (JGB) issuance is expected to be 976.4 trillion yen (Figure 2) at the end of March 2019. The breakdown of 149.9 trillion yen includes 33.7 trillion yen for new government bonds to compensate for the financial shortage, 103.2 trillion yen for refunding bonds and 13 trillion yen for other bonds (Fiscal Investment and Loan Program, etc.).

The reason why Japan can continue to issue such large amounts of government bonds is that, due to the zero-interest rate policy, the interest payment has not increased. However, a 1% increase in the interest rate will increase the payment by 1.5 trillion yen. Moreover, the increase in interest payment will snowball, leading to an immediate risk of fiscal collapse.

(Source)Ministry of Finance

(Source)Ministry of Finance