Column Finance and the Social Security System 2018.03.01

【Aging, safety net and fiscal crisis in Japan】No.46: The Third Layer of Employees' Pension Has Changed Significantly

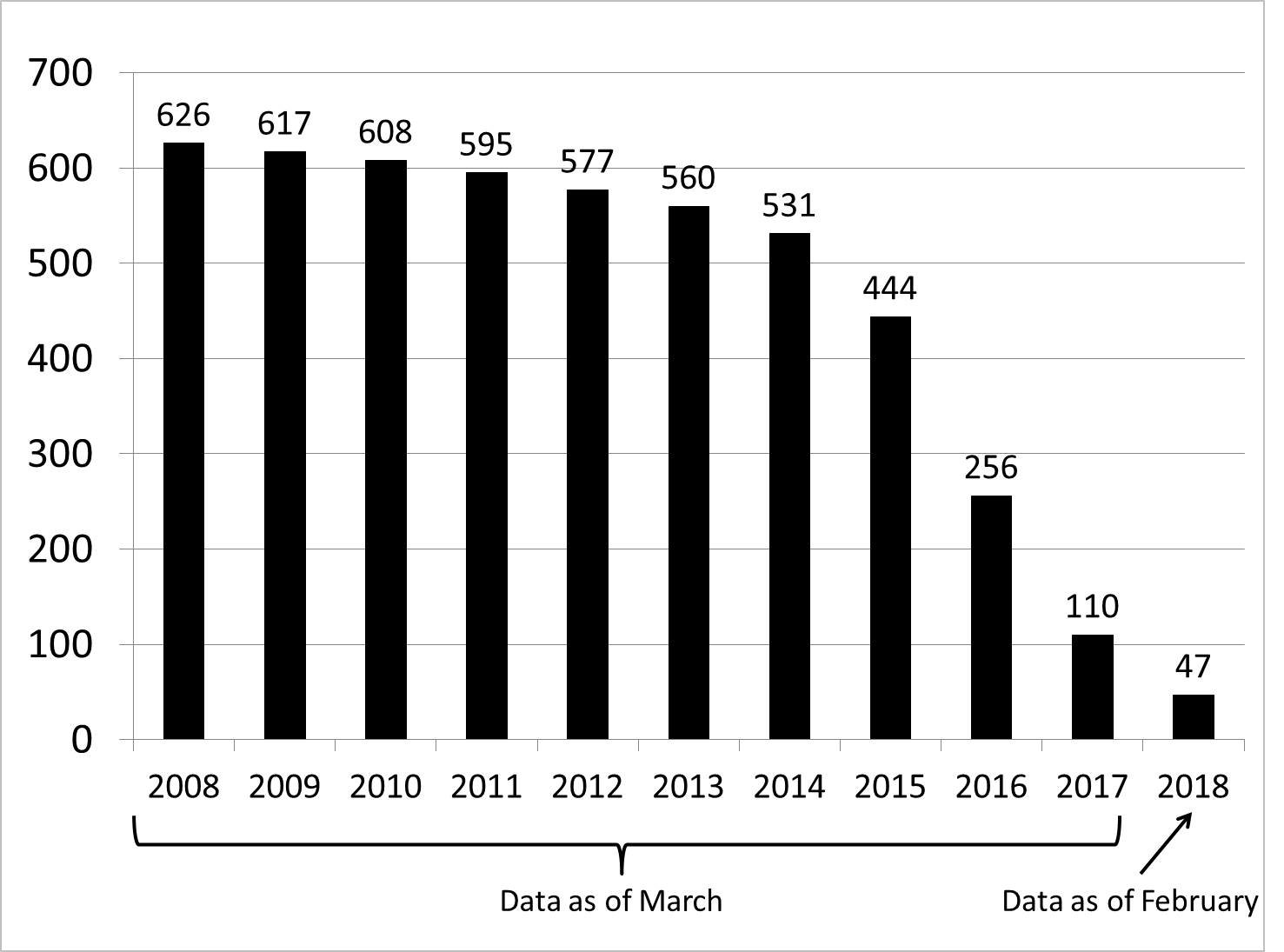

During the era of steady economic growth in Japan, the Employees' Pension Fund was at the center of the third layer of the pension system. At its peak, there were approximately 1,900 funds and 12 million individual subscribers. One characteristic of these funds is that they take a portion of the premiums from the public welfare pension and invest them on behalf of the government, in a sense acting as private organizations. If the investment yield is higher than the expected yield, a company can use the surplus for the benefit of the third layer, which lightens the burden on the company side. However, in the era of low interest rates, the investment yield has actually been below the expected yield, and companies have been responsible for replenishing the deficit. Consequently, the funds have been dissolving one after another, with only 47 remaining in February, 2018 (Figure 1). The number of individual subscribers was down to 690,000 as of March 2017.

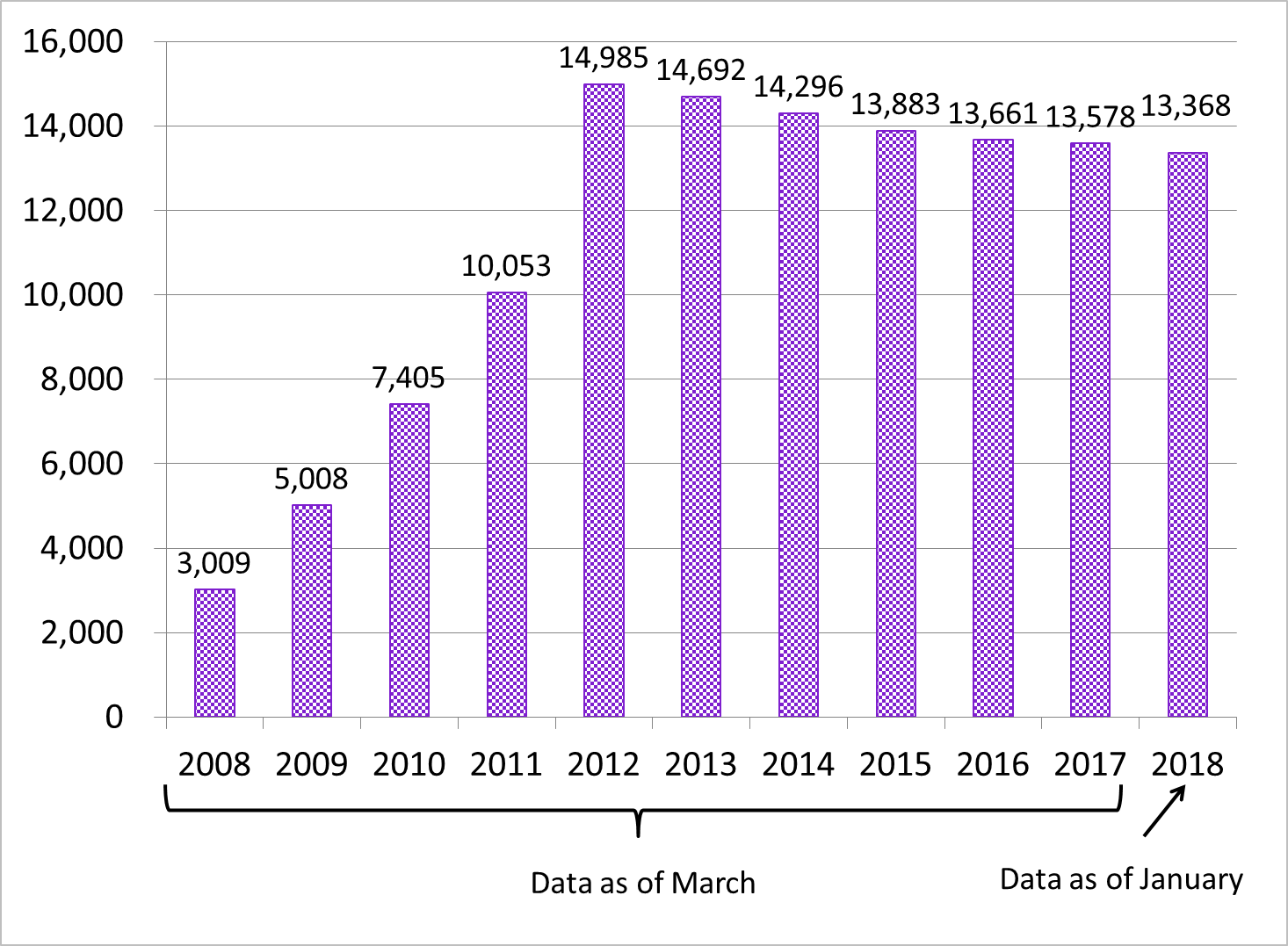

In 2002, the government established a new pension system to replace the Employees' Pension Funds‐the Defined Benefit Corporate Pension. As shown in Figure 2, there were 13,368 of these funds as of January 2018. The number of subscribers has already reached 8.18 million.

(Source)Pension Fund Association