Column Finance and the Social Security System 2018.03.01

【Aging, safety net and fiscal crisis in Japan】No.45: Japan's Pension System

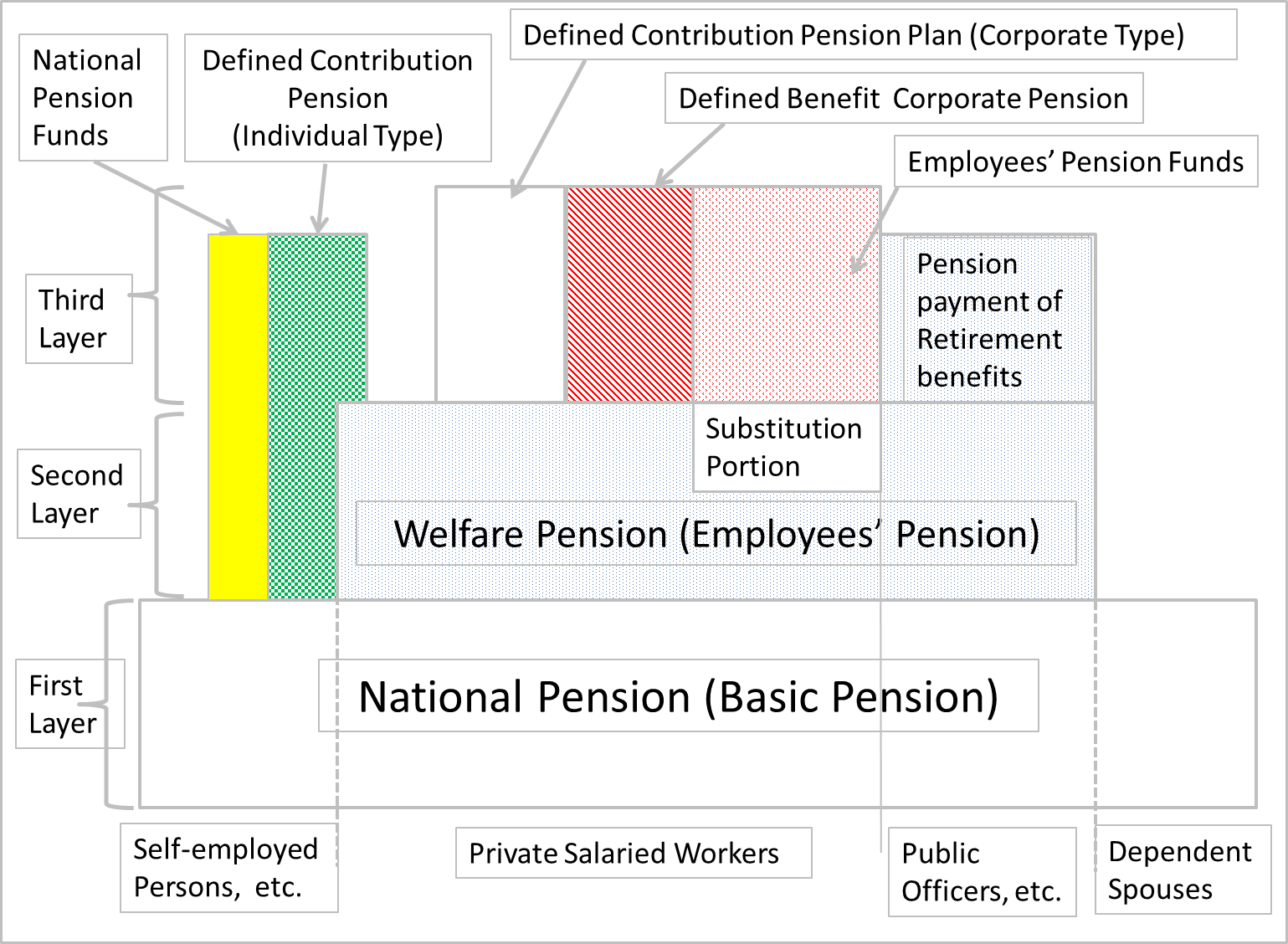

Figure 1 shows the overall picture of the pension system in Japan, which has a three-layer structure. The first layer is the "National Pension," the common basic pension; and the second layer is the welfare pension, which is for employees in private companies and public organizations. There are two additional pensions for self-employed persons: Defined Contribution Pensions (individual type) and National Pension Funds. The third layer of the pension system will be explained later.

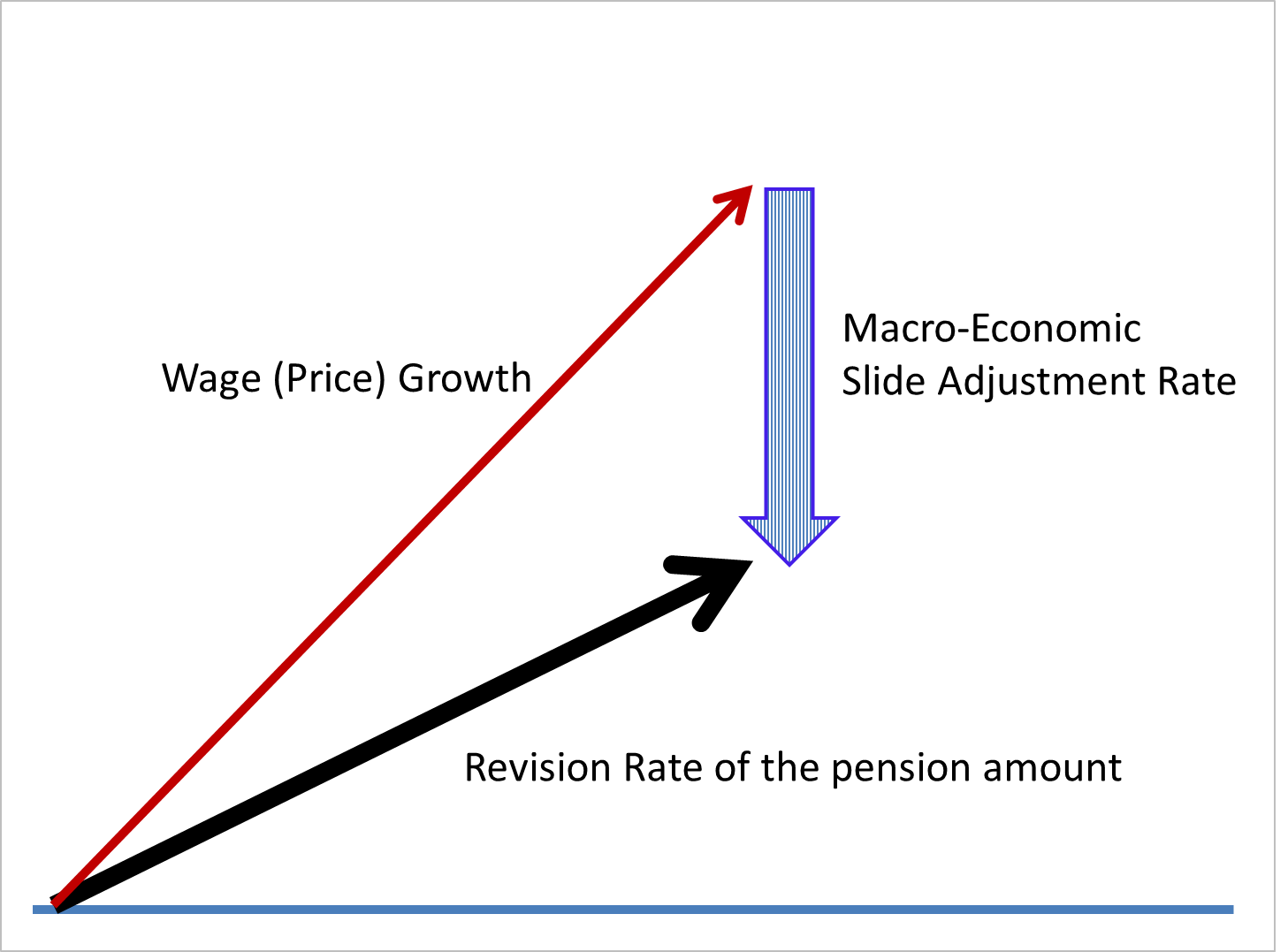

In the conventional pension system, the annual amount of the pension benefit increased with wage and price increases. However, in the era of falling birthrates coupled with an aging population, the number of pension subscribers decreased while the period for benefit payments expanded due to the increase in average life expectancy. Under these circumstances, the scheme of the old pension system was not sustainable. Therefore, the government introduced Macro-Economic Slide, which lowers the increase in the pension benefit by deducting "Slide Adjustment Rate" from "Wage (Price) Growth" (Figure 2).

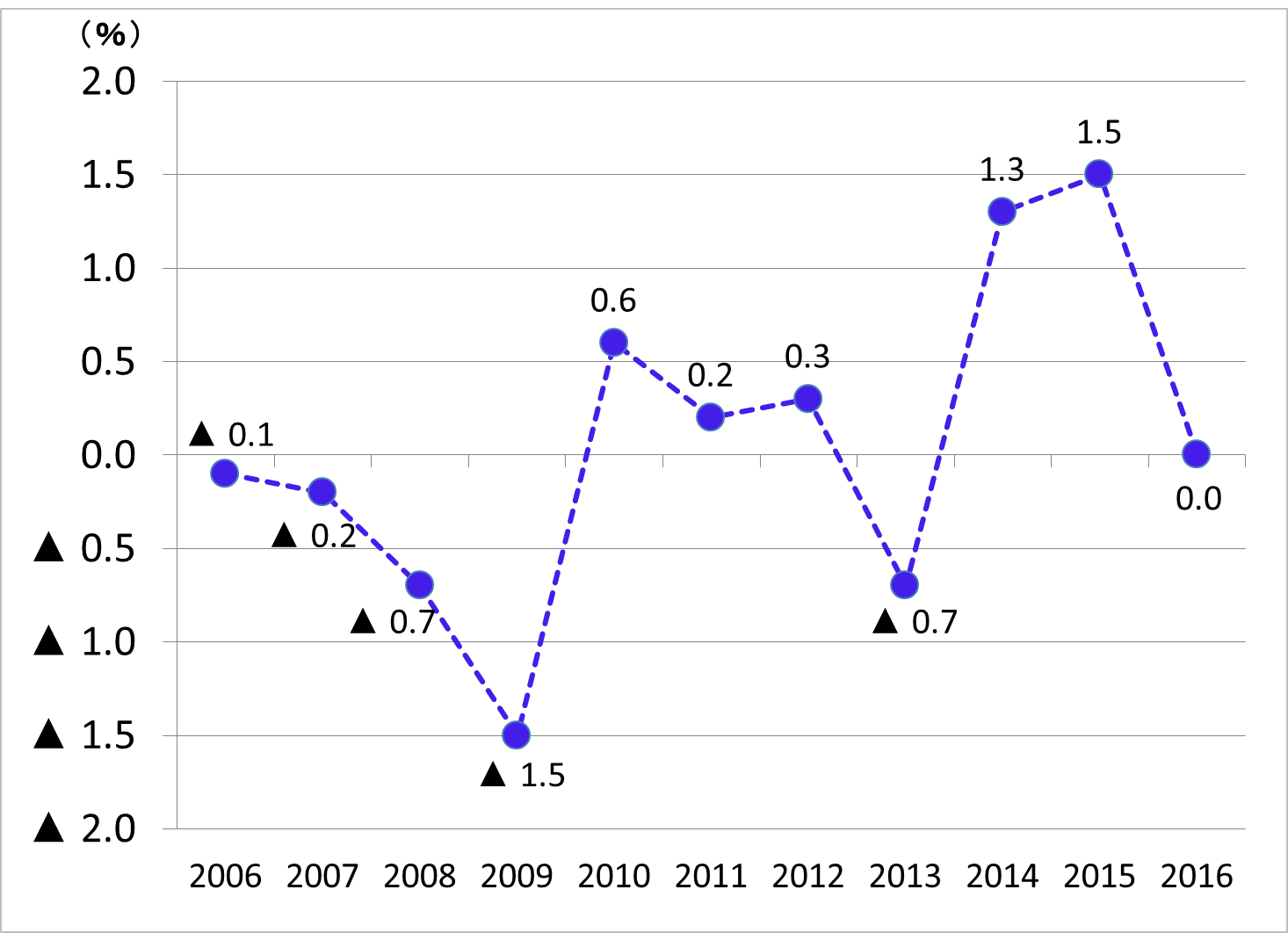

The calculation of the public pensions' fiscal outlook was completed in 2014. However, one criticism is that the economic indicators that were proposed at that time were too optimistic. For example, the nominal wage increase rate in the standard case was expected to be 3.4%. However, as shown in Figure 3, the actual nominal wage increase rate was far below it.