Column Finance and the Social Security System 2018.02.19

【Aging, safety net and fiscal crisis in Japan】No.34: Medical insurance premium rate by prefecture

As mentioned in Column No.19, all citizens under 74 who are not enrolled in workplace medical insurance are mandated to subscribe to National Health Insurance, which is operated by 1,716 municipalities. From April 2018, the transfer of the responsibility of administration of the National Health Insurance from municipalities to prefectures will start. This means that a disparity in medical insurance premium rates between prefectures will arise due to the superiority or inferiority of health system administration by prefectures in the near future.

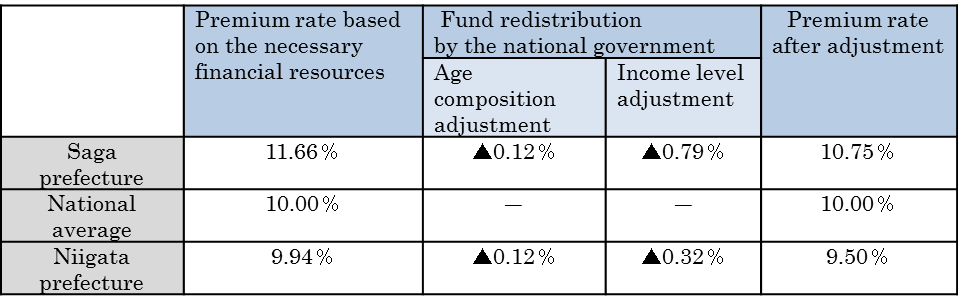

Data is available that indicates the extent of disparity. It is a prefectural premium rate table created by the Japan Health Insurance Association, which is an insurer for small-medium company employees. When the National Health Insurance is to be managed by prefecture, it becomes necessary to redistribute funding sources throughout the country to alleviate excess or deficiency born out of disparity of age structure and income which is not under the control of prefectures. The Japan Health Insurance Association has created an insurance premium table after the redistribution. As shown in Table 1, the difference between Saga prefecture, which had the largest premium rate (insurance premium ÷ salary income) in 47 prefectures, and Niigata prefecture, which had the lowest rate, was 1.25% in 2017.

(Source)Japan Health Insurance Association