Column Finance and the Social Security System 2018.02.09

【Aging, safety net and fiscal crisis in Japan】No.32: There are many people who do not pay national pension premiums

The public pension system in Japan is roughly divided into two sections: Welfare pension - where joining procedures are carried out in the workplace - and the national pension, to which people who do not join through their employer subscribe. National pension is a basic pension system to which all registered citizens of Japan aged between 20 and 59 - irrespective of their nationality - must subscribe and pay the premiums of. Since the welfare pension premium that is deducted from monthly salary includes the basic pension premium, the welfare pension subscribers and their spouses are automatically subscribed to the national pension.

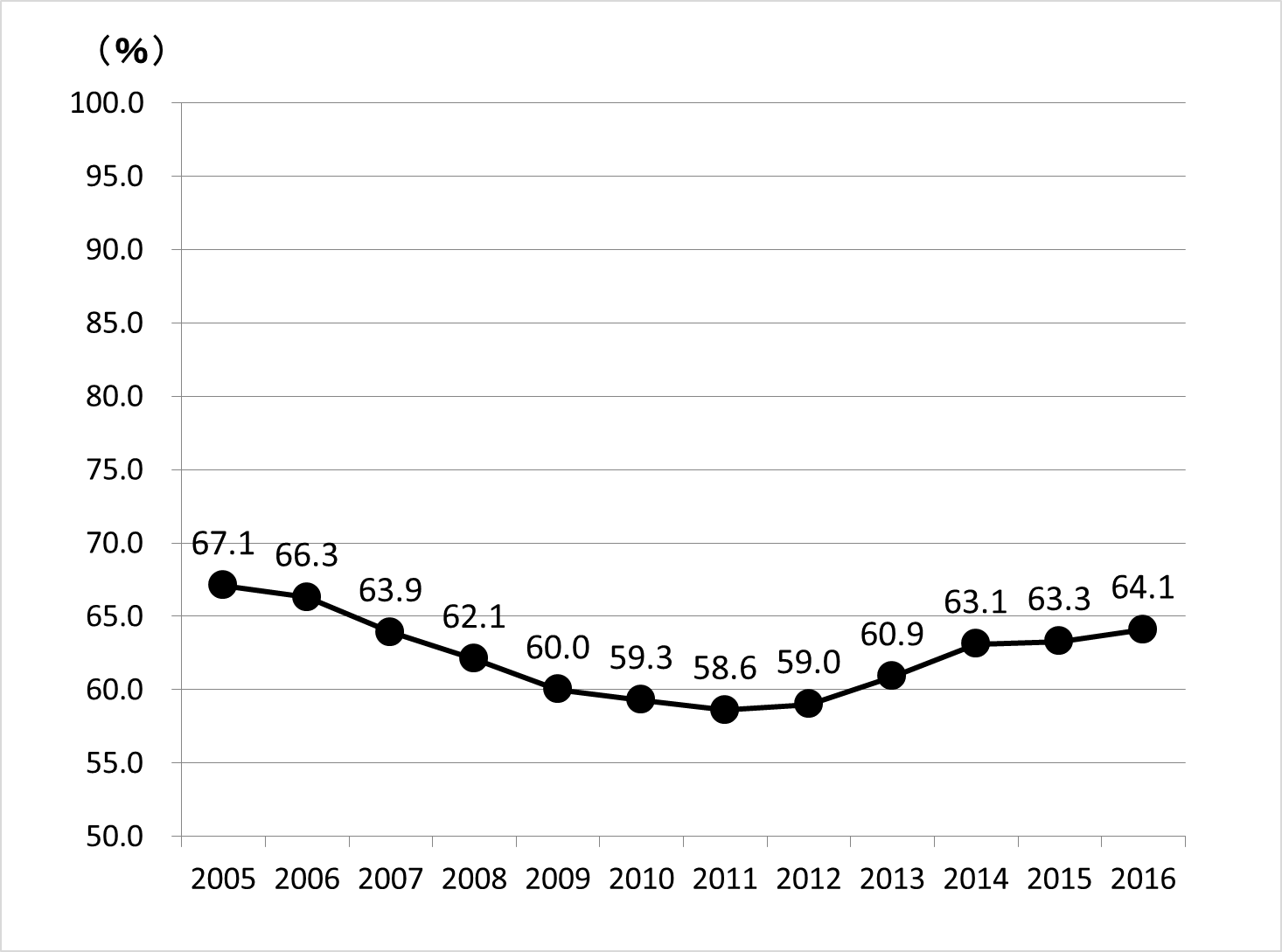

The number of national pension subscribers was 67.12 million at the end of March 2016. Among them, 16.45 million people - who are neither welfare pension subscribers, nor are their spouses - were obligated to join the national pension system. Furthermore, 5.76 million of the 16.45 million are exempt from insurance premiums, or suspended due to their low-income or student status. Therefore, 10.69 million people are obligated to pay national pension premiums. The monthly premium is 16,490 yen (150 US$; 1 US$ = 110 JPY) as of 2017. The problem is that less than 70% of the people in question are paying their pension premium without delay (Figure 1). As mentioned in Column No. 31, as long as there are these many people who do not pay their premiums, the universal system cannot fulfill its mission successfully.

(Source)Ministry of Health, Labor and Welfare