Column Finance and the Social Security System 2018.01.31

【Aging, safety net and fiscal crisis in Japan】No.22: Misunderstanding concerning fiscal collapse risk

One of the reasons for Japan's fiscal crisis is the continuing increase of medical care and long-term care expenses. I have often encountered healthcare facility managers who make the following claims at lectures on medical reform. They say, "as Japan has more external assets than external debt, the Japanese government will not go bankrupt. Therefore, Japan should use more tax money for health care."

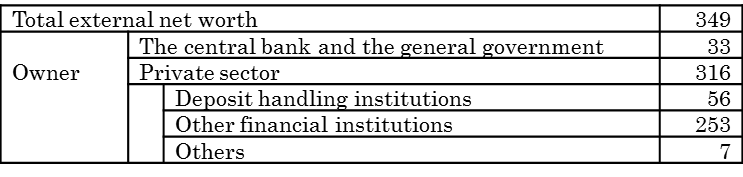

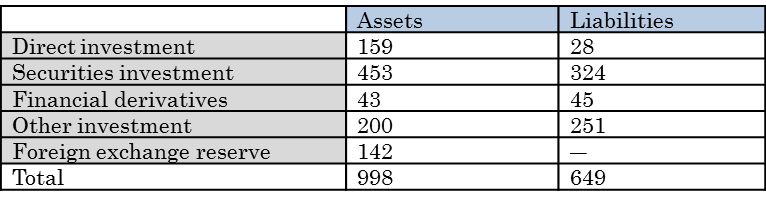

They may have read an article that Japan is a foreign net worth country. However, they are not looking at the data on the external asset liabilities balance, as published by the Ministry of Finance. Table 1 shows that, out of 998 trillion yen of external assets at the end of 2016, only a small part, such as foreign exchange reserves of 142 trillion yen, belongs to the central bank and the general government. Most are financial assets and overseas factories attributable to the private sector. Table 2 shows that the net assets of the central bank and the general government are only 33 trillion yen out of the total net assets of 349 trillion yen. We cannot offset the general government debt exceeding 1,000 trillion yen with those assets.

(Source)Ministry of Finance