Column Finance and the Social Security System 2018.01.30

【Aging, safety net and fiscal crisis in Japan】No.19: Financial structure of public medical insurance

The public health insurance system in Japan has a complicated structure in which the number of insurers exceeds 3,000. Therefore, it is necessary to know the financial structure of insurers in order to predict the impact on each insurer's cash flow when the government finances fail and the flow of public expenses for insurance benefit stops.

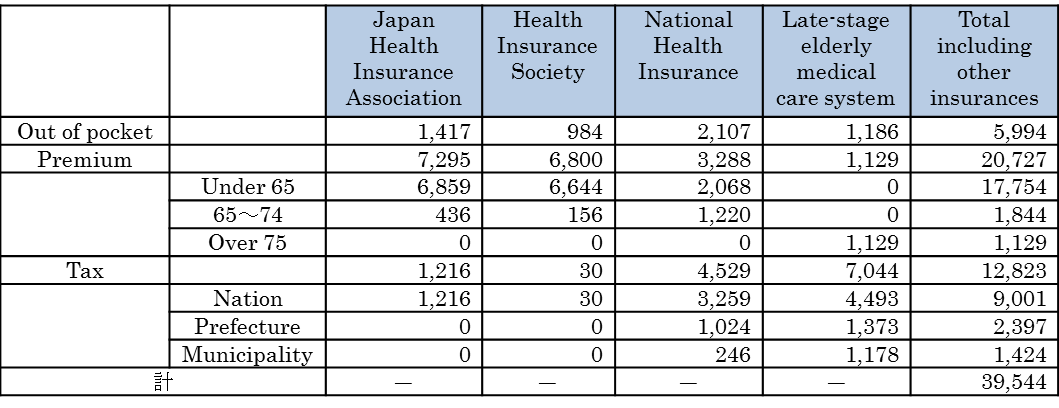

Table 1 shows the financial structure of major insurers. The Japan Health Insurance Association is an insurer for small-medium company employees and has one organization, but insurance calculation is separately accounted for by prefecture. The Health Insurance Society is an insurer for large company employees and there are 1399 insurers as of April 2016. National Health Insurance is a mandatory requirement for all citizens under 74 who are not enrolled in workplace insurance. National Health Insurance is operated by 1,716 municipalities. From April 2018, the reform of transferring the administration responsibility of the National Health Insurance from municipalities to prefectures will start. The late-stage elderly medical care system, the insurers of which are 47 prefectures, is for elderly people aged 75 and older.

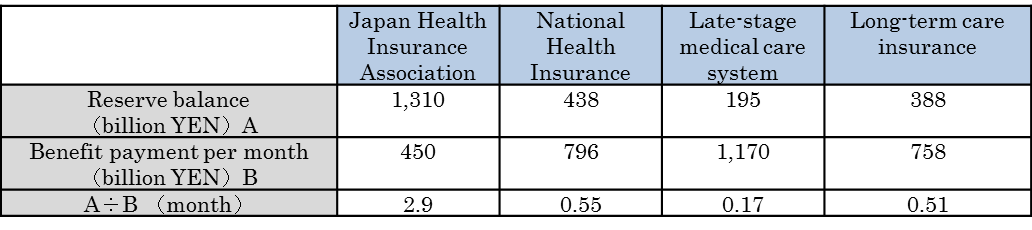

Of the total medical expenses of 39,544 billion yen, the public expenditure (TAX) is 12,823 billion yen. It is noteworthy that the Health Insurance Society has received little support from public expenditure, but the Japan Health Insurance Association, the National Health Insurance, and the late-stage elderly medical care system are greatly dependent on public expenditure and would be greatly affected by a government bond market collapse in the future. Therefore, it is important how much insurers have payment reserve, which acts as buffers for cash flow, when the flow of public expenditure stops. Table 2 shows how much payment reserve is available for benefit payment per month. The Japan Health Insurance Association has 2.9 months' worth reserve, the National Health Insurance has 0.55 month, and the late-stage elderly medical care system has only 0.17 month. Data on the Health Insurance Society is not available. The long-term care insurance system also has payment reserve of only half a month.

(Source)Ministry of Health, Labor and Welfare

(Source)Insurer's 2015 financial data