Column Finance and the Social Security System 2018.01.18

【Aging, safety net and fiscal crisis in Japan】No.7: Probability to Require Long-term Care Services

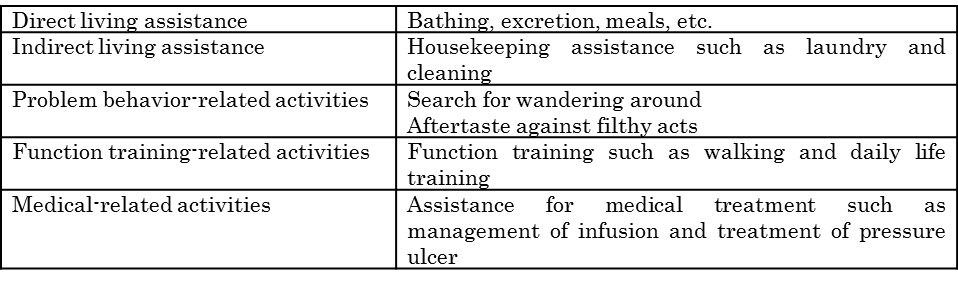

Japan introduced the public long-term care insurance system in 2000. As Table 1 shows, this system classifies care services into five categories. The level of long-term care is determined by the time required to provide these services. For example, the reference time of Level 1 is set to 32 minutes or more and less than 50 minutes, and the reference time of Level 5 is set to 110 minutes or more.

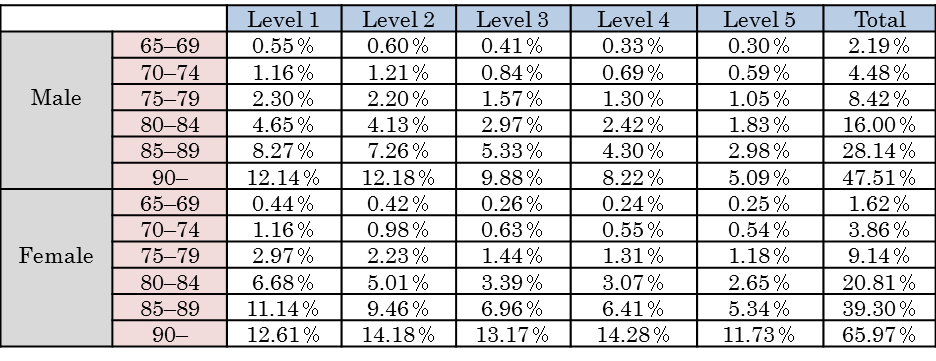

In column No.1, I predict that long-term care expenses will expand by 2040 at a pace that greatly exceeds the increase in medical expenses. Table 2 shows the probability (the actual value as of March 2015) of being qualified for services from long-term care insurance as the precondition of the prediction. It clearly shows that long-term care needs increase beyond the age of 80.

(by gender, age group, and care level)