Column Finance and the Social Security System 2018.01.15

【Aging, safety net and fiscal crisis in Japan】No.4: Trade deficit of pharmaceuticals and medical devices

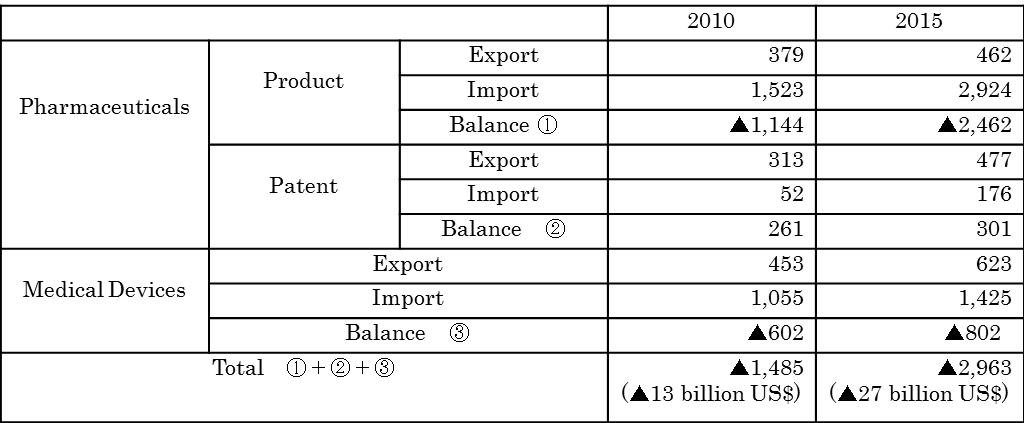

Japan's trade balance has greatly improved, from a deficit of JPY13.8 trillion in FY2013 to a surplus of JPY4 trillion in FY2016. However, as Table 1 shows, the trade deficit in pharmaceuticals and medical equipment continues to increase. This indicates that Japan will not be able to purchase medical supplies, resulting in a dysfunction of the medical provision system. Furthermore, when the fiscal collapse becomes a reality in the future and the credibility of the yen is lost, a sharp depreciation of the currency would take place.

The patent trade balance of pharmaceuticals is in surplus because pharmaceutical companies have built factories overseas to avoid the high corporate tax rate burden in Japan and patent fees are obtained from these overseas subsidiaries. As a result of the imports from overseas subsidiaries, the trade deficit of pharmaceutical products is expanding. This scenario is similar to the one in the United States where, despite the presence of the world's best drug development capabilities, the pharmaceutical trade balance showed a deficit of $45 billion in 2016. One of the reasons why President Trump has decided to cut corporate tax rate drastically is to drive improvement of the pharmaceutical companies.

Japan's international competitiveness of medical equipment is weak. One of the reasons behind this is the absence of a major healthcare delivery entity such as the Mayo Clinic or the UPMC in the United States, which could aid in quick introduction of newly developed medical devices into clinical practice.

(Note) 1 US dollar = 110 yen