Column Finance and the Social Security System 2017.12.28

【Aging, safety net and fiscal crisis in Japan】No.1: Age dependency ratio

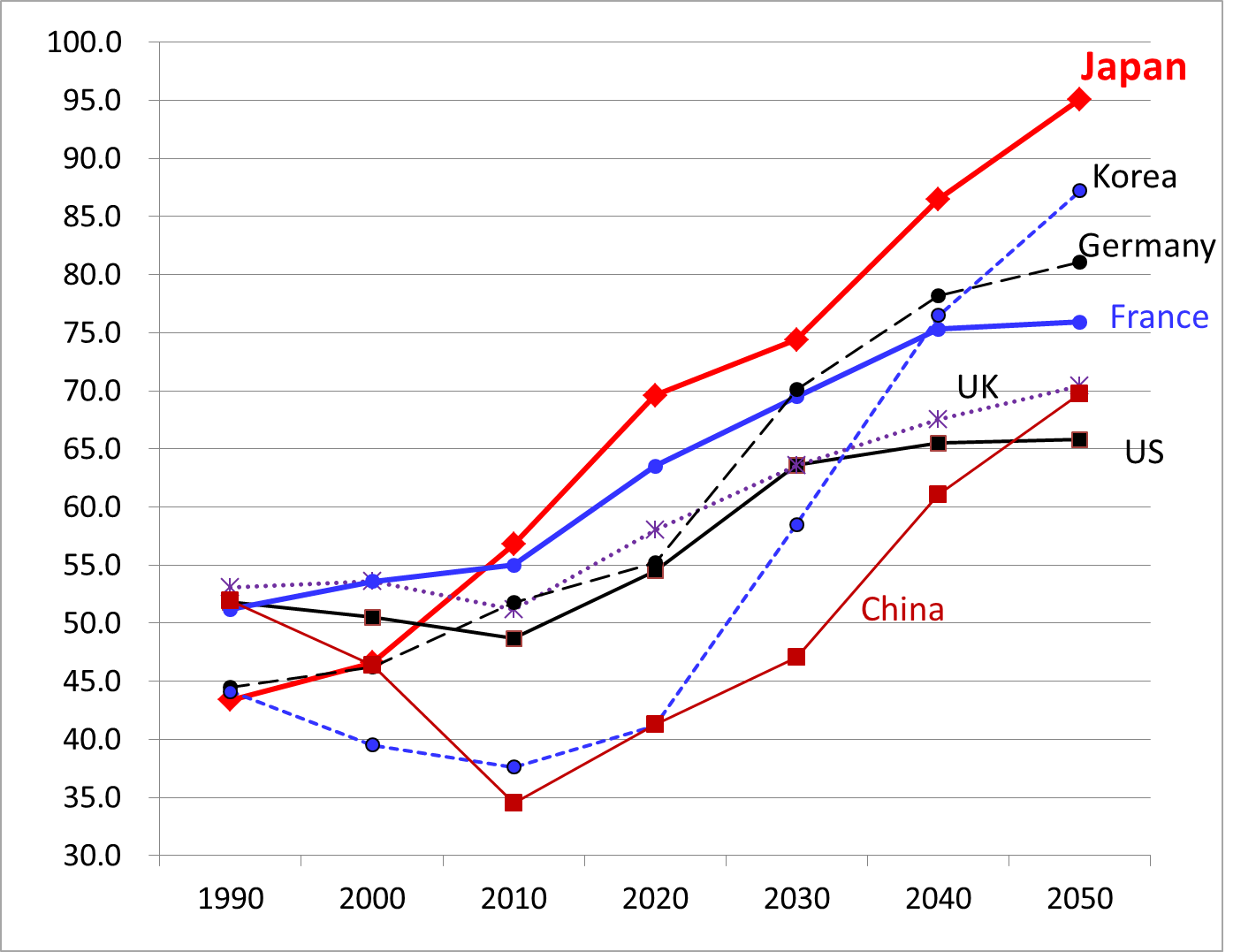

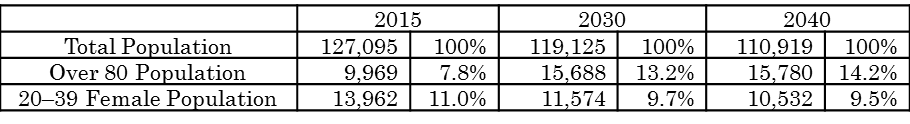

Age dependency ratio is an important index to measure a country's economic and social resilience, as well as its power to promote reform in the face of large environmental changes. According to the definition on the WEB site of the World Bank, age dependency ratio is the ratio of dependents-people younger than 15 or older than 64 years-to the working-age population, that is, those in the age group 15-64. The ratio is presented as the number of dependents per 100 working-age population. Thus, the lower the dependency ratio, the easier it is to maintain the social security system of the country. Among the age dependency ratios shown in Figure 1, the ratio for Japan reflects the latest population forecast and those for other countries are based on data from the World Bank database. The dependency ratio of Japan was the lowest in 1990. In the 1980s, the international competitiveness of Japan was the highest in the world. However, because of the paucity of effective policies since the collapse of the bubble economy in 1991 has continued, Japan's ratio is projected to reach 95 in 2050. As Table 1 shows, amid the decline in total population, the female population between 20 and 39, which is the cohort that can give birth, will decrease precipitously, while the proportion of those over 80 in the population will increase. This means that the total population decline and the increase in the age dependency ratio increase cannot be reversed until 2050, even if the fertility rate (1.44 in 2016) rises somewhat.